Before I begin, I wish to clear a few points. This article is by no way attacking Crypto or Cardano and is only my opinion. I am invested as heavily in the space as the next guy and am only rooting for its success.

And lastly, before I dive in, I would like to point out that I may, in fact, be utterly wrong on this matter, and if that’s the case, as it often is more than I would like, please feel free to correct me.

However, over the past five months, I have spent a significant proportion of my time interviewing and researching the different projects and aspects of Cardano and blockchain and have gotten a good grasp of the ecosystem and where things are going.

In my opinion, we have been slightly blindsight in our rush to develop products and solutions for the new financial system. The community enthusiasm, while terrific, may be causing more harm than good in allowing proper feedback for the projects to align them into a good product market fit. i.e. asking your family(given they’re a supportive one) what they think of your project will seldom result in getting the feedback you need, not want.

I read this tweet the other day, which embarrassingly I cannot find, but it went something like this “We have been really good at finding a different way of sourcing liquidity via NFTs and Loans etc.. but have we actually impacted the lives of anyone in a meaningful way? Not really. So where are the revolutionising solutions that were being promised back in 2017.” And this struck a chord with me, and I began to think.

Crypto, in general, is developing at a rapid pace, with Dapps and Nft launches flying through Crypto Twitter left, right and centre. But in reality, many of these projects follow the same path. The low-hanging fruit of DeFI has all but been picked, and every Dex is just a copy of one another. And how many more 10,000 mint AI-generated art Collections do we really need?

My point is innovations seem to be slowing slightly and especially innovation to the problems that are actually required are all but tapering to a drip.

It’s required once in a while to step back and relook at the space from the first principles.

- What was Crypto designed for -> Decentralised, Secure, Scalable ledgers

What’s the point in creating a really fast scalable Layer 1 like Solana? For example, when you trade decentralisation for speed, you have basically created another Web 2.0 App similar to AWS or Google Cloud.

2. What do we need to solve for mass adoption, i.e. how do we now get people to use the tech that has been built on mass?

There’s no point in making another DeFi project when it’s not going to be able to affect the people it’s designed to because they’re not onboarded into Crypto. And rightly so, why should the regular Joe who works his 9–5 and relaxes with a cold beer in the evening care about decentralisation when the centralised systems seem to him to be working fine? Obviously, we know that these systems are not working fine and are draining and leeching off this Joe in a slow and clever manner to which he is oblivious. But we are just not creating enough of an incentive for the masses to switch.

Do you see where I am getting at?

I want to break this down a little further by separating the different crypto categories and their ultimate use case/MVP over the centralised products we have today.

Category 1 — Store of Value/Money

Here we have the famous Bitcoin and its many counterparts, BitcoinCash, Litecoin, Monero, etc… These coins are all trying to fill the same purpose, to become either digital gold or the next global currency. And in this manner, I believe one of them will be.

Benefits over Fiat include:

- Decentralisation: Bitcoin is a decentralised currency that operates on a peer-to-peer network. It is not controlled by any government or financial institution.

- Security: Bitcoin transactions are secured using cryptography and stored in a public ledger called the blockchain. This makes it virtually impossible to counterfeit or double-spend.

- Global Reach: Bitcoin transactions can be made anywhere in the world, without the need for currency conversion or expensive transaction fees.

- Accessibility: Anyone can use Bitcoin, regardless of their credit score, income, or location.

- Low Transaction Fees: Bitcoin transaction fees are typically lower than those charged by banks or other financial institutions.

- Limited Supply: Bitcoin has a limited supply of 21 million coins, which makes it a deflationary currency. This means that it is likely to increase in value over time.

- Transparency: Bitcoin transactions are transparent and can be viewed by anyone on the blockchain. This makes it easy to track the movement of funds.

- No Middlemen: Bitcoin transactions are direct, peer-to-peer transactions, which eliminates the need for intermediaries such as banks or payment processors.

In pretty much every way, Bitcoin is better than Fiat and, ultimately, is coming to the end of its development lifecycle. There’s not much left to invent or build here. It’s a great product and is slowly seeing adoption as the fiat world crumbles.

Category 2 — The specific

Next, we have specific blockchains. These are not projects looking to overhaul the entire system but are more about revolutionising a particular Industry or sub-industry. Examples are FileCoin or VeChain, both are separate blockchains with a singular aim. Hence any structural decision is made only with this goal in mind.

