Metera Protocol is a comprehensive decentralized finance (DeFi) asset management platform within the Cardano ecosystem. The platform aims to transform how individuals invest in tokenized portfolios by providing index solutions that cater to a diverse range of needs within the Cardano community. Through Metera, users gain access to a diverse range of tokenized assets and investment opportunities.

What are Metera Tokenized Portfolios (MTKs)?

Metera’s main mission is to bring liquidity to the chain by providing index tokens and tokenized portfolios to the Cardano platform. Basically, the platforms provides a marketplace of different indexes and strategies to users so they can get access to the Cardano market in a seamless way. Both new and experienced investors can participate in the world of tokenized portfolios, thanks to Metera Tokenized Portfolios (MTKs).

MTKs are tokenized portfolios consisting of a wide array of asset classes created by Portfolio Managers (PM´s). They help users diversify their portfolio and mitigate risks as you can invest capital into a basket of different assets. This works in a similar way to asset tokens or tokenized strategies, such as ETFs or funds in traditional asset management.

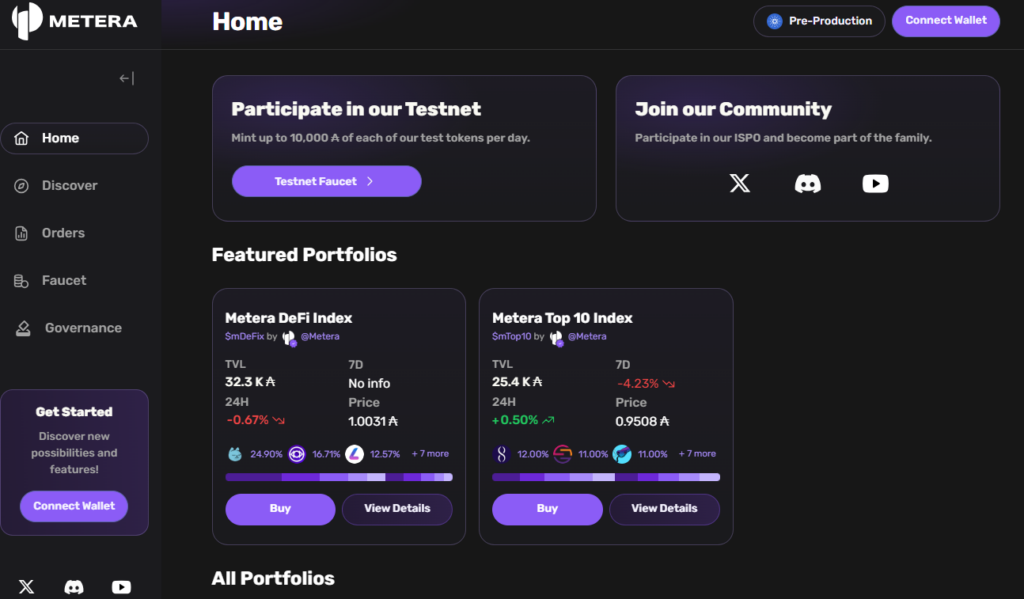

By holding a single MTK, you invest in multiple assets. Your portfolio consists of portions of assets underlying the MTK. For example, the Metera Top 10 Index gives you exposure to the top ten assets by market cap within the ecosystem. The Metera platform decentralizes readitional asset management by giving you control over your investment strategies. With everything happening on-chain, Metera allows you to track underlying assets, buy into a portfolio, or redeem your shre of the portfolio. When

Unlike hedge funds where portfolio managers have access to your money, Metra smart contracts do not give portfolio managers access to your assets. It works as a big liquidity pool that can only be assessed by burning or minting the MTK tokens.

Why do you need MTKs?

Metera Protocol is reshaping DeFi on Cardano by offering tokenized portfolios (MTKs) that simplify and enhance asset management. Here are some key benefits of MTKs.

- Leverage the power of indexes – Indexes are essential because they provide broad exposure to a group of assets through a single investment. In traditional finance, indexes help investors track the performance of sectors or markets, reducing the risk tied to individual assets. Metera brings you these powerful tools in Cardano through MTKs.

- Enable investment in tokenized portfolios – As an investor, you can seamlessly put your money on a diverse range of MTKs. A single token will also give you access to multiple assets.

- Manage your investment strategies and associated risks – As a Metera user, you become a portfolio manager who can create your own tokenized portfolio based on your preferred assets, investment goals, and risk preferences. MTKs also play a key role in risk management. By spreading investments across multiple assets, they help mitigate the impact of any single asset’s volatility, offering a more balanced and stable approach to investing in DeFi.

- Secure and transparent custody – Metera holds all assets underlying an MTK securely in non-custodial vaults using smart contracts. This ensures complete transparency and security of your assets. Your funds are always safe from unauthorized access as the only time they enter the vault is during minting or burning.

