I’ve been in the crypto space for a while now, and there’s something about Decentralized Finance (DeFi) that always keeps pulling me back in. But, let’s be real, it can get confusing especially when you’re trying to earn yield on your digital assets.

There’s endless journey hopping between platforms, understanding liquidity pools, staking, and yield farming. It follows the same process like you’re learning a new language. That’s where I found Optim Finance and honestly, it’s been a bit of a revelation.

I’m not saying I’ve got it all figured out, but Optim Finance has definitely made things easier. Here’s what I’ve learned, and why it’s worth taking a closer look especially if you’re someone who doesn’t have time to sit through a hundred tutorials on staking and farming.

What exactly is Optim Finance? It’s a DeFi protocol that built on the Cardano blockchain, and the main goal here is to simplify yield generation. Instead of having to navigate all the complexities that usually come with DeFi, Optim offers a more streamlined experience.

If you’re not familiar with smart contracts, they’re essentially self-executing contracts with the terms of the agreement written directly into code. This means no middlemen. You’re interacting directly with the blockchain, and everything runs as programmed.

The best part is that you don’t need to be a blockchain expert to use Optim Finance. They’ve created this protocol with the regular person in mind. The goal isn’t to bombard you with technical jargon, but to help you earn from your digital assets in a way that makes sense. And honestly, that’s a breath of fresh air.

The fact is that I had my hesitations at first. I mean, Cardano is known for its strong academic background and careful development, but that doesn’t automatically make everything built on it flawless. So, I did what any cautious crypto enthusiast would do, I did my homework.

Optim Finance leverages Cardano’s Plutus smart contracts, which are designed to be secure and scalable. They focus on getting things right, rather than rushing unfinished products to the market. Everything is decentralized, your assets are your assets, and Optim simply gives you the tools to make them work harder for you.

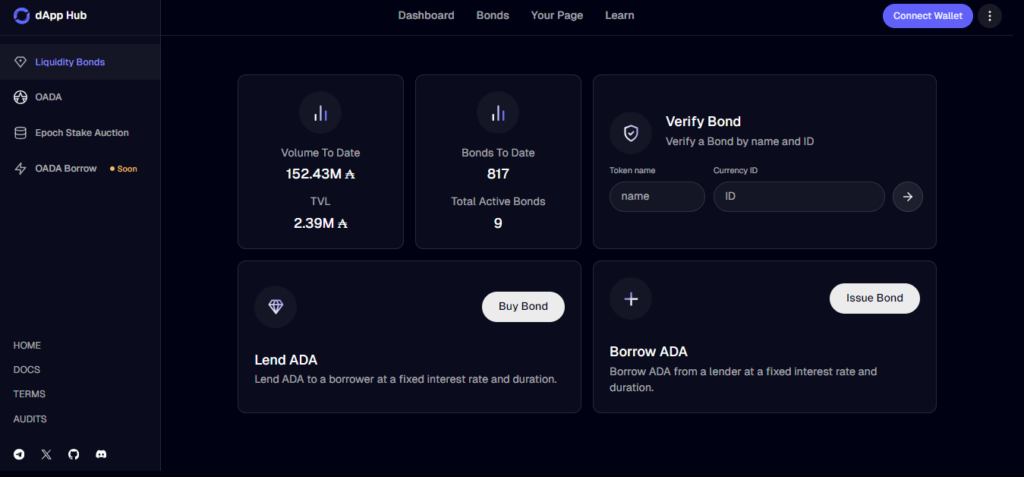

Optim Finance’s first product, Liquidity Bonds, isn’t just another DeFi tool. This isn’t your typical yield farming or staking setup. It’s a unique way to generate returns, bringing a whole new angle to how liquidity works in the crypto space.

