This post was adapted from a thread originally posted by @Flantoshi on Twitter

One difficulty that comes when writing about China is that a lot has been said about the country, and much of it isn’t friendly or complimentary. Indeed, much of the rhetoric is that it ought to be treated as an enemy bent on world domination.

In my estimation, it’s an emerging world power asserting itself on the world stage. It’s the Romans asserting themselves with the Carthaginians, the Athenians with the Spartans, etc. These powers rising or defending their claims are not evil, they’re just incomprehensibly large entities affecting the environment around them to survive. And, much as the Ancient Greek historian Thucydides noted, when emerging powers step on the toes of present world hegemons, there’s bound to be geopolitical conflicts.

This turmoil is commonly known as the Thucydides Trap, and it applies just as much as to China with the United States, as cryptocurrency to the status quo. There’s bound to be metaphorical and real blood spilt over this in the coming years.

As such, if the thread that inspired this post is any indication, there will be people who take offence at my treatment of the subject. You can look at it from a thousand angles, all with their different philosophical interpretations -and in my own, admittedly very cynical and overly pessimistic estimation, this is what is happening:

After a lull in its power, China has reemerged on the world stage having learnt from past mistakes. It will no longer act with hubris in thinking it can retain supremacy by default. Instead, it will rule either by hook or by crook and it will not tolerate anyone that stands in its way — including decentralized projects like Cardano.

In this article, we shall explore why China and Cardano are about to lock horns, and what the consequences will be from it.

Growth Spurt

Following US President Nixon’s visit to China in 1972, the country began to open up to influence that wasn’t overtly Soviet. It was hardly an overnight thing and took several decades for the country to open up and reform, but with time it struck trade relations all over the world.

This was done partly out of necessity, as with the weakening and eventual collapse of the Soviet Union, China’s aegis of influence waned. Now, it must be said, the Soviets and the Chinese weren’t always the best of friends, sometimes they were even at the brink of war, but they had more in common than not when compared to the rest of the world.

Hence, to survive and thrive, China took to doing one of the tried and true methods that developing countries often take — specializing in cheap and unskilled labour.

The reason is that this particular type of work is reliant on one type of resource that developing countries have in spades — huge populations. This strategy typically works rather well, as you attract capital from all over the world to build factories and infrastructure, to take advantage of this asymmetry in production costs.

However, what happens a few decades into this strategy if you have succeeded, is that your economy has developed too much for this strategy to work. In other words, your workers demand ever higher wages for the associated labour, as they’ve had the opportunity to train and increase their capabilities, or they’ve been brought up with the expectation their lives will keep improving when compared to their parents, and grandparents.

Naturally, you can’t increase wages as you’ll lose the cheap prices that drew businesses to you in the first place. So your society has two main options: evolve into a middle-income service economy, or stagnate as you’re unable to change with the times.

Not every country makes it out the other end, and the adaptation is painful. This is such a commonly observed phenomenon that it even has a name, “The Middle Income Trap.”

Due to China’s spectacular development, it has been on course to crash into the Middle Income Trap for decades. However, while it hasn’t been able to change course, it has managed to postpone the crash by artificially lowering the price of its currency relative to the dollar.

In other words, even if a worker were to earn more in Yuan, within the context of the international markets (in US Dollar terms), their wage increase might be nonexistent or negligible. As such, it’s a means of making the populace think they’re getting richer while keeping business as usual.

Mind you this doesn’t solve the issue, but it certainly gives the powers that be more time to think about their next move and use the positive investor sentiment in their favour.

Indeed, on the one hand, they’ve accrued the wealth from being the world’s factory, enough to be the planet’s second economy; but on the other hand, they can still qualify for loans from the World Bank, an international financial institution that provides loans to the governments of low- and middle-income countries to pursue developmental projects.

This has been a matter of some debate in many political circles. Be that as it may, China can use the massive low-interest-rate loans it has access to (from both private and government institutions) to fund development.

The problem though is that growth is not infinite. Given a certain population size and its general demographic trend, there are only so many infrastructure projects that make sense given our current technological capabilities. You can only build so many roads, airports, high-speed trains, sanitary infrastructure, etc before it stops making sense.

