Blockchain technology has ushered in a new era of decentralized digital systems, with potential implications for a wide range of industries, from finance to supply chain management and beyond. At the heart of blockchain’s transformative potential is its decentralized nature, a feature that eliminates the need for a central authority, enhances security, and promotes transparency.

Amidst the plethora of blockchain platforms, Cardano stands out with its unique consensus algorithm known as Ouroboros. This protocol serves as the cornerstone of Cardano’s security and decentralization, distinguishing it from many other blockchain platforms, including the pioneering cryptocurrency, Bitcoin, and its Proof of Work (PoW) consensus mechanism.

Cardano, a third-generation blockchain platform, is designed to overcome many of the limitations that earlier blockchain technologies faced, such as scalability, interoperability, and sustainability issues. Its consensus mechanism, Ouroboros, is an innovative Proof of Stake (PoS) protocol that focuses on energy efficiency and robust security. At its core, Ouroboros mitigates the potential actions of malicious actors within the network, maintaining the integrity of the blockchain.

In contrast, Bitcoin, the original and most widely recognized cryptocurrency, uses a PoW consensus algorithm. PoW, while groundbreaking, has been criticized for its high energy consumption and the potential centralization of mining power. Nevertheless, it has proven resilient to a range of attacks and remains the security backbone for Bitcoin and many other cryptocurrencies.

This essay will delve into the inner workings of Cardano’s Ouroboros protocol, detailing its specific measures to thwart malicious actors’ attempts to undermine the network’s security. Further, it will compare these measures with the defenses inherent in Bitcoin’s PoW system, shedding light on the evolution of blockchain technology and its ongoing efforts to balance decentralization, security, and efficiency.

Explanation of Cardano’s Ouroboros Protocol

At a high level, Cardano’s Ouroboros consensus algorithm is a novel implementation of the Proof of Stake (PoS) paradigm. Unlike Proof of Work (PoW), which requires miners to solve complex mathematical problems to add a new block to the blockchain, PoS operates on the principle of validators holding and staking the native cryptocurrency — in this case, ADA, Cardano’s native token.

The essence of the Ouroboros protocol is its unique method of selecting validators, who are chosen to create new blocks and validate transactions. The selection is made based on the amount of ADA they are willing to ‘stake’ or lock up in the system. In simpler terms, the more ADA tokens a participant holds and is willing to stake, the higher the chance they have of being chosen as a slot leader, the equivalent of a miner in a PoW system.

Ouroboros operates in timeframes called epochs, which are divided into slots, akin to turns. Each slot has a slot leader, who is responsible for adding a block to the blockchain during their turn. However, not just anyone can become a slot leader. The protocol uses a lottery system, where the winning tickets are called ‘follow-the-satoshi’ and the likelihood of winning depends on the number of ADA tokens staked.

Staking can be done individually or via staking pools, which are groups of ADA holders combining their resources to increase their chances of being selected as slot leaders. Staking pools ensure that even smaller holders of ADA can participate in and benefit from the protocol’s operation.

In addition to staking, Ouroboros introduces a unique incentive scheme to motivate honest participation in the protocol’s operation. Rewards in the form of ADA tokens are distributed to both individual stakeholders and staking pools, proportional to the amount staked.

I did a lengthy breakdown of the Ouroboros protocol and would recommend reading it to understand the next part fully of this article

Defense Mechanisms of Ouroboros against Malicious Attacks

Ouroboros is designed with robust protection mechanisms against common blockchain attacks, such as double-spending attacks, grinding attacks, and more. Understanding these protections necessitates a deeper dive into how the protocol operates and the rules it employs to maintain security.

Double-Spending Attacks

A double-spending attack occurs when a malicious actor attempts to use the same funds twice. This type of attack is particularly critical for digital currencies because unlike physical cash, digital tokens are essentially data that could be duplicated or falsified.

To counteract this, Ouroboros uses a combination of a random seed (source of randomness) and multi-party computation to select slot leaders. The slot leaders are responsible for validating and adding transactions to the new block.

When a slot leader adds a new block to the blockchain, it also carries a reference to the previous block, creating a chain. This chain of references serves as an ordered record of all transactions. If an attacker attempts a double-spending attack, they would need to create an alternative block that includes the double-spent transaction, and then this block must be accepted by other nodes. But in the Ouroboros protocol, only the longest chain is accepted as valid.