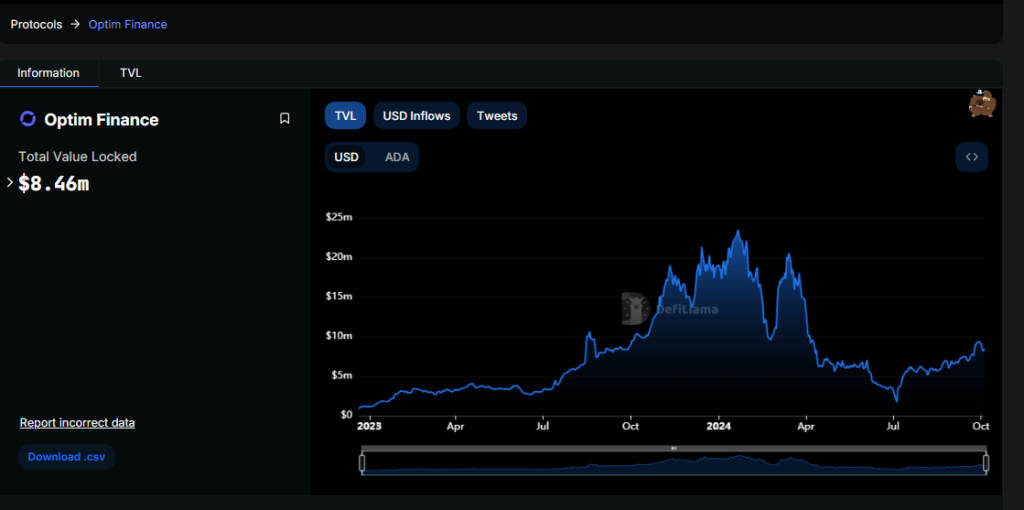

They’ve launched a fully functional dApp even landing in the top 10 for Total Value Locked (TVL) on the entire Cardano network. They safely managed over $8.46 million ADA in TVL on their platform. It’s a big deal, not just because of the numbers, it doesn’t come easy in the DeFi space.

What are Liquidity Bonds?

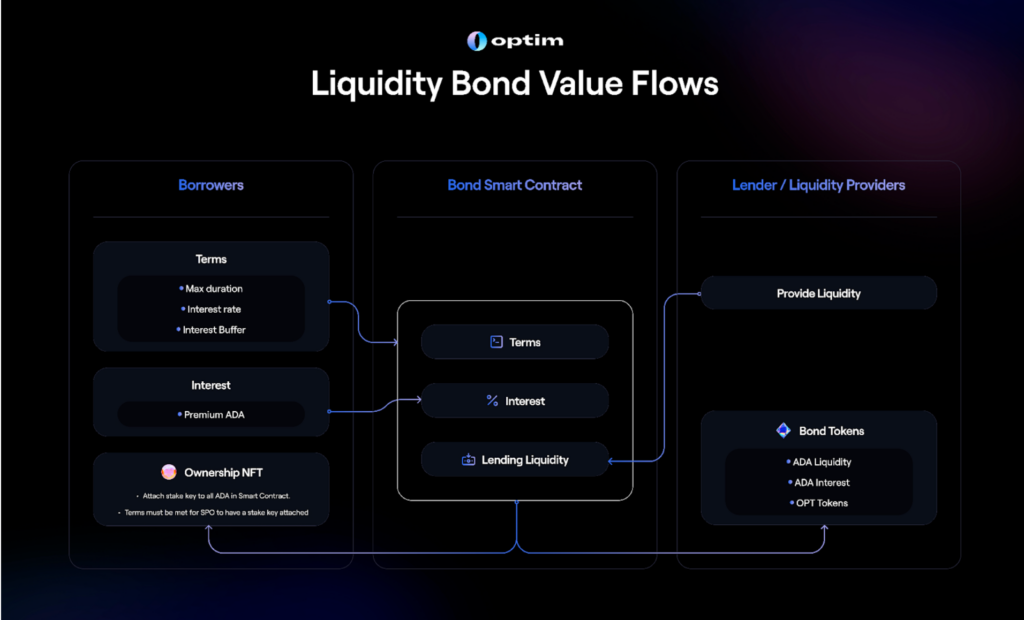

Liquidity Bonds are a unique feature of Cardano’s DeFi ecosystem, built on its solid staking system. In simple terms, they let you rent ADA staking rights and rewards for a set period. Here’s how it works:

Borrowers deposit interest into a smart contract, while lender deposit their ADA. Borrowers don’t take control of the ADA itself but gain rights to delegate its staking and collect rewards. Unlike traditional loans, borrowers don’t need huge collateral, but have enough to pay the agreed interest.

What is OADA and sOADA?

Optim Finance utilize two tokens: OADA and sOADA.

OADA is a derivative system for ADA that opens up some exciting yield opportunities, audited by Anastasia Labs. But it’s not just about earning a bit more ADA, there’s more to it. OADA brings in enhanced governance and makes sure your assets can play nicely with other DeFi products.

