Hey there, future crypto expert. So, you’re diving into the world of cryptocurrency, huh? Exciting times. But let me guess, you’re a bit overwhelmed with all the jargon and the endless choices, right? Well, you’re not alone. One of the first things you’ll need to wrap your head around is the difference between Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). Trust me, it’s not as scary as it sounds.

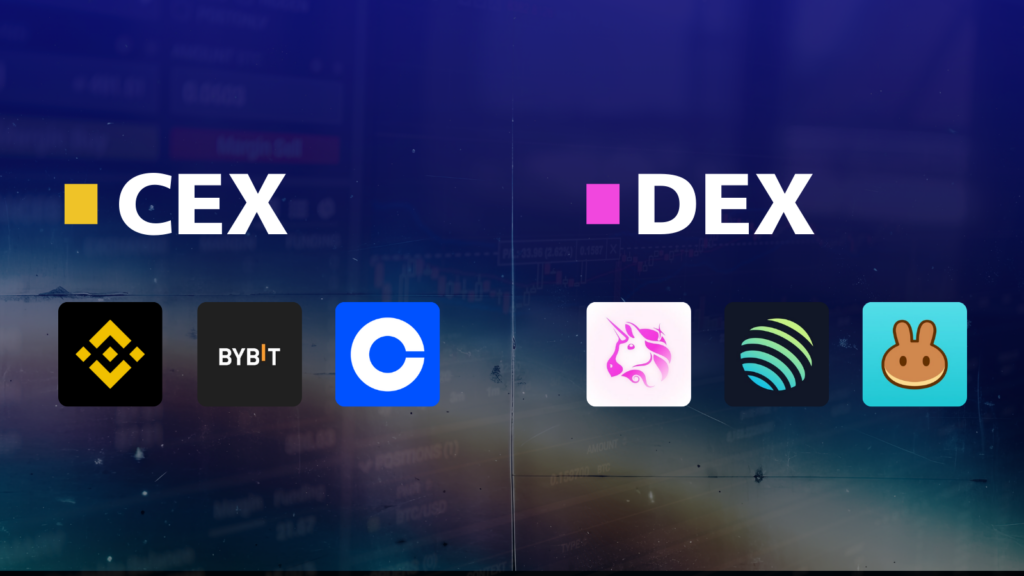

Imagine you’re in a big bustling marketplace. On one side, you’ve got these massive, shiny superstores with managers, security guards, and customer service desks. That’s your CEX. They’re the Binance and Coinbase of the crypto world, run by companies that keep everything ticking smoothly. On the other side of the market, there’s a more laid-back, open-air flea market vibe. No central authority, just individuals trading directly with each other. That’s your DEX. Think Uniswap, Minswap or PancakeSwap.

Now, why does this matter to you? Well, whether you choose to shop in the superstore or at the flea market can make a big difference in your trading experience. Let’s break it down.