This longest chain rule makes double-spending attacks difficult. To successfully carry out a double-spending attack, the malicious actor would need to control more than half of the total stake, enabling them to create a longer chain faster than the honest nodes. This is similar to the 51% attack in PoW systems. However, given the high financial stake required and the potential devaluation of the attacker’s own funds, such an attack is economically impractical.

Grinding Attacks

In a grinding attack, a malicious actor attempts to influence the random selection process of slot leaders by generating several variations of the next part of the chain, and then choosing the version that benefits them the most.

Ouroboros mitigates the potential for grinding attacks through the use of a secure, multiparty implementation of a coin-flipping protocol. This protocol generates a random value for the selection of slot leaders, preventing any single participant from influencing the outcome.

Furthermore, Ouroboros uses a delay function known as “follow-the-satoshi” in which the lottery outcome for who gets to produce a block is not known until the end of the current slot. This makes it almost impossible for attackers to compute or predict who will win the next slot, thereby preventing grinding attacks.

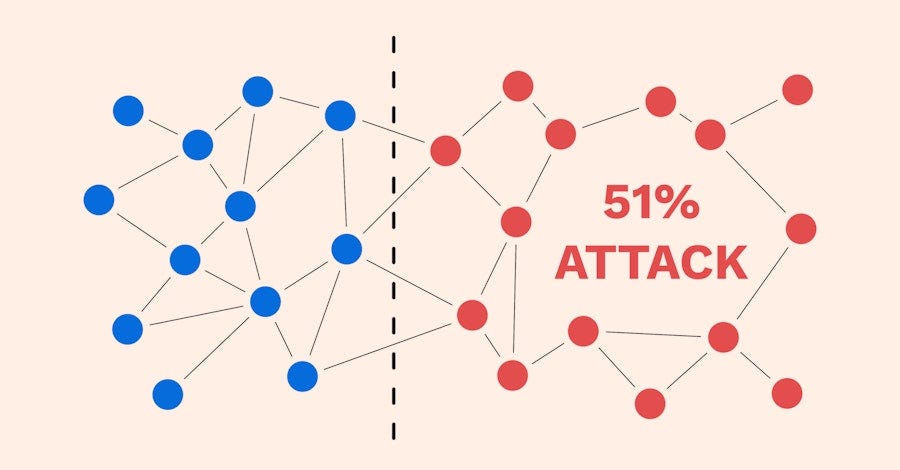

51% Attacks

A 51% attack refers to an attack on a blockchain by a group of miners that control more than 50% of the network’s mining hash rate or computing power. In the context of Ouroboros, which employs a PoS mechanism, this would mean controlling more than 50% of the total staked ADA tokens. Possessing such a majority would, theoretically, allow the entity to disrupt the network by manipulating the block validation process.

However, in the case of Ouroboros, carrying out a 51% attack would be significantly challenging and economically disincentivized. Given the high value and volume of ADA tokens that would need to be staked, the attacker would incur substantial costs. More importantly, such an attack would likely cause a major loss of trust in the network, leading to a sharp decline in the ADA token’s value. Given that the attacker holds a majority of these tokens, they would essentially be devaluing their own investment, making the attack counterproductive.

Nothing at Stake Problem

The ‘nothing at stake’ issue is a potential vulnerability in Proof of Stake (PoS) blockchain systems. This is because, in PoS systems, creating new blocks doesn’t require substantial computational resources, meaning stakeholders could try to create multiple versions of the blockchain simultaneously without incurring significant costs.

However, Ouroboros addresses this through a unique chain selection rule. This rule directs participants to disregard any drastic deviations from the most recent block they received, preventing the growth of multiple competing chains.

Moreover, unlike other consensus protocols, Ouroboros ensures each slot, or opportunity to create a block, is uniquely assigned to a single stakeholder at a time. This means it’s highly unlikely for sincere forks, caused by two stakeholders creating a block at the same time, to occur.

The protocol also contains a safeguard against potential ‘bribe attacks’, where stakeholders might be tempted to join an attack for financial gain. The Ouroboros incentive structure offers rewards to those contributing to the legitimate chain, reducing the potential profit of participating in attacks. Therefore, stakeholders are less likely to risk their reputation and potential rewards by joining an attack.

