“Humanity is acquiring all the right technology for all the wrong reasons.” – R. Buckminster Fuller

In the previous article we took a look at DePIN projects on Cardano. This time we are taking a look at another buzzword that has been going around the cryptoverse, real world assets or RWA for short. The idea of tokenizing real world assets is nothing new in the cryptocurrency industry, it is however, gaining more attention since the Wall Street titans decided to join the game with the approval of the Bitcoin spot ETFs in the United States.

Blackrock CEO, Larry Fink, who for years had been bad mouthing bitcoin and cryptocurrencies, now decided that the cost of not participating was too high. But don’t be fooled by the marketing slogans to bring bitcoin to the retail investor in a safe way. Their real goal is to be the gatekeepers of access to cryptocurrencies, like bitcoin. And also to advance on their agenda to tokenize everything and they mean everything.

Like everything in life, nothing is inherently good or evil, it just depends how it is used or implemented. In the early days of crypto the talk around tokenization had the goal of making markets more agile and democratically available to a larger population. It would allow the opportunity for a group of people to come together and chip in to purchase an expensive art piece for example. Or it would allow the modernization of the real estate market, having property rights represented on the blockchain for more transparency and ease of trade.

Investigative journalist Whitney Webb published on February 8th, 2024 in her website Unlimited Hangout an article titled Tokenized, Inc: BlackRock’s Plan To Own The Fractionalized World where she and fellow journalist Mark Goodwin, editor in chief of Bitcoin Magazine, go into much detail about Wall Street’s plan to tokenize nature, the last frontier. I won’t go into much more detail since the referred article covers this topic in great depth. But I wanted to start off this article with a warning, it’s not enough to develop these amazing technologies, we also need to safeguard them from evil implementations.

Real World Assets on the Cryptoverse

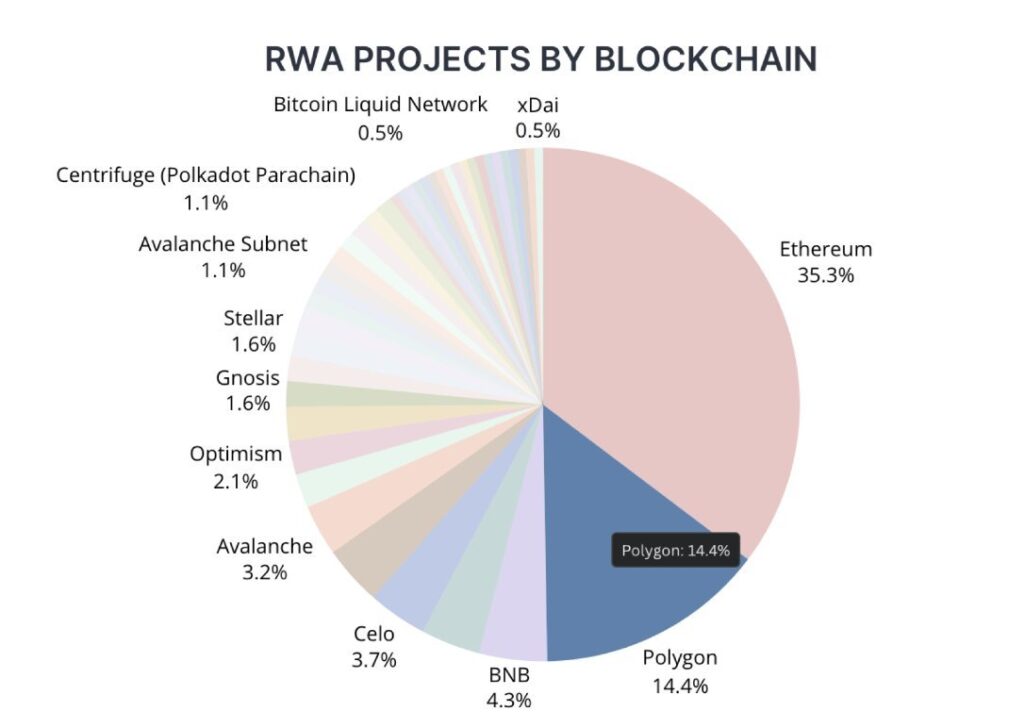

Before jumping into RWA implementations on Cardano, let’s take a look at what the rest of the industry is doing. This post on X/Twitter by user @covertheflames provides a great summary of the current landscape of RWA projects in different blockchains. Unfortunately as it often happens, Cardano is left out of the picture.

At first glance we can see that Ethereum holds a third of the market share for RWA projects, which is not surprising given that Ethereum is the king of DeFi. What is surprising, at least for me, is that Polygon is second with 14.4% of market share. If we consider that Polygon as a Layer-2 of Ethereum is in fact part of the Ethereum ecosystem family, one could argue that Ethereum already holds 50% of the RWA market. The third blockchain is BNB with 4.3%, which is surprising the gap between 2nd and 3rd place.