It’s hard to describe the scope of the development that has occurred in the last few years in China. Just to make a point, according to the IMF, an international financial institution, between 2019–2020, the Chinese economy grew by $429.56bn — for reference, the United Arab Emirates and Norway have a GDP of $410bn and $445bn respectively.

In other words, China’s economy is growing by a UAE or Norway EVERY YEAR. Its construction plans are no less impressive either as China used more concrete in three years than the US used in the entire 20th century.

Nevertheless, as we suggested, there comes a point of diminishing returns. So by the point where you’re building dozens of fully functioning ‘ghost cities’, as in operational cities that have everything in them except people, you perhaps begin wondering whether there’s a better use for the piles of cash being given to you.

Hence you begin to look abroad.

Global China

Imagine you’re the leader of China, you’re suddenly at the helm of one of the most powerful economies in world history. Nevertheless, in recent memory, your country did not have the power to dictate terms.

Worse still, before China’s entrance on the world stage, it had a century where it was dominated by many Western Powers and the Japanese. This period from 1839 to 1949, known as ‘The Century of Humiliation’ left a deep scar in the psyche of the nation, and many leaders have vowed for it to never happen again.

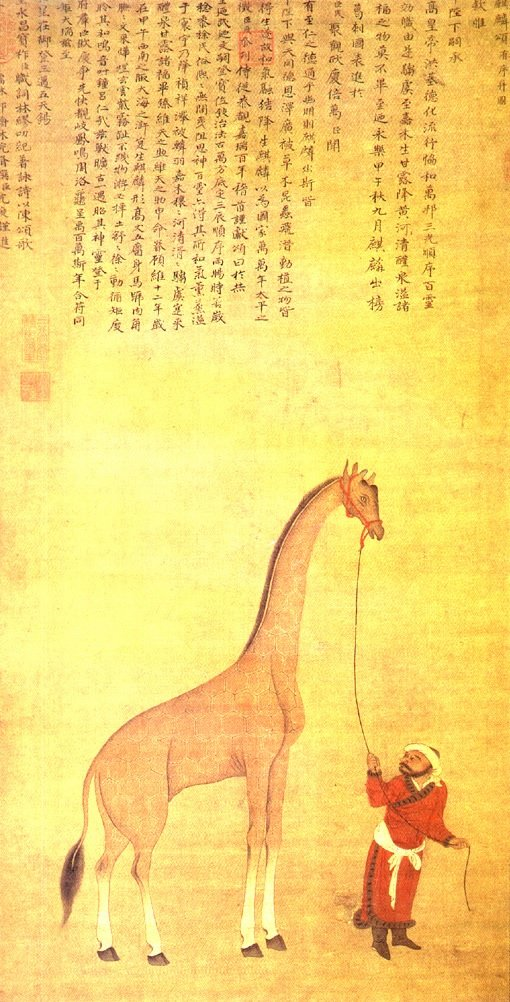

The reason this happened in the first place was that China had gotten comfortable. It believed it alone was the world’s sovereign, and the rest of the planet, while perhaps not necessarily vassal states, ought to show submissiveness.

Emperor Qian Long’s Letter to King George III in 1793 captured this sentiment perfectly:

“You, O King, live beyond the confines of many seas, nevertheless, impelled by your humble desire to partake of the benefits of our civilisation, you have dispatched a mission respectfully bearing your memorial. Your Envoy has crossed the seas and paid his respects at my Court on the anniversary of my birthday. To show your devotion, you have also sent offerings of your country’s produce. […]”

The letter goes on and on, but you get the picture. The Chinese elite felt so in control of the world, that they considered the British Empire, with continent-sized colonies, to still need to kowtow to them.

Naturally, this did not go well, and almost like a Greek Tragedy, their hubris brought them to ruin and humiliation. Hence, when modern Chinese leaders look to the past, they realize they need to be considerably more proactive if they are to survive and thrive in the modern world.

