Investing and managing assets is already a challenging task in traditional finance, with complexities ranging from researching assets to monitoring performance. Now, lets talk about the volatility in Web3, especially on the Cardano blockchain.

It’s easy to see why many potential investors feel overwhelmed. From understanding native assets to dealing with high volatility, users face numerous difficulties that make Web3 investing feel frustrating.

Key Takeaways

- Metera Protocol simplifies investing in Cardano native assets through diversified, tokenized portfolios (MTKs)

- MTKs provide exposure to various sectors like DeFi, RealFi, and Metaverse, reducing investment risk

- Diversification is important in volatile blockchain markets, helping protect against asset downturns

- Smart contracts and oracles ensure transparency, security, and real time portfolio balancing

- Users can easily invest in vetted portfolios, benefiting from professional management and secure automation

- Metera’s rating system helps investors make informed decisions about which portfolios best match their goals.

Metera Protocol is an innovative protocol built on the Cardano blockchain, Metera provides investors with a simple and secure way to invest in high quality, sustainable projects through tokenized investment strategies called MTKs.

By offering diversified portfolios, Metera helps mitigate risks while allowing users to tap into the fast growing opportunities within the Cardano ecosystem. Before going into the features and how the Metera protocol works, there’s a need to understand the challenges of investing in Web3.

The Challenge of Web3 Investing

The blockchain and crypto markets are known for their high volatility. In 2022 alone, the overall crypto market lost $2 trillion in value after peaking at nearly $3 trillion in late 2021 . This kind of market fluctuation, while filled with opportunity, it also presents a serious challenge for retail investors, especially those new to the space.

Beyond market volatility, another obstacle is the sheer complexity of Web3 native assets. Web3 investments often require deep technical knowledge and thorough research to understand the fundamentals of each project, including its utility, adoption potential, and development roadmap.

It’s easy to get lost in the noise when trying to differentiate solid projects from speculative bubbles. This is especially true on Cardano, which boasts over 1400 native tokens and 100 decentralized applications (dApps).

With this complexity in mind, Metera Protocol simplifies the process by creating tokenized portfolios that allow users to invest in a diversified set of Cardano native assets without needing to micromanage or fully grasp every project in detail.

What Are MTKs?

