This post is the second part of a long article covering all the positive aspects of Cardano. It was adapted from a thread originally posted by @Flantoshi on Twitter

Hello, and welcome back!

This is the second of three parts of a mega article that covers all the reasons why Cardano is a good investment. Last time we talked about all the things in Cardano’s mindset and system architecture that make it unique.

Today we will be exploring how Cardano’s community and decentralization will play a pivotal role in shaping its competitive advantage. But before we do that, I just need to quickly cover my ass from a legal standpoint:

I’m not a financial advisor, nor do I have any special knowledge that isn’t widely available to the public. I’m a guy who pretends to be a flan on the internet. Make of that what you will. If you want a more in-depth disclaimer as to why ADA might not be right for you, check out the first article or my “Why you SHOULDN’T invest in Cardano” post. Suffice to say though, these are just my opinions and the title is for clickbaitiness, not meant as a life prescription. I mainly just want to highlight interesting and good things about Cardano

With that said, let’s begin with what you actually came here to read!

Community

Roughly half of the budget of the average startup is spent on marketing. It’s partially a growth strategy that has come about due to the cheap borrowing rates of the last decade.

In other words, the average tech startup is designed on growth above common sense. They pay $10 for a customer that they know will only bring them $5 in value throughout their business with them. But this audience growth looks good on paper, and will hopefully attract even more investors, with access to cheap money.

It’s ultimately an unsustainable Ponzi scheme, and you don’t get loyal customers that way, you get mercenaries. For instance, I only order from Uber Eats when they offer me such a steep discount to use their service, that they’re losing money on me. I’m not loyal to them, and wouldn’t be sad if they disappeared, I just like getting underpriced food deliveries.

In the words of Ben O’Hanlon, head of community marketing and communications for Cardano, “competitors can’t copy communities,” neither can they buy them for that matter.

But that doesn’t mean that they won’t try. So, the wider crypto community is not immune from Venture Capitalist-backed largesse, in the hopes of attracting customers.

In the crypto world, it’s become commonplace to talk about “burning coins” to increase price appreciation, project treasuries buying assets with their coins to artificially inflate their token value, charging a “tax” for performing any transaction with the coins, etc.

I’m sure that it gets a fair greedy few, but I don’t think it’s ultimately sustainable. Reminds me of Machiavelli when he warned the Medici not to use mercenaries as soldiers:

“Mercenaries and auxiliaries are useless and dangerous. If you are counting on mercenaries to defend your state you will never be stable or secure, because mercenaries are ambitious, undisciplined, disloyal and they quarrel among themselves. Courageous with friends and cowardly with enemies, they have no fear of God and keep no promises.

With mercenaries the only way to delay disaster is to delay the battle; in peacetime they plunder you and in wartime they let the enemy plunder you. Why? Because the only interest they have in you and their only reason for fighting is the meagre salary you’re paying them, and that’s not reason enough to make them want to die for you. Sure, they’re happy to be your soldiers while you’re not at war, but when war comes, they run for it, or just disappear.”

He then goes on to conclude that no state is secure without its own army, comprised of people loyal to the cause. If it hasn’t got men to defend it determinedly and loyally in a crisis, it is simply relying on luck.

“Bet ya didn’t expect to see me in a Cardano article”

– Machiavelli

The broader point is that loyalty is not something that can be bought. It’s gained over years, over the trials and tribulations that people jointly overcome. Beyond mercenary convictions, there has to be some sort of vision that ties these people together.

Cardano offers this vision of what the future could be if we put our minds to it. While I think it might occasionally be to our detriment, in that the community can be too idealistic, there’s a growing group of people who genuinely believe in Cardano’s ability to change the world for the better.

Ultimately, these are not your fair-weather supporters. These are people who’ve made Cardano an immutable aspect of their lives. There’s a reason why Cardano often gets labelled as a cult, and it’s this unwavering conviction by some of the core members.

More importantly, though, it translates into genuine excitement for Cardano. Whether the price is up, or down, the community is still there, building and evangelizing.

This last point is of particular importance, as word of mouth is a powerful marketing tool. Not only is a good portion of the Cardano community die-hards, but they’re not afraid of making their voices heard.

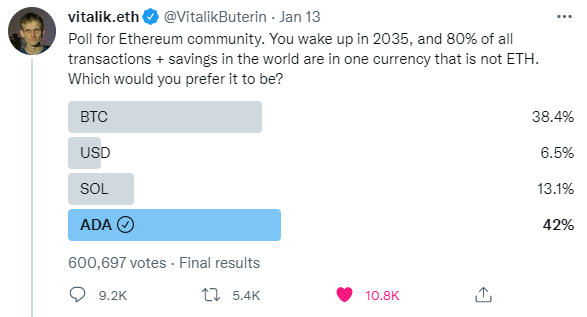

Much to the chagrin of online crypto outlets and pundits, the Cardano community consistently wins online polls. An interesting vote that’s worth mentioning again was when Vitalik asked that if Ethereum were not to work, which one was the likeliest alternative.

