The biggest news out of the Cardano Summit 2024 was the announcement of the collaboration between Emurgo, one of Cardano’s funding entities, and BitcoinOS, a smart contract operating system for Bitcoin. Through the use of cryptography, in the form of zero-knowledge proofs, Cardano will be able to provide decentralized finance services to Bitcoin’s user base. Meanwhile, Bitcoin’s immense liquidity could help Cardano thrive by proving to the world that formal and peer-reviewed development is the way forward for decentralized finance.

The project of BitcoinOS is fairly new, its Twitter/X account was created in November 2023. They published their whitepaper titled “BitSNARK & Grail” a couple of months later in April 2024. Authored by Ariel Futoransky, Yago and Gadi Guy, its work is based on a previous whitepaper titled “BitVM: Compute Anything on Bitcoin” by Robin Linus. By July 2024 the BitcoinOS was able to complete their proof-of-concept by verifying for the first time on the Bitcoin mainnet a zero-knowledge proof.

How we got to this point

But how did we get here? The journey of Bitcoin has sparked a lot of debate about how to scale it up and add new features. Since Satoshi Nakamoto launched Bitcoin on January 3rd 2009, people have been grappling with a tricky trade-off involving three key things: scalability, the ability to run complex programs (computational expressivity), and decentralization. Improving one of these often means compromising on the others, making it seem like a solution to this problem was just out of reach.

Back in 2013, Bitcoin Core developer Gregory Maxwell proposed a potential fix using some cutting-edge cryptography called SNARKs (Succinct Non-Interactive Arguments of Knowledge). He believed that with SNARKs, Bitcoin could achieve the holy grail of being scalable and able to run complex programs while still being decentralized. SNARKs could let you run any program in special environments and create proofs that would keep Bitcoin secure. However, it was thought that implementing this would require a soft fork, leaving the idea as more of a thought experiment for nearly ten years.

Fast forward to 2023, and many in the Bitcoin community had almost given up on finding a solution, with some even downplaying the need for scalability and programmability. But then Robin Linus introduced BitVM, a new computing paradigm for Bitcoin. This was a game changer, as it not only allowed for running any program on Bitcoin but also made verifying SNARKs possible. This opened the door for Bitcoin Rollup Bridges, which could let Bitcoin assets be used in specialized environments called rollups, offering both scalability and computational power.

However, BitVM isn’t without its challenges. One big hurdle is the need to pre-generate, pre-sign, and store billions of transactions for every potential verification challenge, complicating the development of a practical bridge.

To tackle these issues, the authors of the paper came up with two key innovations to create practical Bitcoin Rollup Bridges with fewer compromises. The first is BitSNARK, a software library that helps verify SNARK proofs directly on the Bitcoin blockchain. Unlike BitVM, which is more general, BitSNARK is designed specifically for SNARK verification. It drastically reduces the size of the programs involved and can cut the length of the challenge/response protocol by up to 50%. Plus, it simplifies the process down to just one type of challenge, making everything more secure and transparent.

The second innovation is Grail, which has three main components: BitSNARK for verifying SNARKs, a system to generate SNARK proofs for Bitcoin and Rollup transactions, and the Grail Bridge, which securely moves assets between the Bitcoin mainchain (Layer 1) and Rollups (Layer 2). Together, these innovations are significant steps toward solving the trilemma and making Bitcoin more functional and scalable.

The Renaissance

Cardano’s recent integration with BitcoinOS is a major win for both its developers and investors. This new tech essentially gives Bitcoin the ability to interact with other blockchains, which lets Cardano enhance Bitcoin, making it even more impressive.

As the first alternative Layer 1 blockchain to connect with Bitcoin, Cardano is set to tap into Bitcoin’s massive pool of unused capital and users, potentially skyrocketing its own adoption rates. Despite being a seasoned player in the blockchain world, Cardano is just getting started.

Cardano and Bitcoin actually make a great pair. They both use the UTXO (unspent transaction output) accounting model, which means they work really well together. This connection allows Cardano to create smart contracts that can run directly on Bitcoin’s mainnet, without needing any bridging. Plus, Cardano’s layered architecture prioritizes stability and scalability, aligning with some key ideas from the Bitcoin community.

Cardano’s consensus algorithm, Ouroboros, is based on meticulous peer-reviewed research, together with a decentralized governance model that lets thousands of people from around the globe participate. This community really believes in building a secure, tested, and sustainable system for the future.

By hooking up with Bitcoin, Cardano is poised to reap the rewards of its careful planning and development. With Bitcoin currently valued at $1.3 trillion, Cardano provides a reliable place for Bitcoin investors to manage their digital assets. Users can access various decentralized finance services on Cardano, like various decentralized exchanges for trading and protocols for lending and borrowing, all without the risks that come with centralized custodians or EVM (Ethereum Virtual Machine) chains.

BitcoinOS is more than just a new type of bridge; it’s a game-changer. It transforms Bitcoin into a more versatile system that can verify activities on other blockchains. With the Grail bridge, Cardano can be seen as a true partner of Bitcoin, allowing secure, trustless transactions between the two networks. This could encourage more Bitcoin users to start using their assets on Cardano’s decentralized finance ecosystem, boosting its credibility.

As Cardano’s ecosystem grows through this partnership, the demand for its token, ADA, is expected to rise. More activity on the network means more people will need ADA for transaction fees. Plus, with the buzz around the “Bitcoin Renaissance,” Cardano is in a prime position to attract investors looking for exciting opportunities beyond just Bitcoin.

Bitcoin has always been the king of crypto, and with this integration, Cardano is ready to become the prince that was promised. After seven years of hard work, Cardano is finally ready to step into the spotlight and become part of a much bigger story in the blockchain space.