As such, they’re taking the trillions of dollars in capital that they have at their disposal and are using it to enhance their influence all over the globe. There are three main vectors through which they exert their influence:

- Silk Road Economic Belt: This is the likeliest to be the one that you’ve seen in the news, so I won’t spend that much time on it. In short, the concept behind this is that through careful investments in key infrastructure in the Asia Pacific, African and Central and Eastern European regions, China can become a better and more influential trade partner by lowering obstacles that would’ve otherwise reduced business with them.

- String of Pearls: China isn’t on the best of terms with India, and there’s always been a certain tension. However, given the size of both countries, conventional warfare would be difficult. As insurance against any military confrontation, China has taken to building military bases and commercial outposts and thereby surrounding India by partnering with neighbouring countries. If a war ever were to occur, China can retaliate from any possible angle as it has essentially managed to corner India.

- Pan African Strategy: As China’s economy has become more sophisticated, and even with its currency shenanigans, it has not been able to maintain low production costs. So it has begun setting shop elsewhere, chiefly Africa. This locale also has the attractive benefit of being rich in raw materials necessary for the production of more sophisticated goods in their home country.

In practice, China’s strategy works much like the famous line from the Godfather “I’ll make them an offer they can’t refuse.” And indeed, if you are a leader of an impoverished, developing nation — even if you aren’t corrupt and are genuinely looking out for the wellbeing of your people — taking China’s assistance, even if it comes with some strings attached, makes sense.

When you’re in the desert with a dry throat, and there isn’t water to be found for miles, you’re not going to question the motivations of someone who hands you a bottle of water. This is exactly what China is counting on, as it aims to assert its place on the world stage.

Neocolonialism

The world has largely moved on from the idea of colonizing other territories in the traditional sense of the word. If we are to go in the legal weeds of things, members of the United Nations are supposed to not have colonies at all. On the 14th of December 1960, the UN passed the Declaration on the Granting of Independence to Colonial Countries and Peoples, which characterized foreign rule as a violation of human rights.

Besides that, after crunching the numbers, it’s been argued that many colonies in history were often vanity projects that made a handful of people very rich, but often weren’t worth the trouble, or occasionally stopped being profitable.

If you want specific resources, does it make sense to go through the trouble to take over every aspect of a country by force, or does it make more sense to bribe/kill specific people so that you gain and retain that resource while building the least amount of infrastructure that you can get away with while still extracting value?

That’s the grand lesson of nation-building in the twentieth century — you can optimize for resource extraction without bothering to change much about the nation.

It may feel like I’m pointing the finger at China, but they’re far from the only ones doing it. The US has done it for decades via the international capital markets and the rating agencies; as well as via entities like the IMF, where struggling countries need to adhere to the ominous-sounding ‘Washington Consensus’ to save their economies.

TRANSLATION: The economy must be open to transnational conglomerates (ie the Americans), and laws should be designed to promote the interests of businesses first, people second.

Hence the US ends up not caring whether or not they’re actually in direct control of the government, as everyone ends up in blue jeans and eating McDonald’s anyway. In other words, cultural assimilation happens via osmosis, as American culture becomes the default choice and local alternatives can’t compete with the scale and resources of their international rivals.

Perhaps it bears mentioning that it’s been argued many of these struggling countries were put in that situation by so-called “Economic Hitmen,” which are high-tier white-collar agents who push countries into these financial arrangements by any means necessary.

An example you’ll often hear mentioned in these topics is that of the United Fruit Company, which in the 1930s owned 3.5 million acres (14,000 km2) of land in various Latin American countries. Long story short, they could exert undue power in the various nations and that’s where the term “Banana Republic” comes from.

However, not everyone was pleased with foreigners essentially taking control over their countries. As such, in 1952, the Guatemalan government took back the unused land owned by the United Fruit Company and gave it to landless peasants.

The company wasn’t pleased, so it lobbied Washington by labelling the Guatemalan government as communist, and shortly after the CIA staged a coup to install a pro-business dictatorship.

This is the playbook that China has read up on but is operating with a speed and efficiency that has certainly terrified the US.

