“Honesty is a very expensive gift, Don’t expect it from cheap people.”

― Warren Buffett

When you talk to a person who doesn’t know about the cryptocurrency and blockchain ecosystem, what you usually hear (more often than not) is that it’s a scam. Being intellectually honest, this is not a wrong assessment of a sector of our industry. They probably formed this opinion because of news they read or information that came to them about some hack, robbery or pyramid scheme.

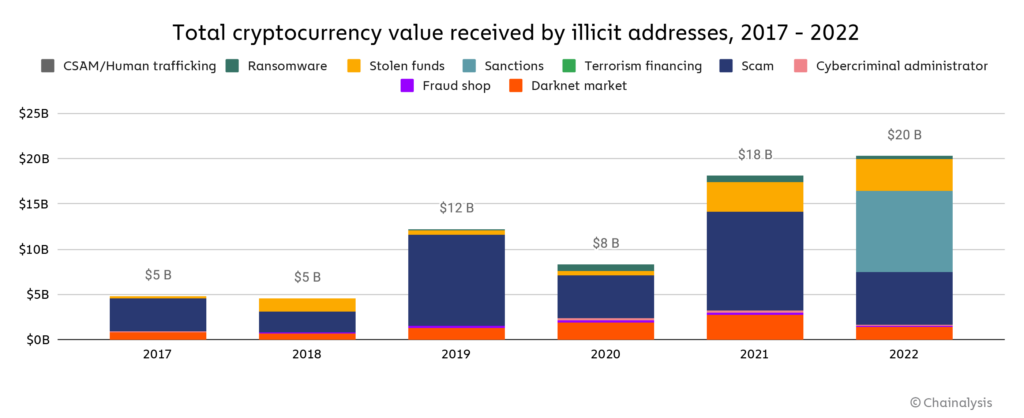

Chainalysis’ 2022 crypto crime report indicates that an exorbitant $20 billion was acquired through illicit activities.

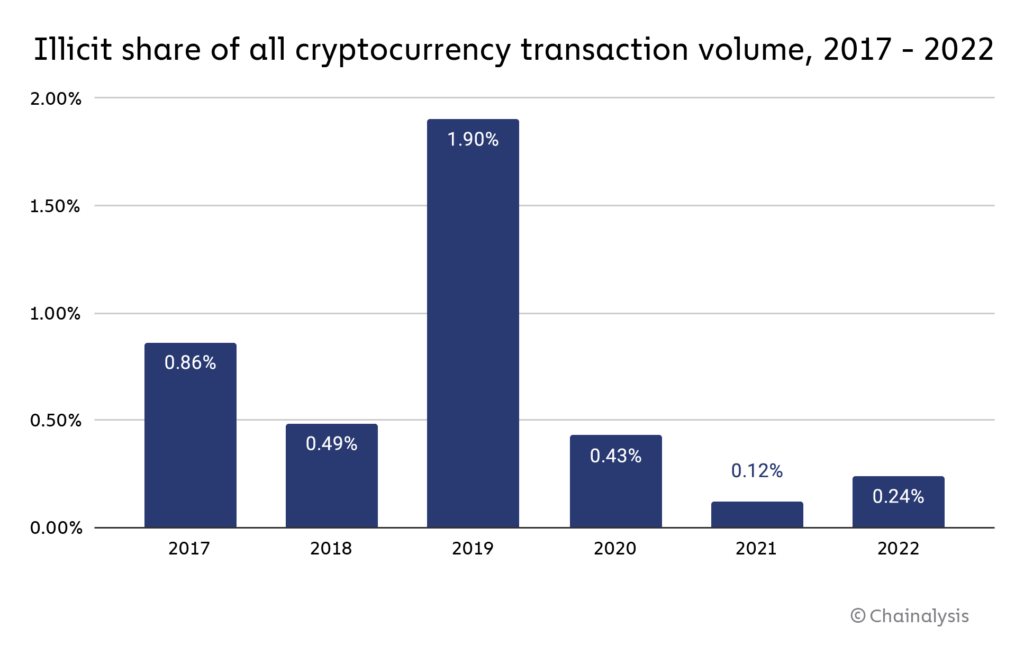

However, the same report also compares the share of illicit transacted volume to the total cryptoasset industry volume. As we can see, this represents a miniscule part of the total. This does not mean that as participants in this new decentralized financial system we should not strive to minimize the illicit use of these tools. But it’s also important to provide the full picture of the situation.

Why is it important to make this differentiation? Because the people who need cryptocurrencies and blockchains the most are the people most vulnerable to being manipulated, scammed, hacked and abused by a myriad of malicious actors with different objectives. In the following paragraphs we will explore who they are and how to differentiate them.

Establishment

On the one hand we have the status quo, the establishment and all its minions. Those people who see nothing wrong with the current system of fiat money, fractional reserve banking system and advocates of modern monetary policy. These people are the main beneficiaries of the system, the closer they are to the creation of money out of thin air the more they will have benefited and the more fervently they will defend the current system.