The Institutional Play

Like I mentioned in my previous article Wall Street Greed and The Cardano Treasury, Wall Street is indeed greedy and there are rumors of a potential future Cardano ETF. 2024 has been the year of the ETFs and institutional investors disembarking on crypto. And one thing bankers love is to make money with someone else’s money. Right now the bitcoin from the ETFs is sitting in cold storage with the custodian, but imagine if those BTC could be put to work earning a yield using Cardano’s decentralized finance ecosystem while the coins remain safe in the hardware wallets. That’s the magic of zero-knowledge proofs.

According to Twitter/X account @lookonchain the amount of bitcoin now in the hands of institutional investors exceeds 1 million Bitcoin as of November 1st, 2024. That’s almost 70 billion dollars at current prices.

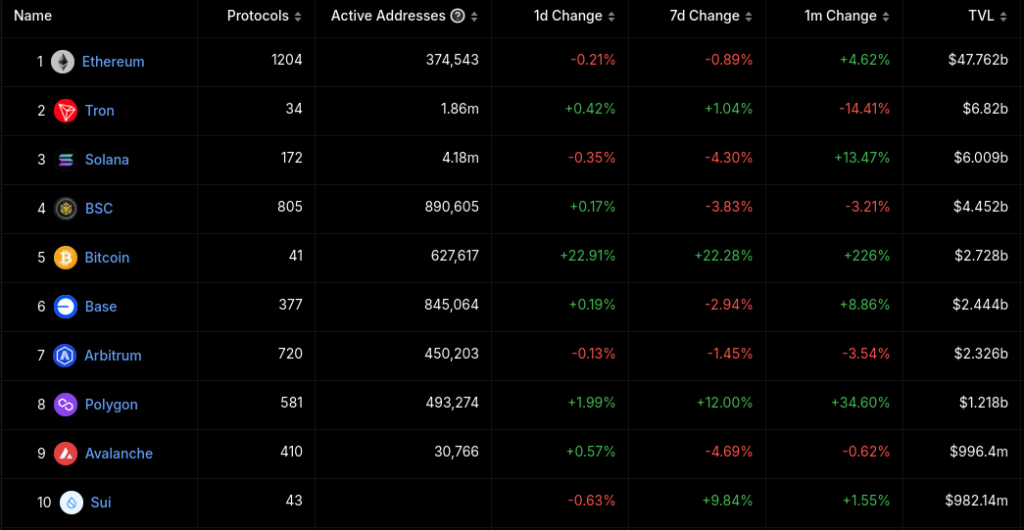

When looking at the top 10 chains on Defillama by total valued locked (TVL), we can see that Ethereum currently stands as the number one chain with $47.76 billion dollars. Which is not surprising since Ethereum was the winner of the second generation of blockchains and the king of DeFi. However, the union of Bitcoin and Cardano has the potential to upset the current standing. Tron currently stands in second place, which is leagues away from Ethereum with $6.82 billion in TVL. If Cardano can capture at least 10% of the $70 billion liquidity sitting idle on Bitcoin’s ETF, it could take Cardano from the 27th position it currently occupies to be number two.

The path forward is not without challenges, the ever growing competition of new blockchains and protocols is not slowing down anytime soon. Cardano started the journey to become the financial operating system of the world way back in 2015 and has chosen to follow the slow and meticulous path of development. Since then the cryptoasset industry and the world have changed substantially. Nation states have adopted bitcoin or are actively mining it, institutional investors, wall street titans and hedge funds have dipped their toes into this revolutionary technology which years prior was accused of being nothing more than a scam or a ponzi. Central banks and private corporations are working on Central Bank Digital Currencies (CBDC) and regulated stablecoins to act as CBDC-proxies, in order to fight back against the ever-growing popularity of cryptocurrencies.

Conclusion

The partnership between Cardano and BitcoinOS marks a pivotal moment in the evolution of decentralized finance, suggesting that the long-anticipated “Bitcoin Renaissance” is well underway. By bridging Bitcoin’s liquidity with Cardano’s robust DeFi ecosystem, this collaboration has the potential to reshape the blockchain landscape, offering a decentralized alternative to traditional finance and proving that peer-reviewed, formal development can be both innovative and scalable. Cardano’s meticulous development strategy, underpinned by its layered architecture and rigorous approach to security, aligns well with the values of the Bitcoin community, strengthening the foundation for a synergistic relationship.

Through the use of zero-knowledge proofs and the Grail bridge, Bitcoin can now expand beyond its primary function as a store of value to engage in secure, decentralized applications without compromising its core principles. This unique ability to link Bitcoin with DeFi while ensuring trustless interactions between networks is a game-changer, making it possible for billions of dollars in institutional Bitcoin holdings to flow into Cardano’s DeFi protocols.

As this integration matures, Cardano’s position in the blockchain ecosystem is poised to rise significantly. Institutional investors, drawn by the dual appeal of Bitcoin’s security and Cardano’s innovative DeFi solutions, may catalyze this shift, boosting demand for Cardano’s native token, ADA, and driving total value locked (TVL) across its network. The partnership has the potential to disrupt Ethereum’s dominance in DeFi and transform Cardano into a major player, signaling that the “Bitcoin Renaissance” may, indeed, be led by Cardano.

In a world where traditional financial institutions are beginning to explore cryptocurrencies, this collaboration represents a transformative step forward, one that underscores the enduring value of Bitcoin and the emerging role of Cardano as a leader in decentralized finance. The path ahead is competitive, but with its strategic positioning and steadfast community, Cardano has never been better equipped to take on the challenges and become a cornerstone of the blockchain revolution.