- Quality assurance – Metera uses Xerberus crypto risk ratings to maintain quality standards across all it’s tokenized portfolios.

Metera Protocol Recent Developments

The Metera Protocol team has been diligently working to enhance the platform with new features, resolve critical issues, and improve the overall user experience. The work spans from feature updates, bug fixes, audit status, and key Testnet metrics. The following snapshot shows a summary of the key timelines for development progress and milestones.

The Metera Testnet continues to attract significant participation as per the August 2024 metrics:

| Metric | Value |

|---|---|

| Total Testnet Users | 2,325 unique wallets |

| Users Completing All Quests | 434 |

| Total Orders Placed | 14,411 |

| Total Orders Processed | 11,756 |

| Total Value Locked (TVL) | 1,158,345 tADA |

| MTKs Created | 4 |

| Portfolio Managers | 2 |

Test and Earn with Metera’s Protocol TestNet

Metera announced the going live of the Protocol’s Public Test-Net towards the end of June 2024. A total of 1,000,000 $METERA tokens are up for grabs with the introduction of Metera’s test and earn Program.

According to Metera, the test and earn program aims to incentivize the Cardano community to try out Metera Protocol by participating in the public test-net. The rewards will be divided between all users that complete ALL of the following tasks:

- Collect all MTKs

- Active Buyer (Complete 10 “Buy” Transactions)

- Active Seller (Complete 10 “Sell” Transactions)

- Cautious Buyer (Cancel 2 “Buy” Transactions)

- Cautious Seller (Complete 2 “Sell” Transactions)

Once a user has completed each of these tasks, they’re able to see the progress in their wallet within the test-net interface and add their mainnet address.

Rewards will be tallied to the mainnet address and claimable after the TGE happens. It would be great participate and share your experience, progress, or any issue with the Metera team to help improve the protocol in preparation for mainnet launch

The previous private testnet program was announced earlier in the month of May. To participate in the Metera TestNet, users should have had at least 5 Metra NFT’s or the OG role on Discord. This gave the most loyal Metera users a chance to participate in the private testnet before it opened up to the public.

Metera’s Initial Stake Pool Offering (ISPO)

Metera Protocol has been focusing on expanding its reach, and it’s ISPO has been key to distributing the $METERA token. The ISPO, which has been running since epoch 451 and is set to end at epoch 493, lasting 42 epochs.

During the ISPO, a total of 15 SSPOs were selected to participate. Of these, 7 were selected by Metera as they were key in the platform’s growth within the community, while the remaining eight were voted by the community through a governance initiative. A total of 90,000,000 tokens were allocated for distribution to the larger community via the ISPO, which constitutes 9% of the total supply of $METERA. For a closer look into Metera’s tokenomics, token distribution, and vesting schedule, you can have a look at the Metera Protocol tokenomics summary.

Metera’s Fund 12 Proposals

As the Metera Protocol team prepares for key milestones scheduled for 2024 and beyond, including the launch of the Metera token on the mainnet, the team submitted two Fund 12 proposals to help the platform deliver as per the roadmap. While these proposals didn’t meet the funding threshold for Fund 12, the community continues to support them in all ways.

Metera Protocol Smart Contract Audit

The Metera team intends to audit the protocol´s code before launching into mainnet. This will provide more confidence and trust to the community that their funds are completely safe and managed in a fully non-custodial way.

According to the proposal, the code audit will done in collaboration with either Sundae Labs or Anastasia Labs. The scope of this code audit includes a formal review of the smart contracts to identifypossible security vulnerabilities oand ineeficiences. Once done, the auditing team will provide a detailed audit report with recommended fixes and action items. For a deeper look into the smart contract audit proposal, have a look at the complete proposal on ideascale.

Metera Protocol DEX Aggregator Integration

Metera is looking to improving their user experience by integrating the protocol with a DEX aggregator. This will facilitate swapping ADA to Cardano native tokens and ultimately, CNTs to MTKs. This integration will make it possible to submit a deposit order in a portfolio directly from the Dapp when you don’t have the required tokens. For more insights into the milestones and implementation details of the project, check the Metera’s DEX aggregator integration proposal on ideascale.

Putting it all together

The Metera Protocol demonstartes the great potential of decentralized finance and community-driven development. By collaborating closely with other leading developers within the ecosystem including MLabs and TXPipe, Metera is set to make a lasting impact on the Cardano ecosystem and the broader blockchain landscape. Additionally, it’s governance structure empowers the community to vote, propose, and make critical decisions regarding the future of the protocol. This democratic approach ensures that the protocol evolves in alignment with the collective needs of the community

For more detailed information and updates on the Metera Protocol, interested parties are encouraged to visit the official sources and stay informed about the latest developments.