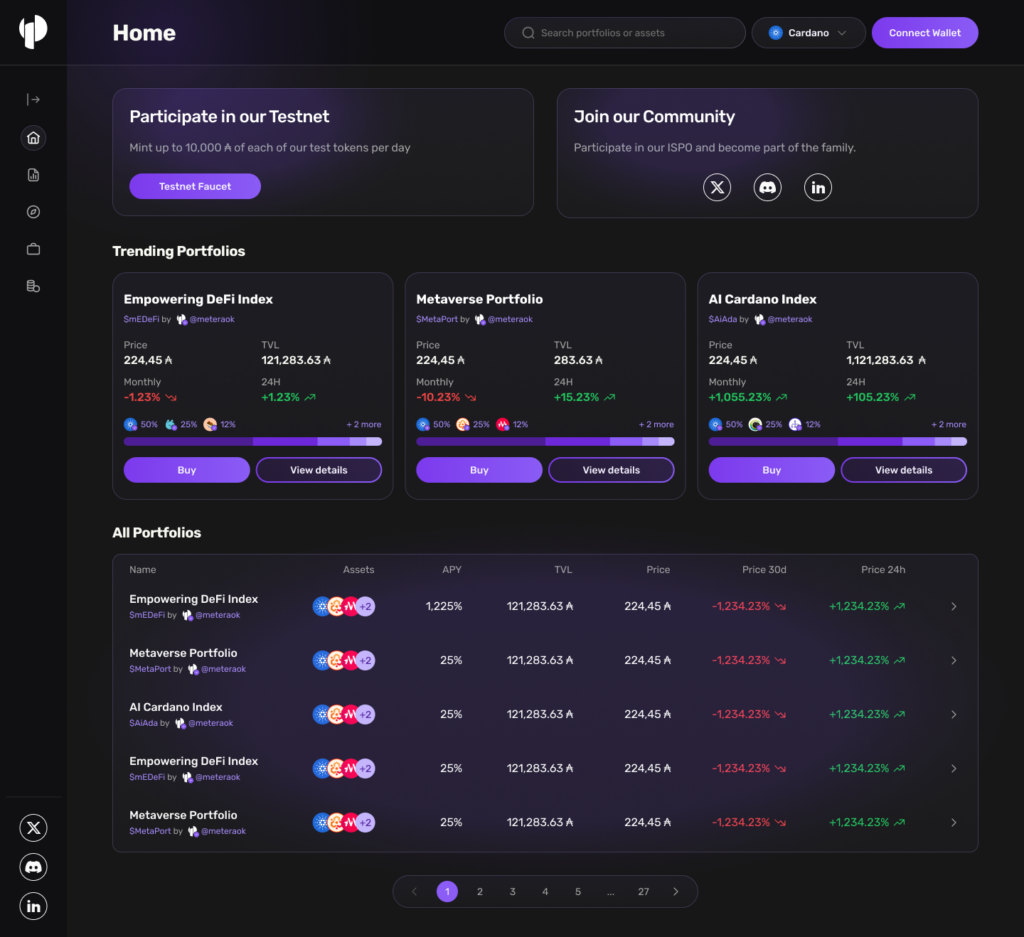

Metera Tokenized Baskets (MTKs) are tokenized investment portfolios created by vetted and experienced portfolio managers. Each MTK represents a curated basket of Cardano native assets, with exposure to specific sectors such as DeFi, RealFi, Exchanges, or Metaverse projects.

For example, a user can invest in an MTK focused on Cardano’s DeFi sector, gaining exposure to several tokens without having to buy and track them individually. This approach is a huge leap forward for blockchain investing because it provides instant diversification while being powered by smart contracts for security and automation.

Why Diversification is Key

Diversification is one of the fundamental principles of safe and effective investing, and this holds true for both traditional and blockchain investments. As the saying goes, never put all your eggs in one basket. This principle is essential in volatile markets like crypto, where the value of a single asset can swing dramatically in a matter of hours.

Historically, diversified portfolios outperform those concentrated in a single asset class. According to a report by BlackRock, diversified portfolios have the potential to reduce risk by over 50% while still capturing market returns .

Applying this principle to the fast growing but volatile blockchain space, Metera offers users access to diversified portfolios of Cardano native tokens, balancing risk and return by spreading exposure across different sectors.

For example, while a single DeFi token might face high volatility, an MTK that contains several tokens across multiple sectors like DeFi, exchanges, and metaverse projects helps offset those risks. This way, even if one token underperforms, others can help maintain stability in the portfolio.

