How to save Cardano from the bureaucrats and value extractors

A chain is as strong as its weakest link. In the case of Cardano, its weakest link is governance.

The Cardano community is currently going through what is probably one of the most important times in its history. The transition to a decentralized governance on-chain. But what started a revolutionary endeavor to further the cause for decentralization is quickly starting to look like nothing more than another corporate structure put in place to bamboozle regulators and users alike.

In my previous article Wall Street Greed and The Cardano Treasury I presented the idea that given the current size of the Cardano treasury and the potential for its growth, it would attract malicious actors both outside and inside the ecosystem who would want to take advantage of it. We are now seeing the first battles over it, as the Cardano budget is now being discussed.

The amount being discussed currently sits around 300 to 500 million ADA per year. Given its current size of 1.5B ADA, it doesn’t take a genius to realize it would be depleted in just three years. This is not accounting for the ADA that comes into the treasury which is paid by every user of the network when doing a transaction.

The problem, in my opinion, is that the budget is being presented as “the Cardano budget” however it is Intersect, the one that will not only decide the amount, but also the allocations and manage it afterwards. Their rationale is that Intersect represents the community as a whole, but in reality is just a company registered in Wyoming by Input Output executives.

But this company won’t be the one holding the 500 million ADA annually because it’s based in the USA. That privilege goes to another corporate entity registered in the Cayman Islands by the name of Cardano Development Holdings. Which Intersect’s executives have recently stated that they plan to stake the annual Cardano budget with Intersect members’ stake pools in order to profit from the rewards.

This is not a minor thing. Intersect, a private company created by IOG executives, is using their power over the community to take a third of the treasury, which are public funds that belong to the entire ecosystem, to profit and distribute as they see fit.

You might be asking yourself, “what’s the problem with that?” well to start is a carbon copy of the current corrupt political and economical system crypto was trying to escape from. At least that was the original idea Satoshi Nakamoto had when creating Bitcoin.

Intersect, a self-proclaimed government of the entire ecosystem (even if you don’t agree or support them) will be taking public funds that belong to everybody because it was collected from taxation, and using them to profit themselves and those closer to them. Any project or alternative organization (like Pragma) will need to bend the knee and kiss the ring to get funding. Not very different to how lobbying works nowadays.

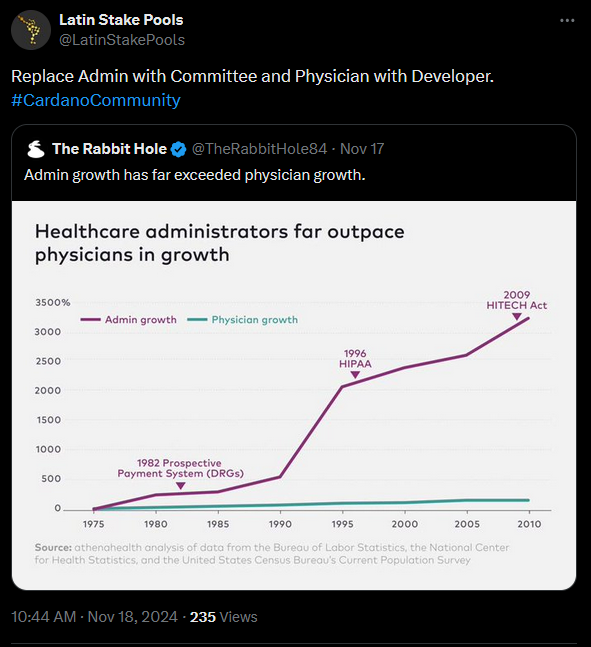

On top of that, you have to consider that everyone involved in Intersect’s bureaucracy expects to get paid handsomely. An ever growing bureaucracy of paper pushers will receive funds automatically, while the real builders of the ecosystem (the developers) will have to fight for a piece of the cake.

How did this happen? You might ask. The problem, in my opinion, was always CIP-1694 which was originally presented as a framework for “decentralized democracy on-chain” but after the second draft it was clear there was nothing decentralized nor democratic about it.