China’s China

With all that out of the way, we get to China in Africa. The continent had largely been left to rot by Western Powers in the last few decades, as service economies achieved growth prospects far above anything that could be offered by this neocolonialism, while material goods were supplied by places like China and raw resources were sourced from more developed international markets.

Yet China is playing the long game. It’s a millenary culture that is used to long and expansive projects that take generations. Hence, throughout Africa, they’ve built roads, stadiums, ports, power stations, factories, government buildings, and any other large scale construction project that you can think of.

We must always keep in mind though that this isn’t done out of largesse, or with an immediate expectation of return on investment. An argument could even be made that China fully expects to write off these loans, as they’re often given at far below market value to entities that might not have the income to repay them.

What this “generosity” does buy is influence, both in the countries themselves and on the world stage. There have been studies that hint that an increase in resource exports to China increases the probability of voting in line with China in the United Nations, even if said votes are contrary to the wishes of the United States.

Even if we assume no foul play or quid pro quo behind the scenes, it makes sense — why should African countries automatically be expected to vote against the best interests of world powers that are “helping” them?

Not only do they build things, but they’re also bringing jobs to Africa both in the construction of these sizable projects and within the production plants that China has opened. In aggregate, the African continent has become China’s China — its source of cheap labour and goods.

Yet, as the interests of the independent nations are increasingly tied to China’s, an interesting question emerges: At what point are they just a vassal state?

Sure, they still have their own borders and governments. But when it comes to exercising autonomy over themselves, that’s a bit of a harder task. If they go off-script, it stands to reason that China bears no obligation to continue their support, and who’s to say we don’t have a United Fruit Company situation on our hands?

Make no mistake, the governments are kept on a tight leash. For instance, the Chinese built the African Union (a continent-spanning intragovernmental agency) headquarters in Addis Ababa, Ethiopia as a “gift”. Six years later, the French newspaper Le Monde broke the story that the place was bugged and the servers were sending information to China.

Amusingly enough, Ethiopian Prime Minister Hailemariam Desalegn and many other high dignitaries denied these allegations, but then quietly changed the servers and began encrypting messages shortly thereafter.

China also dismisses these allegations as absurd.

Whatever the case, what is undeniable is the increasing Chinese influence on the continent. And if history is any guide, this influence will begin to be exercised in the wider public’s currency preferences.

Put yourself in the shoes of citizens of African countries, many of whom have grown up with mismanaged economies that aren’t strangers to rather high inflation rates and devaluations. Would they not instead prefer to be paid in a comparatively stable currency like the Yuan, especially if they can use it all over the world due to its growing influence?

As luck would have it, their new employers are essentially arms of the Chinese government, despite supposedly being private corporations. So they would be more than happy to pay with their own currency.

Not only that, but China has also recently unveiled a Central Bank Digital Currency (CBDC) that they have been using in their country, which can be used to seamlessly provide financial infrastructure with the comfort of an app on a phone. This comes as a blessing to the wider African population, as the management consulting firm McKinsey estimated in a report that by 2022 only half of Africans would be banked.

In other words, they could completely sidestep having to develop banks as institutions if they were to adopt crypto. And that’s precisely where Cardano enters into the picture offering to help African countries build their data infrastructure, as well as possibly even run their sovereign currencies on the blockchain.

Cardano, an alternative to China?

A problem with these types of articles is that they treat “the African continent” as if it were one homogenous entity, or something comparable to a European Union, where despite their cultural differences you can make some vague generalizations.

The truth is far more nuanced. Even within the same country there are bound to be vast cultural differences. As an admittedly unrepresentative example, back when I used to be a financial journalist, I used to have a Ghanaian coworker and she would have very strong opinions about communities that lived just the hill over where she was born.

This is because in just Ghana there are over 100 ethnic groups, each with its distinct language, culture and traditions. A year or so later, a Nigerian lady started working at the office as well, and despite the conversation always being pleasant there was always playful banter between them about Ghanaians & Nigerians.

To an outsider, these distinctions between Ghanaians and Nigerians might seem trivial, but it’d be like comparing Americans to Canadians or Brits. Then you have the entire rest of the continent, with different histories, cultures, development levels and problems to solve.