The status quo uses the mainstream media to spread only the dark side of the cryptoasset industry. 100% of their coverage focuses on the 0.24% illicit transaction volume while ignoring the rest of the 99.76% licit uses. It is not surprising then that most people who never interacted with any blockchain have a negative notion about the space and what it’s meant to accomplish.

Still, it is not only malicious actors outside the crypto space that threaten the integrity of our space and our goals. There are also many malicious actors within the space who undermine the prospects for success of the crypto revolution for selfish reasons of personal enrichment.

How to recognize them? This group is pretty straightforward to recognize, they are the usual mainstream media outlets that work as propaganda apparatus for the establishment and status quo. Regardless of their position on the ideological spectrum they all take their marching orders from the same few real centers of power, the cartel of fiat money.

Venture Capital

One of the main malicious actors are VCs or Venture Capitalists whose goal is to exploit the cryptocurrency bubble to extract as much value as possible for their shareholders. Through financial backing of centralized blockchain projects with little or no added value. Large sums of money are used for marketing and to reach, once again, the most vulnerable people who do not have the tools to differentiate a fraudulent project from a legitimate one.

In exchange for funding the project, VCs demand a large amount of the tokens that will be sold to the public, but they receive them before the rest during a private investment round. Through marketing they generate hype and attention on social media, pay influencers to talk about the token promising extraordinary returns and thus ensure their exit liquidity. It’s these programmed masses through marketing that will be buying the tokens from the same VC that received them before the public sale and for a fraction of the cost or in some cases totally free.

These same VCs then lobby to push regulators against their competition, i.e. serious cryptocurrency projects working towards the goal of financial inclusion. Generating a cycle of extraction and abuse on the most vulnerable people who most need access to cryptocurrencies that solve real life problems.

How to recognize them? You might need to have some technical knowledge to recognize a centralized VC blockchain but it’s also a skill you can develop with time. The rule is always to ask yourself Why? Another rule that can be applied, not only for blockchain and crypto, is that if a product needs to spend more money and resources on selling the product than producing it, it’s because the product isn’t worth it.

In the case of blockchains in particular, every project needs to make a conscious decision of what is more valuable to them. Every decision to improve a particular aspect of it, has a negative impact in another aspect. For example, blockchains that value speed often need higher hardware requirements that tend to centralize the infrastructure in a few wealthy actors capable of running it.

Memecoins & Shitcoins

Following the same line of behavior we find the fake coin projects known as memecoins or shitcoins. These are tokens created without any utility or objective to generate added value for users. They are usually copies of other memecoins/shitcoins that came out previously and carry names associated with popular trends.

Dogecoin was the first and currently the most famous memecoin, created as a joke and using the source code of a legitimate project such as Litecoin. These strategies of extracting value from the public are also based on the generation of hype in social media and empty promises of extraordinary returns.

There’s also no shortage of influencers who use their platforms to promote these scams disguised with funny names and pictures. They usually target younger people with little or no financial experience necessary to discern legitimate projects from empty husks lacking any utility or purpose.

How to recognize them? These are particularly easy to recognize due to their not so subtle marketing and branding strategies. They rely on exploiting the current popular trend and often have names related to animals or foods. They don’t have a clear reason for existing, a problem they want to solve or provide any added value. The only sales pitch is “buy because it’s going to go higher just because”.

Wolves in sheep’s clothing

Perhaps the most dangerous group is the wolves in sheep’s clothing, these are those people or groups that present themselves with a mission and a just objective. Whether it’s “banking the unbanked”, “connecting the unconnected”, or some other slogan repeated in the crypto space ad nauseam. Of course there are legitimate projects that want to achieve these goals, that’s why this group is the most dangerous because by the time you can tell them apart it’s too late.

These malicious actors infiltrate cryptocurrency communities by posing as beneficial actors for the space, but their goal is the same as the rest of this article, to extract value for self-enrichment at the expense of others. They generally launch tokens with no utility and big promises, publish ambitious roadmaps that they later modify or completely ignore. They use all available means to raise funds but rarely produce anything of value or show progress in line with their plans.

How to recognize them? As mentioned this group is the most dangerous to the future of our space because they are the most difficult to identify. They require the most due diligence, investigation and patience to slowly raise red flags about a particular individual or group. People that raise these red flags on social media are often accused of Fudding meaning to create fear, uncertainty or doubt. Those individuals that bought into one of these projects are quick to attack well-intentioned actors that smell something fishy about. Most often than not, they are vindicated when the project, group or individual finally rugs the community and runs away with the loot.

Conclusion

Satoshi Nakamoto created bitcoin with a clear purpose, to create a distributed and decentralized system without the need for a central authority so that people can exchange value without using banks or non-permissive payment systems. The need for such a system and its free and open source nature is what led to an explosion of adoption as well as copying, experimentation and evolution.

As with any new cutting-edge industry there will always be malicious actors trying to profit at the expense of others. In the case of cryptocurrencies and blockchains this factor is multiplied as it’s a permissionless and purely digital space. For this reason it’s even more important that we, well-intentioned actors, make an effort to educate newcomers to the space. Warn them about dubious practices and report malicious actors when they show up.

The only thing necessary for the triumph of evil is for good men to do nothing.

- Edmund Burke