In that specific instance, Cardano won with a 10% lead against Bitcoin, while the alternatives of Solana and the US Dollars were left in the dust.

Generally speaking, from an enthusiasm standpoint, Cardano either outright wins in social media engagement, or it can comfortably trade blows with all other competitors. This has been noted by social media influencers, which is why occasionally they kick the Cardano hornet’s nest to get a viral tweet or two out of it.

For the first few weeks of the year #Cardano was almost always trending, and the on-chain metrics seem to support that view. For instance, in February of last year, there were only 300k wallets in the whole of Cardano, now there are over 3,174,000!

We might also already occasionally have more on-chain activity than the top two chains (Bitcoin & Ethereum) put together.

Last month, Messari.io, a crypto research firm, reported that there were 24 hour periods where Cardano saw a transaction volume of $17.56 billion. During this time Bitcoin and Ethereum pulled $10.65 billion and $5.77 billion respectively.

Some caution might be warranted though, and we should not take this number at face value. These figures have become the subject of some debate. The proposed counter-argument is that these reports are misleading as they’re not taking into consideration Cardano’s Extended UTXO accounting model which may lead to some overestimates when one compares figures.

I’m not a data scientist, nor do I feel comfortable making any major pronouncements on the matter. What is clear though is that Cardano is rapidly developing into a powerful enough force where such scenarios are not dismissed out of hand.

Is Cardano presently able to shoulder more transaction volume than the two largest blockchains put together? Who knows?

Is it plausible? Yes.

Rivals vs Cardano

I don’t think it’s an exaggeration to say that Cardano gets a disproportional amount of hatred from critics and rival investors. Some of the animosity is understandable.

After all, according to the lore, Charles left the Ethereum project in ignominy and disgrace. Not only that, but he has had all manner of bizarre rumours, accusations and falsehoods circulating about him. This is partly because, compared to the average crypto project CEO, Charles is very visible, as he holds regular livestreams, AMAs and he’s not afraid of going for the jugular on social media.

Needless to say, with that sort of attention and willingness to run your mouth, you’re bound to create some enemies.

Besides that, there’s the nontrivial consideration that Cardano’s ownership composition is vastly different from its peers. Look at the following charts of comparable crypto projects, notice anything interesting?

The average Layer 1 crypto project tends to be largely owned by insiders. To further add insult to injury, large financial entities start taking a seat at the table once it seems like they might be important.

For example, Ethereum, as it becomes a more established player has started to cosy up to funds and big bank investors. Recently, the US banking giant JPMorgan acquired an “influential” stake in Metamask and Infura, which are the most widely used wallet on Ethereum and a blockchain node infrastructure network, respectively.

Unsurprisingly, as it is now under the aegis of a large financial entity, this critical Ethereum infrastructure will have to comply with banking regulations. This is not something to be taken lightly and will have profound effects on our industry.

We’ve already started seeing the initial effects of this type of influence. For instance, a few weeks ago, Venezuelan users were unable to use their Metamask wallets, as their country was on a sanctioned list.

In other words, crypto has largely failed in its mission to create a parallel financial system. It got greedy and concerned with short term appreciation over taking the time to build a contender. It has become part of legacy finance.

Cardano offers a change in the status quo

Crypto has stopped being about the little guy being able to mount a reasonable defence against the elites in power. Now, if you want to mine Bitcoin profitably, you have to do it at a scale so large that you can comfortably be listed on the New York Stock Exchange.

Similarly, the hardware requirements of other chains have risen exponentially over the years. The hardware requirement is far beyond the budget of any normal person. Just to give an example, I’ll borrow data originally published by the famous Cardano Whale.

These are the Cardano hardware requirements framed against the average of the three blockchains (Solana, Luna and Avalanche) it’s usually compared against:

– Storage: 2% (30GB)

– Memory: 20% (12GB)

– Network: 6% (10Mbps)

– CPU: 25% (2 core)

This is why Cardano is so unique.

It’s no big secret that I’ve been thinking about running a stakepool someday. So, over the last few months, a friend and I have looked at the costs of setting up a Cardano stakepool for ourselves.

We ran the numbers and came to the conclusion that it would take a few thousand Euros to set up, and then a few hundred Euros monthly on top of that to keep it running. So, for the time being, we have decided that until Flantoshi has a large enough community to warrant it, we’re not going to immediately jump on it.

The defining factor will be when we can feasibly attract a large enough delegation to cover the running costs without going into debt. But it is definitely in the cards, and I hope that in the not so distant future we might be able to launch it.

The broader point though is that despite being a middle-class writer in a Western country, it is feasible for me to run a pool profitably in the foreseeable future. That is the challenge that Cardano presents to the wider community: until people of average means can profitably run a node in your network, you are not decentralized.

Don’t take the ravings of a dessert for granted, look at the evidence. Cardano’s Nakamoto Coefficient, the number of entities you need to control to take over Cardano, is 25.