The system works in hand with the OADA/ADA stableswap pool on Splash DEX simply to ensure stability.

- OADA is pegged to ADA but does not receive any yield.

- sOADA is staked OADA. It is not a pegged token, but it receives all of the yield generated by the system and also bears the risk of any unlikely losses the system may take on.

How to Get Started with Optim Finance

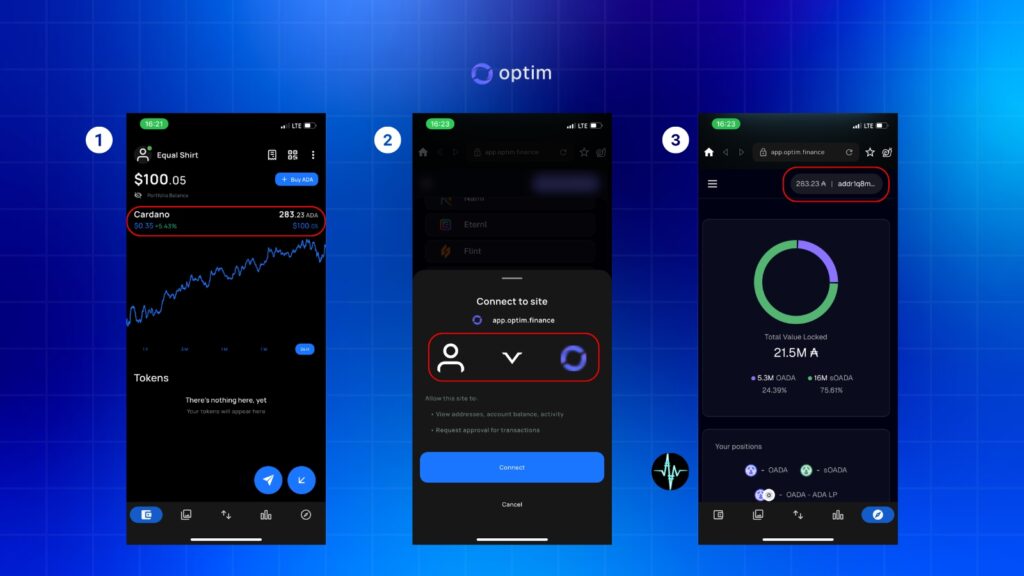

Jumping in was surprisingly simple. After connecting my Cardano wallet (VESPR, in case you’re curious), I was able to start interacting with Optim’s decentralized suite. There’s something almost intriguing about being able to lend out your ADA and generate yield, all without relying on traditional financial institutions.

Optim Finance is built for efficiency and the smart contracts ensure that your assets are working 24/7, generating yield even while you’re off doing something else. You don’t have to watch every market move, but set things in motion, and the protocol handles the rest.

Here is a guide on how to start using Optim Finance (Passive yield with sOADA):