I only have a little to say here, as there isn’t a significant problem with this category of blockchains. They have their goal and are working towards it, with the only criticism being interoperability, which may be needed in the future.

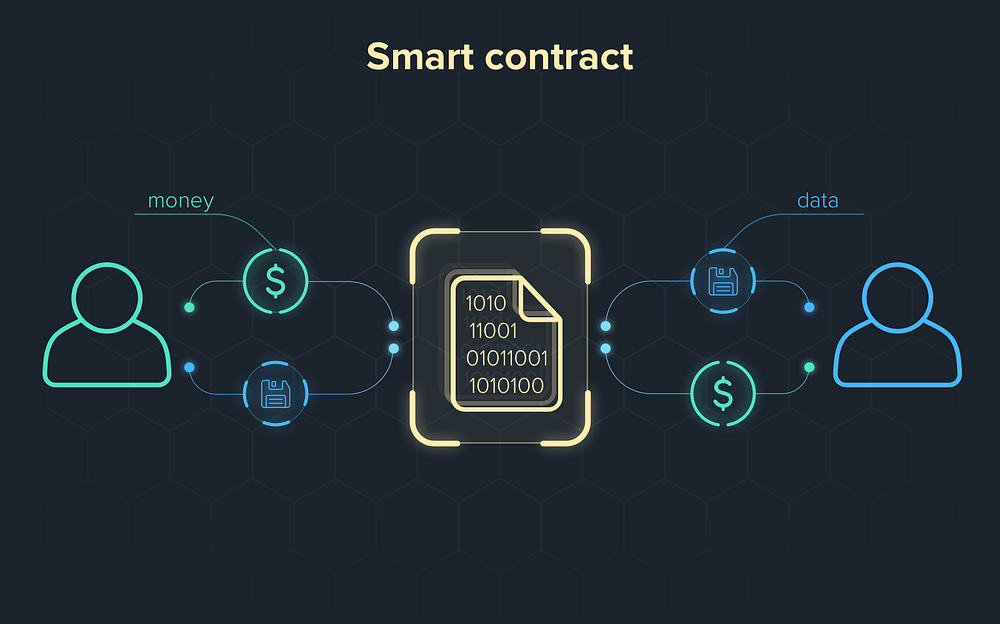

Category 3 — The Smart Contract platform

The last major category of blockchain is the most exciting and the one I have to most gripe with. Specifically, it’s not these blockchain platforms that have much wrong with them but the way in which they are being used. This category includes Etheriums Cardano and others like Solana and avalanche.

And yes, there are vast differences in how they build this decentralised platform, with Cardano being far at the forefront of these in terms of security and scalability. But when it comes down to it, they are all attempting to achieve the same thing.

To run code permissionless and in a decentralised manner.

While this is a lofty goal, the reality is that many of the projects being developed on these blockchain platforms are not living up to their full potential. Now apart from the obvious gripe of many developers simply using these platforms to launch initial coin offerings (ICOs) and other token sales in order to make a quick profit.

The Projects that are Serious about building great applications and Dapps are stuck in a no Innovation Box.

We don’t need more DeFi, we don’t need more NFTs. What we do need are solutions that leverage that amazing ability” to run decentralised code” to provide solutions to the average Joe that make his life much easier than using the centralised version.

It’s not enough to build solutions that have their main selling point being decentralisation and censorship resistance because at the end of the day, you’re growth strategy is just waiting for the competition to fail. People will not change solutions from a faster, better one to a slower, more expensive one just because it’s safer until the one they are using breaks down.

We need to be proactive with our solutions. Not only do they need to be decentralised, but they need to be BETTER than the centralised versions while also satisfying the immediate human need.

Getting good APY on your Cash is not a Direct human need, while not paying so much in lawyer fees or to estate agents for selling your house is. This is just one of a million examples where a decentralised solution could come in and cut out the middleman with code.

Now, it’s not easy to build and develop these solutions that interact with the real world, but it is where blockchain’s vast potential is.

We need to stop innovating blockchain applications for blockchain people and start innovating blockchain apps for non-blockchain people. This really is key if we ever are to grow and change the world for the better.

The key takeaway here for any founder or entrepreneur is to think about this one question. If you could run decentralised code, would it make this industry better in some way?

If it’s a yes, then get building!