The Importance of CEX and DEX in the Cryptocurrency Market

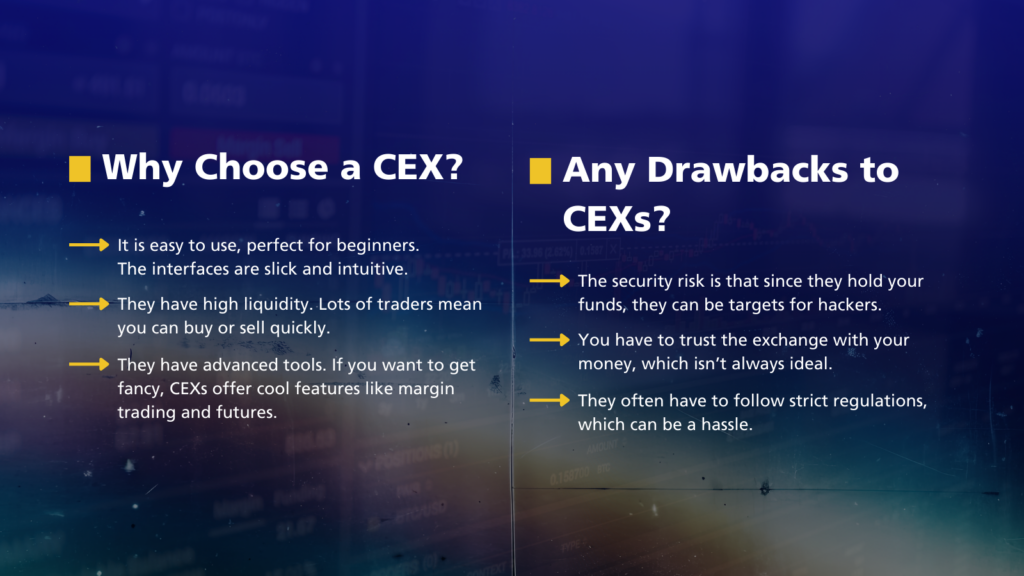

Centralized Exchanges (CEX) are like the trusted gatekeepers of the crypto world. They offer a user-friendly experience, high liquidity, and a ton of trading pairs. If you’re just starting out, a CEX can be a great place to get your feet wet because they’re designed to make trading as easy as possible. Plus, they often come with perks like customer support and advanced trading tools. But keep in mind, since they hold your funds, you’re trusting them with your security. It’s like using a bank, convenient but with certain risks.

On the flip side, Decentralized Exchanges (DEX) are all about putting the power back in your hands. Here, you’re in control of your funds at all times. No middlemen, no need to trust a central authority just pure, peer-to-peer trading. This can be incredibly liberating and also adds an extra layer of security because you’re not handing over your assets to a third party. However, DEXs can be a bit trickier to navigate, especially for beginners, and sometimes suffer from lower liquidity and slower transaction times.

So, why are these two types of exchanges so important? Well, they represent the diversity and adaptability of the crypto ecosystem. CEXs bring the polish and convenience of traditional finance into the crypto space, making it accessible to the masses. DEXs, on the other hand, embody the true spirit of blockchain – decentralization, security, and personal freedom.

Whether you’re looking for ease of use or maximum control, understanding CEX and DEX will help you make smarter, more informed decisions on your crypto journey. Ready to explore more? Let’s dive deeper into the pros and cons of each.

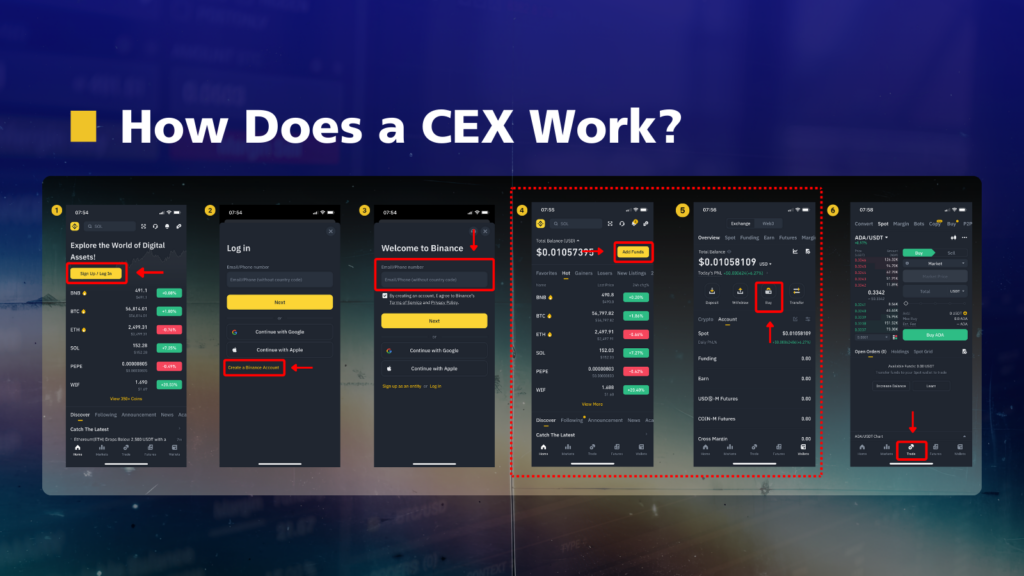

How Does a CEX Work?

Here’s the lowdown. You sign up by creating an account, and deposit your money or crypto. The exchange takes care of the every details, matching buyers and sellers, and handling all the transactions. CEXs are like personal assistant for your crypto trades.

Signing Up and Getting Started

First things first, you need to sign up. This is like creating an account on any website. You can visit Binance for your registration, you’ll provide some basic info, and sometimes you’ll need to verify your identity. It’s a bit like showing your ID to open a bank account. Don’t worry, it’s usually pretty straightforward.

Depositing Funds

Once your account is set up, you’ll need to deposit some funds. You can transfer money from your bank account or send some cryptocurrency you already own. Think of this like adding money to your Amazon account so you can shop for all those cool gadgets.