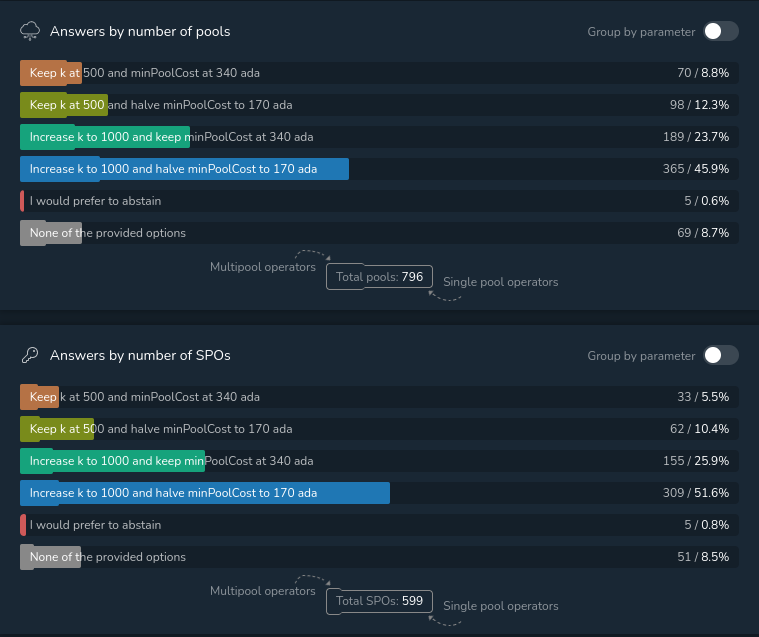

I have shared my point of view and concerns in the article Why Governance on Cardano Will Fail published on September 15, 2023. The warning signs were the manipulation of Project Catalyst funding by big whales and the complete disregard for the result of the first on-chain vote regarding parameters K and minpoolcost.

Call to action

So, that’s a lot of complaining. What do I propose we do about it? Since stopping the implementation of CIP-1694 seems very unlikely at this point, we can at least try to inform and educate the users of the ecosystem of what is being discussed behind a wall of bureaucracy and endless zoom meetings.

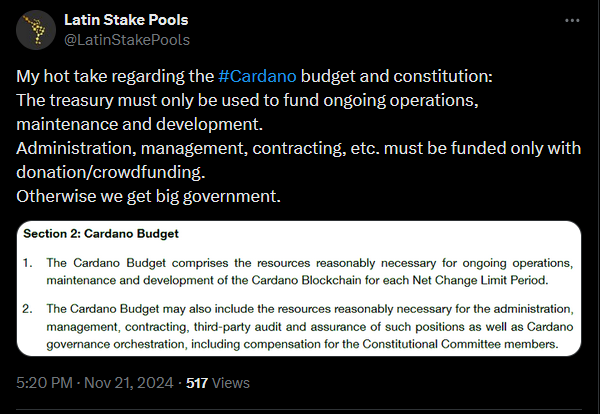

For starters, we can push for limited use of the treasury. This post I made on November 21, 2024 highlights the problem of the current draft of the constitution. In which they intend to use the treasury to pay for administration, management, contracting, third-party audits among other things. My point of view is that the treasury (public funds) must only be used to fund ongoing operations, maintenance and development (public services). Everything else must be funded with donations/crowdfunding. Otherwise, this is how we implement big government on-chain.

What else can we do? The following are five technical changes that can be made to make the Cardano blockchain ecosystem more decentralized and open to all, not only to a few insiders. However, being realistic, I don’t see any of the following proposed changes ever happening since the new structure introduced by CIP-1694 and Intersect makes it almost impossible to alter or affect the current status-quo in any significant way.

Decrease Tau

The first parameter that should be changed is Tau, which determines the tax that every user of the network pays when doing a transaction. It currently sits at 20%, which is much higher than the intended original value of 5%. But this parameter, among others, was modified just before the blockchain went live.

Why is it important to decrease the tax? First of all, it’s four times higher than the intended value. Second, it would mean more staking rewards for delegates. Which is very important as an economic incentive to secure the network. As staking rewards keep going down during each new epoch the percentage of total stake will keep dropping as users look for better opportunities for their ADA. Third, less ADA going into the treasury means a smaller budget or a better use of said budget. Meaning, not wasting it on paying bureaucrats.

Rich Manderino, a.k.a. Earncoinpool, has created a Parameter Change Proposal (PCP) on this matter. His proposal is to decrease Tau to 0.03 making the effective rate tax of 5% this would increase staking rewards and decrease the amount of ADA that goes to the treasury. Lowering the risk of bureaucrats looting the treasury and increasing security of the network.

If you want to know more about this topic, check out my previous article titled The Cardano Treasury Tax.

Increase K

The following three parameters go hand-in-hand to make stake pool operation more decentralized and open to all. “Taking Cardano to the margins” as it was originally said. Funny how quickly they forgot about that, right?

The K parameter determines the optimal number of fully saturated stake pools in the network. Currently it’s set at 500, which means that the optimal number of fully saturated stake pools (that is around 75 million ADA) is what the network strives to.

