Blockchain technology was pioneered (although not created) by cypherpunks, a group of activists seeking to improve privacy through cryptography as a route to social and political change. The best known of them is Satoshi Nakamoto. At the end I leave an article about them (1).

One of the principles on which blockchain technology was built is decentralization, to differentiate itself from the traditional financial world with power concentrated in a few hands that digitize global markets. Another principle is to have healthy money, different from the monetary policy of the Central Banks, which manipulate the issuance of money according to the dictates of politicians, destroying the predictability of the monetary value.

There are blockchain developments that have departed from these principles. In this article I will talk about the concept of burning cryptocurrencies, an arbitrary monetary policy as an inorganic form that in most cases seeks to increase the price.

In the face of constant demand, burning the coins could cause a shortage in the market. It is a short-term speculation that does not make sense in the long term.

There are cases where token burning might be economically justified, where for example a trading system is downgraded to a planned redesign, and the number of fungible tokens is excessive in that trading scheme.

First of all you need to understand what coin burning is.

Only coins in circulation can be burned. The act of burning a digital asset involves sending it to a location from which it can never be retrieved, also known as a burn address, which effectively removes the digital asset from circulation by locking itself away for eternity. It consists of an address of a wallet that cannot be accessed, because it does not have a private key linked to it, and therefore they are unrecoverable.

The burning of these assets implies (or would imply) in the short term an increase in the price, increasing the profits of current holders to the detriment of futures, which will buy at more expensive values. This methodology is not sustainable in the long term. As you have surely noticed, this is how a Ponzi scheme is generated, a deception race to see who is the last “fool” to buy expensive. In this way, instead of encouraging the usefulness of the network, speculation is encouraged.

Who decides to burn the coins? When? What amount? Why?

As I said at the beginning of the article, it is arbitrary, and it promotes speculation and mistrust in the community.

In a decentralized network, there is no central authority that can make decisions.

Blockchain networks will only make sense if they are adopted organically, and that will happen with significant technological innovation and services, and for this the investment of money is necessary.

Successful projects can lead to higher adoption rates, and this leads to an increase in the value of the cryptocurrency price, sustainable in the long term.

The high volatility of cryptocurrencies is an obstacle to adoption, and only invites speculation (burning is mostly in that sense). The adoption tends to stabilize the price, because it gives greater depth to the market making it less manipulable.

Burning Cases

Ethereum has recently established the gradual burning of ETHER (ETH) in fees for each block (EIP-1559). The idea is that if more ETH coins are burned than new coins are issued in each block, Ethereum would have a deflationary monetary policy. This system is striking since the fees are incentives to cover the costs of running and maintaining the secure network. Although it can work economically, it can be inflationary or deflationary, depending on the number of transactions, and therefore fees. The number of coins in the future can only be estimated with a small degree of precision.

Binance burns its BNB cryptocurrency for events. According to reports up to July 2022, there were 20 events, in total more than 38 million BNB coins were burned, reducing the initial supply of 200 million by 19.34%. The total supply is now 161,316,552.34 BNB. You can see it here.

Stellar is another blockchain that proceeded with the burning of its tokens, in the amount of 55 billion XLM, to increase the value of the currency, reducing its supply by more than 50%. The price effect on XLM was quickly noticeable in the short term, going from $0.069 to $0.088 in one day (about 27% from Nov 5 to Nov 6, 2019). You can read the note here.

In Bitcoin Cash (BCH) mining pool AntPool announced in April 2018, the burning of 12% of its Bitcoin Cash mining fees, sending them to unrecoverable addresses. Considering that AntPool validated approximately 10% of BCH transactions, this was a significant amount of cryptocurrencies. With a risky speculative bet, Antpool sought to revalue BCH and thus its own holdings, but without great results. You can read the note here.

Solana burned 11,365,067 of its SOL coin in May 2020, in accordance with its commitment to reduce token supply to account for market-making activity. At that time the circulating supply was 16,350,594 SOL. You can read the details of the operation here.

ADA is Appreciated for its Developments

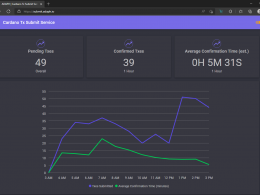

Cardano’s policy, on the other hand, is deterministic and the amount of ADAs in circulation in the future can be accurately calculated. Cardano has capped the total issuance at 45 billion ADAs. At the end I leave an article about the monetary policy of Cardano (2).

The main advantage is that the fees fill the Treasury, so if Cardano is successful, it will never run out of money for further development. This makes Cardano sustainable in the long term.

It is not possible to ask Charles Hoskinson (founder of Cardano) to burn coins. Cardano is a decentralized network and Charles is the CEO of IOG, but he has no control over the Cardano network. Neither Charles nor the team have control over users’ ADA coins, they each have their ADAs under their own control as long as they have private keys (remember “not your keys, not your cryptos”).

As I said before, you can only burn the circulating. You could ask IOG, or Emurgo, or the Cardano Foundation, or Charles himself, who have their funds in ADA, to burn their coins, but do you think they will willingly give up their own wealth knowing the potential that Cardano promises for usability? .

The ADA coins in the Treasury are used for the development of the ecosystem. They are destined to finance developments in Cardano, and today particularly, to winning projects in Catalyst. It is not smart to burn coins that can be used for the development of the ecosystem.

Final Words

You have seen in this article a negative critique of cryptocurrency burning.

The provision of money in any economic system is key, since money is the most required commodity in the economy, because it is used as a means of commercial exchange.

We see how the Central Banks, in their own way, burn fiat, and this is by withdrawing money from the circulating market with the placement of debt, to absorb a certain amount of cash. They also raise interest rates so that the public immobilizes funds to earn interest, thus withdrawing money from circulation, thereby reducing the availability of cash on the street.

When the rules of the game are changed, giving money a different value and cost (to borrow), monetary predictability is lost, and this gives rise to financial speculation instead of investing in economic development.

Few cases could justify withdrawing money from circulation (burning cryptocurrencies or borrowing in fiat, depending on the case), such as a prolonged recession or a change in the economic or monetary system, but all this is not innocuous, and has consequences, in general, negative.

. . .

(1) Cypherpunks