The leading project is ONDO Finance ranked first by market capitalization by Coingecko in the RWA category. ONDO is backed among others by… you guessed it, Blackrock. It currently offers one product, $USDY which is stablecoin that also provides exposure to tokenization of short term treasury bonds. Basically a token that is pegged to the dollar while also paying you interest for holding it. The current high interest landscape we find ourselves in, with an inverted yield curve since July or October 2022 (depends if you analyze the 3 month or 2 year treasury bill) means that short term treasury bonds are paying more than long term ones. This is not normal and it will eventually go back to its natural state. But so far it’s benefiting USDY because it provides exposure to this high interest rate (currently 5.20%) that wouldn’t be possible to obtain if you are not in the United States or have a brokerage account in that country.

Their second, unreleased, product will be $OUSG which apparently only “qualified purchasers” will be able to acquire. This is the tokenization of short term treasury bonds (without the stablecoin feature). This asset is backed primarily by the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) which is the first tokenization of an investment fund issued on the Ethereum blockchain. As we can see Blackrock is playing hard on the tokenization narrative, after years of bad mouthing bitcoin and crypto assets they finally found a way to make it work for them. As the saying goes “if you can’t beat them, join them”.

Real World Assets on Cardano

Now let’s talk about RWA projects on Cardano, unfortunately there aren’t many. Which surprises me, because Cardano is one of the best blockchains to issue tokens thanks to their native asset nature. Unlike Ethereum where each ERC-20 token requires a smart contract to live in the blockchain, on Cardano all tokens are native tokens like ADA and don’t require a smart contract to exist.

Let’s not be naive, the real reason Cardano is ignored by the mainstream media, VCs and bankers is because they can’t take control over it (or control won’t be handed out to them). Ethereum has been mostly co-opted by traditional finance titans such as JP Morgan and UBS group, as reported back in 2021. Consensys, the company behind most of the infrastructure used by Ethereum’s dApps, such as Infura and Metamask wallet, is now owned by the people crypto was supposed to fight against. So it’s not surprising they are using this blockchain to further their grip on the industry. But all hope is not lost, Cardano’s superior tech and development based on rigorous methodology will eventually come out on top, even if they try to suppress it.

The first project to look at is NMKR, a website that started from the mania phase of the launch of NFTs on Cardano. Providing a user-friendly way to mint non-fungible tokens on-chain has now grown into a proper company expanding into the tokenization of real world assets.

Their first approach into this new trend was the partnership with Tiamonds, where they announced on November 2, 2023 that with the help of NMKR they are bringing tokenized diamonds into the Cardano blockchain. These are real diamonds stored in the Swiss Alps and insured in London, which are represented 1:1 on the blockchain to offer another option to diversify portfolios. (Although diamonds’ scarcity is fake, as they can be easily created in a lab but that’s a topic for another time).

More recently on March 18, 2024. Emurgo, one of the three founding entities of Cardano, announced a strategic investment into NMKR to build a new launchpad called Finest “for businesses to issue compliant security tokens, upgrading its tokenization tools & features, expanding its global team, and other objectives.” With the help and investment from Emurgo, this new joint enterprise focused on real world assets may help shine a new light to Cardano’s potential as a hub of tokenization and interoperability.

The next project on Cardano is zenGate Global, the creators of the Palmyra marketplace for tokenized soft commodities. This is a hybrid project, in the sense that it’s both on Cardano and Ergo blockchains. Which is not surprising since Dan Friedman, the founder and CEO, was part of the founding team at Input Output that launched the Cardano blockchain and he is also a strategic advisor for the Ergo Foundation.

Their goal is to empower underserved commodity markets around the world by providing them with access to a global market to offer their products. On the Palmyra marketplace one can currently find tea from Sri Lanka, Nepal and Indonesia. Cinnamon from Ceylon and honey from Zambia. It’s a breath of fresh air to see a project on Cardano actively working to take this revolutionizing technology to the margins and connecting new markets, as it was intended from the beginning, although it seems some people have forgotten about that.

The token that powers the Palmyra marketplace has the ticker $PALM and it will be launched on Cardano, Ergo and BNB smart chain. There’s currently an ISPO (Initial Stake Pool Offering) running on Cardano in which ADA holders can delegate their ADA to their stake pools in order to receive the $PALM token as rewards instead of $ADA. For more information refer to their documentation.

There’s also an IDO (Initial Distribution Offering) planned for the Ergo, BNB and Cardano blockchains, although at this time, there’s no information about when this will take place. This is similar to an ICO (Initial Coin Offering) but it’s done in a decentralized way, however KYC (know your customer) will apply due to existing regulations and compliance matters evolving a registered company receiving funding from investors.

Conclusion

As expressed with the first title of this article, “Humanity is acquiring all the right technology for all the wrong reasons” we can appreciate that real world assets on the blockchain may either have a positive or negative impact on the world. Blackrock seems to be eager to take ownership of the natural world with the tokenization of public good assets, such as any area of rich ecological significance. But we are also seeing benevolent applications like Palmyra with the tokenization of soft commodities providing unrepresented communities a chance to participate in the world market. At the end of the day is the common person making everyday decisions which shape the future of the world. Which side are you going to support?