- Download and fund your wallet with $ADA

- Connect to Optim Finance dApp

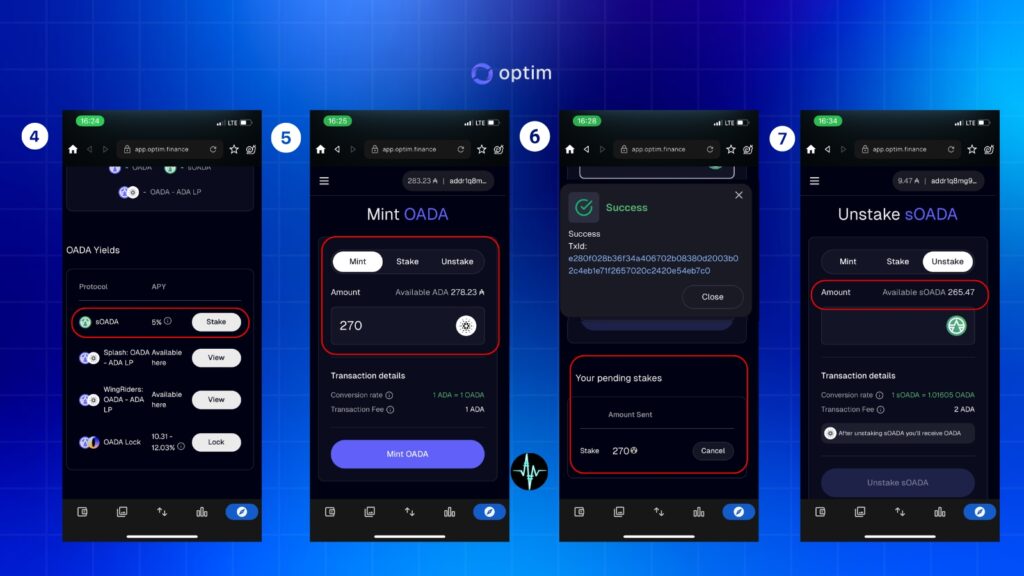

- Select OADA Yields of your choice. You can also use Mint-Stake-Earn function

- Mint OADA, which automatically convert your ADA

- You get sOADA in return of the staked OADA and earn 5% APR

- Explore the dApp and see more.

From where does OADA yield originate?

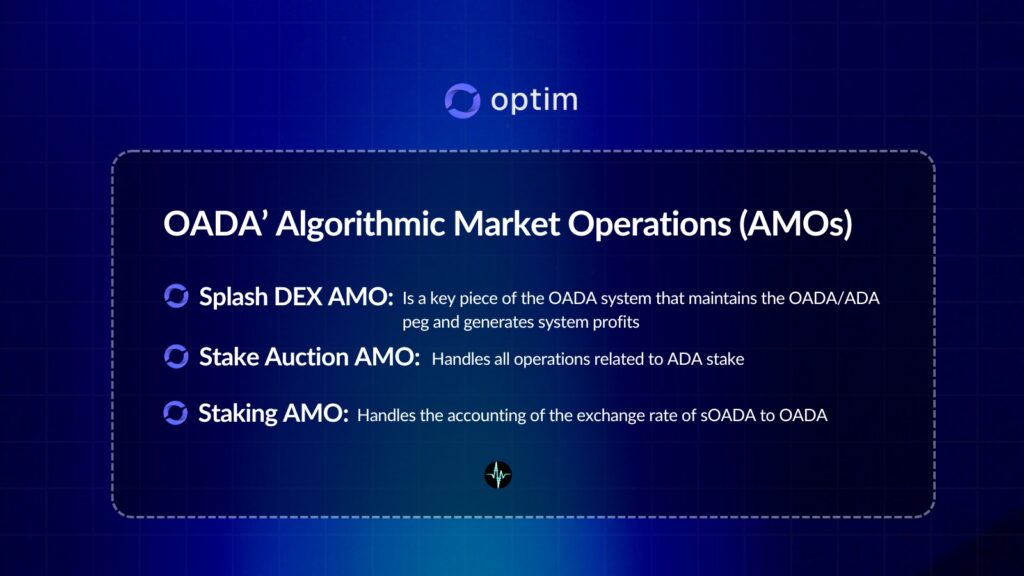

The OADA system is smart when it comes to making profits, using Algorithmic Market Operations (AMOs) to get the job done. These AMOs are kind of like automated machines that knows when to mint or burn OADA tokens, all based on a designed algorithm. You don’t have to worry about someone manually doing this, the system handles it on its own.

Now, about the reserves and how things get allocated, most of it needs a green light from something called a Controller. Controllers are not human though, they’re actually bots that run the show behind the scenes. They don’t actually hold onto any of the assets themselves, except in a rare case where the system might get exploited. Controllers don’t have personal control, they just follow the orders set by governance.

The OADA Governance

OADA system is governed by ODAO, and at the heart of that is a Soul Token. This little token has some serious power because it can upgrade the system however it needs to, keeping everything running smoothly as the protocol evolves.

Right now, the Soul Token is safely stored in a multi-signature wallet. Who controls it? A group made up of trusted members from Optim Labs and key contributors from the Optim DAO community. Basically, the people with the token are those you can count on to make smart, balanced decisions.

Final Thoughts

If you’re still on the fence about navigating DeFi because it all feels like too much, Optim Finance might be what you’re looking for. It takes the guesswork out of yield generation, and its seamless integration with the Cardano blockchain ensures security and reliability.

I’m not saying Optim Finance is perfect, but it’s definitely a step in the right direction. It’s one of those tools that makes you wonder why DeFi wasn’t always this straightforward. If you’re ready to let your assets do the heavy lifting, I’d say give it a go.