This might not sound like much, but even in its hay day, Bitcoin was estimated to have had a Nakamoto Coefficient of 35. Nowadays though for Bitcoin, it’s 4, and for Ethereum, it’s 2.

As such, while we could be better in our decentralization efforts, we’re also comparatively quite good!

Democratized & Decentralized

The Cardano community is a nerdy bunch, and I definitely put myself in that category as well (hell, I learned how to use Excel so that I could better play a videogame when I was a kid. So I’d play with a spreadsheet open). And it’s quite a good thing that we are, as there are two options of personality archetypes if you’re in the crypto space: degens and nerds.

In either case, one of the major benefits of being a bunch of nerds is that as a community we’re not afraid to tinker with things and develop them if we think we can do better.

Partially owing to the ineptitude of Emurgo, the black sheep of the founding entities of Cardano which created the Yoroi wallet, the wider Cardano community decided to create their own wallets.

Now there’s a veritable ecosystem available, just off the top of my head, there’s the Ccvault, Nami, GeroWallet, Typhoon, etc light wallets. Each one has slightly different unique abilities, user experiences and incentives to use them.

As a side note, it’s worth mentioning that a developer friend of mine has told me it’s fairly straightforward to build one yourself. So much so that he played around with building a bespoke wallet for his personal use.

The broader point is that Cardano is presently quite decentralized. There isn’t a single point of failure, no single entity in charge of major portions of the operations, and IOHK is letting go of the reigns and allowing the community to make its own choices.

Not only that but with tools like Marlowe, a smart contract development tool for non-programmers, even people without a technical background will be able to meaningfully contribute to the development of the space.

In the not so distant future, the protocol will be entirely self-governing and ruled by the community with on-chain governance. That’s a level of decentralization that most projects can’t even aspire to have! For example, on Ethereum, there are clunky, bolted on portals that people use as governance centres, and they don’t work particularly well.

Given that Cardano stands out amidst the competition, it’s bound to attract some attention from the critics who view ADA’s alternative operational method, as a threat to their investment. We’ve covered the specifics for why this is, but suffice it to say that in the investment world, it’s preferable to invest like everyone else.

That way, if something goes wrong, fund managers can shrug and say “it’s not my fault, everyone else thought it was a good idea as well.” As such, when Cardano comes along and proves that there are different ways in which you can build a viable cryptocurrency, it’s perceived as a threat.

Until more projects start structuring themselves like Cardano, it will remain a popular target for mockery. As if it were to succeed, it’s proof that the people calling the shots, don’t necessarily know better than the average people supporting Cardano.

While it may not happen overnight, I do view it as a necessary direction that crypto will have to take. After all, a good portion of Cardano’s immediate rivals are encountering protocol and structural difficulties that we are adequately solving (or have resolved) already.

In the words of Péter Szilágyi, the team lead for Ethereum:

“I must emphasize that #Ethereum is not going in a clean direction. Tangentially it’s achieving results, but it’s also piling complexity like there’s no tomorrow […] I can’t say what the solution is, but my 2c is to stop adding features and start culling, even at the expense of breaking things.

There are less and less people knowing and willing to piece together a broken network. And each change pushes more away.”

Cardano has done this before, early on in its history, it became clear that the structure of the network was unsatisfactory. So rather than continue adding bells and whistles to a broken system, they decided to tear it down and start designing from scratch.

This was euphemistically called “the Byron Reboot” and set Cardano back by years. Price appreciation paid dearly, along with adoption by its intended audience, but it proved to be the right call.

A protocol doesn’t care for how much effort you’ve put in prior to its development, it only cares for whether or not it continues to operate satisfactorily. The community must have vision and patience to be able to tolerate a necessary but painful course of action, to flourish in the future.

Interlude & Momentary Conclusion

Today we discovered that Cardano is the people’s coin. Contrary to other projects, Cardano hasn’t created a major incentive for project insiders to act in a hostile manner towards retail investors.

Besides that, normal, everyday people can participate in the running of the network. Insofar as is possible to democratize and share with the community, Cardano has managed to share both the benefits and duties that come with operating a world-class blockchain.

At the risk of painting with a very broad brush, Cardano doesn’t just have speculators and gamblers like most other chains, it has believers and doers who take an active role in the day to day operations of the network.

In the next and final section, we will be addressing how Cardano’s unique system architecture, philosophy, democratization and decentralization will help it win the game!

If you’re in the crypto or in the traditional finance industry looking for someone to ghostwrite content for you or consult regarding your content strategy, please do not hesitate to message me. I’m a full-time content producer.

Join the community over at @flantoshi on Twitter.

And if you would like to support this project and help me pay rent, I’ll pass on the tip hat and you can send ADA to:

- ADA wallet address: addr1qxfgs44d763uuw4hy6qatx383v9mmrrm6qazay6eren9sp5r2usruecwv33lp2t2nqp4ss6hrc9ac8yd2klxnsfnxz2qw3su4s

- Adahandle — $flantoshi

Thank you for your support!