Importance of Stake and Reputation

Stake and reputation are intrinsically linked within the Ouroboros protocol. The more ADA tokens a user stakes, the higher their chance of being selected as a slot leader, incentivising honest participation. This is because as any malicious act could devalue the staked ADA tokens, harming the actor’s investment and standing within the network.

Cryptographic Sortition and Randomness

Ouroboros relies on cryptographic sortition for the selection of slot leaders, adding another layer of security. It uses a source of randomness, derived from previous transactions, to randomly select a validator from the pool of stakeholders. This randomness makes it extremely difficult for any potential attacker to predict or influence the selection process.

Forks

Forks in a blockchain network are potential points of vulnerability and can be used maliciously to double-spend or disrupt the consensus. Forks typically occur when there are disagreements or variations in the versions of transaction histories on the network. In the context of the Ouroboros protocol, the management of forks is handled carefully to ensure network security and consensus integrity.

In Ouroboros, like many blockchain protocols, the “longest chain rule” is applied. This rule states that, given multiple competing chains, the valid chain is the one with the most blocks, i.e., the longest. When forks occur, the protocol is designed to prefer the chain which includes the blocks created by the majority of the stake. Thus, when two blocks are created for the same slot (which might cause a fork), the block created by the slot leader with the larger stake takes precedence.

However, this doesn’t necessarily prevent forks from occurring, as network latency can still lead to multiple blocks being created for the same slot, causing temporary forks. What it does ensure is that these forks are resolved quickly and definitively, as every slot leader in subsequent slots will refer back to the block created by the slot leader with the higher stake. This quickly causes the shorter branch (the one referring to the block created by the slot leader with less stake) to be abandoned.

Comparison to Bitcoin’s Proof of Work (PoW) System

Bitcoin, the first blockchain-based cryptocurrency, uses a consensus algorithm known as Proof of Work (PoW). In this mechanism, miners compete to solve complex mathematical puzzles, with the first to find a solution being allowed to add a new block of transactions to the Bitcoin blockchain.

The solution to these puzzles requires substantial computational power, hence the term ‘work’ in Proof of Work. Once a miner has solved the puzzle, they broadcast it to the network. Other nodes then validate the solution, and if it’s correct, they add the new block to their copies of the blockchain.

How PoW Resists Malicious Attacks

- Difficulty Adjustments: Bitcoin’s PoW algorithm includes a built-in difficulty adjustment mechanism. Roughly every two weeks, the difficulty of the puzzle miners must solve is adjusted, ensuring that new blocks are added to the blockchain approximately every ten minutes. If more miners join the network and the rate of block creation increases, the puzzle difficulty also increases. This keeps the rate of block creation steady, preventing any single miner from dominating the network and ensuring the security and decentralization of Bitcoin.

- Economical Constraints (Cost of Attacking): Launching a 51% attack on the Bitcoin network, where a malicious actor gains control of the majority of the network’s hashing power to double-spend coins or prevent transactions, is highly expensive and thus unlikely. Given the substantial computational power required to control 51% of the network, the costs (both in hardware and electricity) would be massive. As such, the PoW system creates a strong economic disincentive to attack the network.

Comparative Analysis of PoW and Ouroboros’s PoS

- Energy Efficiency: One of the primary criticisms of PoW systems like Bitcoin’s is their high energy consumption. Bitcoin miners globally use more energy than some entire countries. Cardano’s Ouroboros PoS algorithm, in contrast, doesn’t rely on energy-intensive calculations, making it much more energy-efficient. In a world increasingly concerned with environmental impacts, this gives PoS systems a significant advantage.

- Speed and Scalability: PoW systems are often slower and less scalable than their PoS counterparts. The difficulty of the puzzles in PoW and the need for substantial computational resources mean that block creation and transaction validation take time. With Ouroboros, the process of selecting validators is much quicker, making the protocol faster and more scalable, and able to process a higher volume of transactions in less time.

- Security Strengths and Potential Weaknesses: Both PoW and PoS have their security strengths. Bitcoin’s PoW has proven very secure over the years, resilient to various types of attacks. However, its security largely relies on maintaining high levels of computational power, which comes with the trade-off of high energy use. Cardano’s Ouroboros, on the other hand, offers security through its unique leader selection process, stake-based system, and rigorous incentive and penalty mechanisms.