How the Metera Protocol Simplifies Tokenized Investments

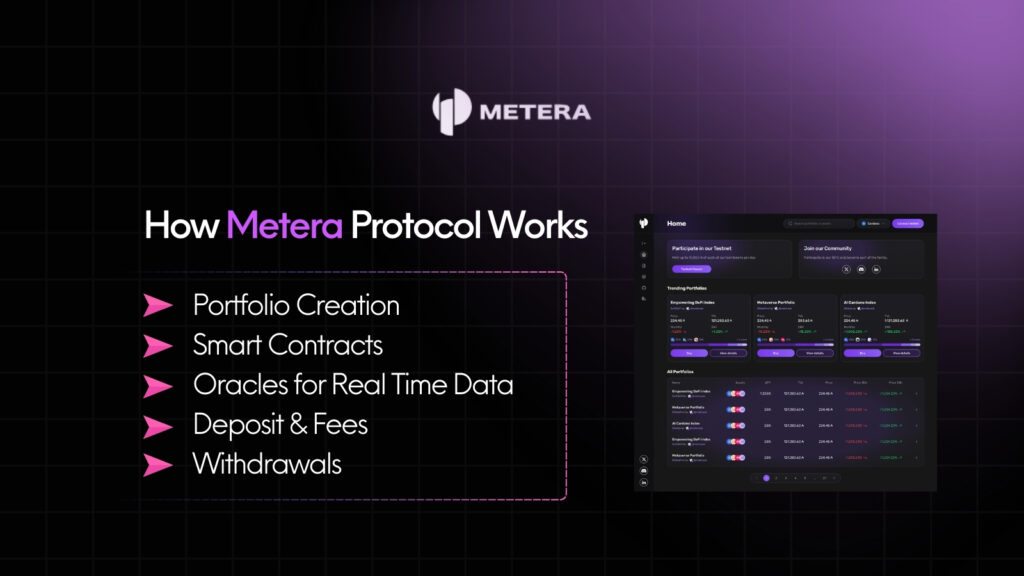

Metera Protocol operates as a marketplace for tokenized investment strategies. Here’s the list of how it simplifies Web3 investing for users at large.

Portfolio Creation

A portfolio manager creates an MTK by selecting a list of Cardano native tokens. They assign specific weightings to each token based on their market outlook and sector opportunities. For example, an MTK might allocate 30% to a DeFi token, 40% to a RealFi token, and 30% to an exchange token. This ensures the portfolio is balanced and reflective of the manager’s strategy.

Smart Contracts

Once the portfolio is created, users can deposit their tokens into a smart contract and receive MTKs in return. These tokens represent their share in the portfolio, providing immediate diversification across all assets within that MTK. Smart contracts also ensure secure transactions, reducing the risk of human error or malicious interference.

Oracles for Real Time Data

Two oracles are associated with each portfolio. The first oracle ensures that the portfolio maintains its target weightings for each asset. The second oracle monitors the real time tokenX/ADA ratio for each token, ensuring that the portfolio is accurately balanced according to market conditions. These oracles are critical to keeping the portfolio aligned with real-time data, giving users transparency and up-to-date performance metrics.

Deposit & Fees

Users deposit ADA or any Cardano native tokens into the portfolio and are charged a small fee in ADA. This fee, which is a fixed percentage, is stored for later collection by the portfolio manager, incentivizing professional management. The smart contract automates this process, making it seamless for both users and managers.

Withdrawals

When a user decides to withdraw from a portfolio, they place a withdraw order to burn their MTKs. In return, they receive tokens from the portfolio, aligned with the weightings specified in the oracle. This process ensures users receive their fair share of the portfolio, even as market conditions evolve.

Metera Protocol’s Testnet

A testnet is a testing environment for blockchain projects, allowing developers and users to experiment with new features, smart contracts, and protocols without using real assets or risking real funds. It serves as a sandbox where bugs can be identified, and improvements can be made before launching on the mainnet

Benefits of Participating in a Testnet

- A testnet lets you interact with blockchain technology hands-on, helping you understand how it works without real risk.

- Many testnets offer incentives, such as tokens or other rewards, for participating in tasks like bug hunting or completing specific actions.

- By engaging in testnets, you get early access to new tools and features before they launch, giving you a head start in the ecosystem.

- Your feedback and interactions help improve the project, making you an active participant in shaping the future of Web3.

Currently, you can join the testnet phase and participate in the Test and Earn Quests directly from the testnet dashboard. However, please note that the testnet is not available for mobile devices. For a smooth experience, use a desktop. Additionally, there’s a detailed YouTube video that provides step-by-step instructions on how to interact with the testnet, making it easy to get started.

Metera Protocol simplifies investing process by offering diversified, tokenized portfolios that reduce risk and maximize returns. Metera gives you the tools to participate in Cardano’s growing marketplace confidently.

With its focus on diversification, transparency, and high quality projects, Metera provides a safe and efficient way to tap into the future of sustainable investments on Cardano. In an industry where volatility is high, Metera helps you stay ahead, offering simplified, secure, and diversified investment strategies for the next generation of Web3 investors.