Increasing K to 1000, as originally intended in 2021, means that the saturation point would change from ~75 million ADA to ~37.5 million ADA. This would mean that delegators in overly saturated pools would need to find pools to delegate to. Optimally, this would be smaller stake pools struggling to stay afloat. But it also means that multi-pool operators would lose money unless they open new stake pools, thus hurting decentralization.

Earncoinpool has also created a PCP for this change, asking the Parameter Committee to honor the result from the May, 2023 on-chain vote to increase K to 1000.

Increase a0

The next parameter is a0 which determines the benefit for the pledge. That is, the “skin in the game” for the pool operator. The original idea was to have a high a0 value which would give the opportunity to people with a small amount to ADA to open and operate a profitable stake pool.

The other reason for this parameter is to avoid a Sybil attack. This is a type of attack on a computer network service in which an attacker subverts the service’s reputation system by creating a large number of pseudonymous identities and uses them to gain a disproportionately large influence.[1]

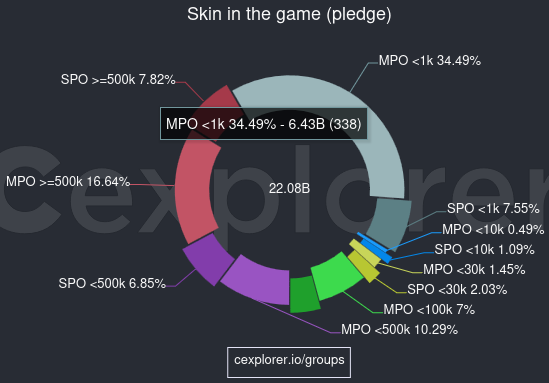

Basically, to avoid what’s happening with multi-pool operators but more precisely the multi-pool operation from big centralized exchanges like Binance or Coinbase. Who currently operate 92 and 29 stake pools respectively, with little to no pledge.

There are currently 338 multi-pools with 6.43 billion ADA delegated to them with less than one thousand ADA as pledge.

Remove minpoolcost

The minpoolcost or fixed cost/fee is another parameter that was absent in the original research and was added last minute before the launch. The idea was to set a minimum value that would guarantee the stake pool operation in the first days of bootstrapping the network.

However, nowadays it’s the reason why running multiple unsaturated stake pools is so profitable. Mostly run by social media influencers, they use their influence over the community to drive delegation into their pools ignoring the fact that by doing so they are decreasing decentralization thus decreasing the value of the network as a whole.

Leaving only the margin fee and removing the fixed cost, would help delegates make a better informed decision regarding where to delegate their ADA and would remove one of the biggest incentives towards multi-pool operation.

It’s important to highlight that these three parameters (K, a0 and minpoolcost) work in synergy and must be changed together to have the appropriate and intended effect.

Develop the Conclave paper

Conclave: A Collective Stake Pool Protocol, is a paper by University of Edinburgh, Tokyo Institute of Technology and IOHK published in September 2021. Which describes a formal design of a Collective Stake Pool, i.e., a decentralized pool with no single point of authority. Allowing for different individuals to come together and create a stake pool with higher pledge that would be possible if each individual created a stake pool of their own. Unfortunately, the paper was never developed into actual code and has remained forgotten since then.

Performing these parameter changes and implementing the Conclave paper would result in:

- Increased staking rewards. Thus increasing the percentage of total staked ADA, resulting in better security of the network.

- New single and collective stake pools would emerge to take advantage of an increased a0, K and no fixed cost.

- Redistribution of stake from saturated multi-pools to smaller and new stake pools.

- The atomization of stake would increase the decentralization of Cardano not only in the Consensus Layer but also in the Tokenomics Layer (from the Edinburgh Decentralization Index).

For more information on the Edinburgh Decentralization Index check out my article.

Conclusion

If reading this article made you angry, ask yourself why. I criticize and point out Cardano’s issues because I care about it. Even though it is moving into a direction in which I don’t agree, away from the original vision that brought me into it.

The full implementation of CIP-1694 with the ratification of the Cardano constitution and the creation of Intersect as the leading entity will bring forth a centralized “big government” plutocracy into effect. Opposed to the original idea of a decentralized liquid democracy on-chain.

How do we save Cardano from the bureaucrats and value extractors? By limiting the power and reach of Intersect over the ecosystem’s treasury, which belongs to all of us. And pushing for the parameter changes described above that would allow for a more decentralized and inclusive stake pool operation. Worthy of taking to the margins.