Fundamentally, these are different people and they should be treated with the respect and decorum they deserve.

Yet, unfortunately, I am not knowledgeable enough in the dozens of countries of the continent and I’m forced to make sweeping generalizations. There are bound to be markets where China holds all the cards, there will be others where Cardano is welcomed with open arms, and most will likely fall somewhere in between.

In either case, to continue with my sweeping generalization, Africa is an underdeveloped market up for grabs, with a huge population and potential, where most people don’t have a bank account, and they’re likely to be more or less permanently bound to early decisions they make now.

That’s why China and Cardano both share expanding their influence there as a goal. That said, to say it’s a contest between the two is a tad disingenuous.

I’m going to put this in no uncertain terms — Cardano is not in a war with China. Hell, it’s hardly a fight, as even with our entire market cap of $41bn we’re barely a rounding error for China.

So no, I won’t even entertain the notion that Cardano stands a ghost (chain) of a chance to beat China. It’d be as silly as trying to defeat a typhoon.

When I introduced the notion on Twitter of Cardano having some potential rivalry with China, some of the comments on the thread hinted that while we were unable to go on the offensive, we were secure in our Proof of Stake fortress.

Quite frankly, I deem that to be naivete of the highest order. There’s what, 3,000 stakepools running at the moment? If China wanted they could set up 30,000 in a day.

They also have billions of dollars to accumulate ADA with, and to preempt the argument, no this would not be impossible. They don’t need to buy all at once and drive the price up exponentially, thereby making a 51% attack where they control the network impossible.

No, they have teams of economists, strategists and mathematical experts. Surely some of them would take a look at the whale game that Bitcoin has, where large players sell their holdings to collapse the price, and then rebuy at low prices, and think this could work with ADA as well.

They could do this over months, and thereby demoralize the wider Cardano community, while also turning a profit. This would continue until they have enough of a stake in the network to dismantle it entirely.

Or they could congest the system with pointless transactions, and make the whole system unusable. There’s also bound to be many more attack vectors that I can’t imagine.

The point is that we’re at their mercy if they ever perceive Cardano as a threat.

(This, among many other reasons, is why I think Cardano should focus on markets like Latin America or South East Asia while they can pivot.)

But perhaps that’s the key phrase to unlock our potential “if they ever perceive us as a threat.” Earlier we mentioned that neocolonialism is uninterested in the everyday minutia of running a state — you can pick whatever accoutrements you want, as long as you’re useful when it’s important.

In other words, China and Cardano can coexist in Africa, as long as Cardano remembers who is truly king.

China already has a seat at the table, Cardano is still in the process of getting one as it signs agreements with the various African nations. It remains to be seen to what extent Cardano can influence the different cultures of the continent.

Ultimately though, I wish that it’s the African citizens who get to decide who gets to sit at their table.

Conclusion

This is bound to be a thorny piece, already with the thread that inspired this post I was called every name in the book, so I’m expecting it. As much as I like to talk about geopolitics, it’s easy to get swept away and forget that the policies and the decisions we discuss here will affect billions of people’s lives.

The tides of history can make us all feel powerless, but we can choose to acknowledge these forces and plan accordingly, or ignore them altogether and be hit with them at the most inopportune of moments.

China is asserting itself on the world stage, and when a giant moves, the earth trembles.

I’m ultimately not a prophet, I don’t see the future. The fate of the African continent remains up in the air.

I just hope for their sake that they’re able to play the cards that they have with the elegance of a professional card shark, or history will repeat itself and even as their economies develop they won’t know true independence.

If you’re in the crypto or in the traditional finance industry looking for someone to ghostwrite content for you, please do not hesitate to message me. I’m a full-time ghostwriter.

Join the community over at @flantoshi on Twitter.

And if you would like to support this project and help me pay rent, I’ll pass on the tip hat and you can send ADA to:

addr1qxfgs44d763uuw4hy6qatx383v9mmrrm6qazay6eren9sp5r2usruecwv33lp2t2nqp4ss6hrc9ac8yd2klxnsfnxz2qw3su4s

Thank you for your support!