Placing Your Orders

Now, here’s where the fun starts. With your funds ready, you can start trading. It’s like browsing through Amazon’s vast inventory, but instead of buying products, you’re buying or selling cryptocurrencies. You choose what you want to buy (take for example $ADA), enter the amount, and hit the button. The CEX matches your order with someone who wants to sell (or buy) the same amount. It’s super fast and easy.

How Does a DEX Work?

DEXs use something called smart contracts to facilitate trades. You connect your wallet, find someone to trade with, and the smart contract does the rest. No need to trust anyone but the code.

A smart contract is basically a self-executing contract where the terms of the agreement are written directly into lines of code. This code and the agreements it contains exist across a distributed, decentralized blockchain network (like Cardano). It’s like having a super honest referee who automatically enforces the rules.

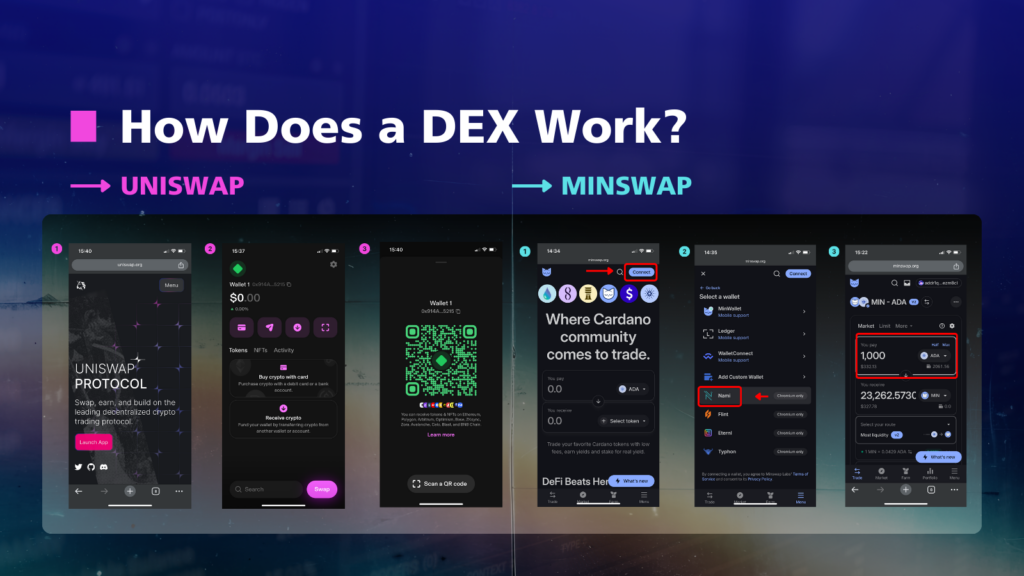

Connecting Your Wallet

- First things first, to use a DEX, you need a crypto wallet like Metamask or Nami Wallet. Think of it as your digital wallet where you keep your cryptocurrencies.

- You connect this wallet to the DEX like Uniswap or Minswap to get some ADA tokens.

- It’s super simple to use Nami Wallet with Minswap if you want to trade on Cardano ecosystem, just a few clicks and you’re in.

Making a Trade

Now, let’s say you want to trade some of your MIN (Minswap token) for another cryptocurrency, like ADA. On a DEX, you will look for someone who wants to make the opposite trade, someone who has ADA and wants MIN. The DEX helps you find this person using something called a smart contract.

Using Smart Contracts

Once you find a trade you like, the smart contract takes your MIN, takes the other person’s ADA, and swaps them. No need for a third party to oversee the transaction. The smart contract does all the work, making sure everything is fair and square.

No Middlemen, More Control

One of the best things about DEXs is that you’re always in control of your funds. Your crypto stays in your wallet until the moment you trade it. This is different from centralized exchanges (CEXs), where you have to deposit your crypto into the exchange’s wallet. With DEXs, there’s no need to trust a third party with your assets.

Liquidity Pools

You might be wondering, what if I can’t find someone who wants to trade exactly what I have for what I want? That’s where liquidity pools come in. Think of a liquidity pool as a big pot of various cryptocurrencies. Users contribute to these pools, and the DEX uses them to make sure there’s always enough of each cryptocurrency to go around. When you trade, you’re often trading with these pools rather than directly with another person.

In the end, both CEXs and DEXs have their place in the cryptocurrency landscape. Whether you prefer the convenience and features of a CEX or the control and privacy of a DEX, the choice is yours. Just make sure to do your research, understand the risks, and trade smartly.