A stablecoin is a type of cryptocurrency that is designed to maintain a stable value, usually pegged to a real-world asset such as the US dollar or gold.

The goal of a stablecoin is to provide a digital currency that is less volatile than traditional cryptocurrencies, such as Bitcoin and Cardano, which can fluctuate wildly in value.

The most common type of stablecoin is a fully backed stablecoin, which means that each unit of the stablecoin is backed by a corresponding unit of the underlying asset it is pegged to. This means that if the stablecoin is pegged to the US dollar, for example, there will be $1 worth of US dollars held in reserve for each unit of the stablecoin in circulation. This helps to ensure the stability of the stablecoin’s value and reduces the risk of volatility.

Stablecoins are essential for blockchain ecosystems and their adoption because they provide a way for users to conduct transactions using a digital currency that is less volatile than traditional cryptocurrencies.

This can make it easier for businesses and individuals to use blockchain-based applications and services without worrying about the value of their funds fluctuating wildly.

What is Shareslake

The Shareslake network is a Cardano-based network running as a sidechain of the Cardano mainnet and powered by the Redeemable stablecoin(RUSD) instead of ADA. Due to the Isomorphic nature of the network with the Cardano Mainnet, every action available on Cardano is available on the Shareslake network, from transactions to executing Plutus scripts. All on top of a stablecoin backed 1:1 with USD reserves. Allowing users to navigate the ecosystem without the crypto ecosystem’s volatility.

Shareslake was the first stablecoin to go live on Cardano. The bridge went live on the 26th of September 2022, allowing users to move assets from and to the Cardano network and is currently available on MinSwap, Wingriders, Muesliwap, and SundaeSwap.

How it Works

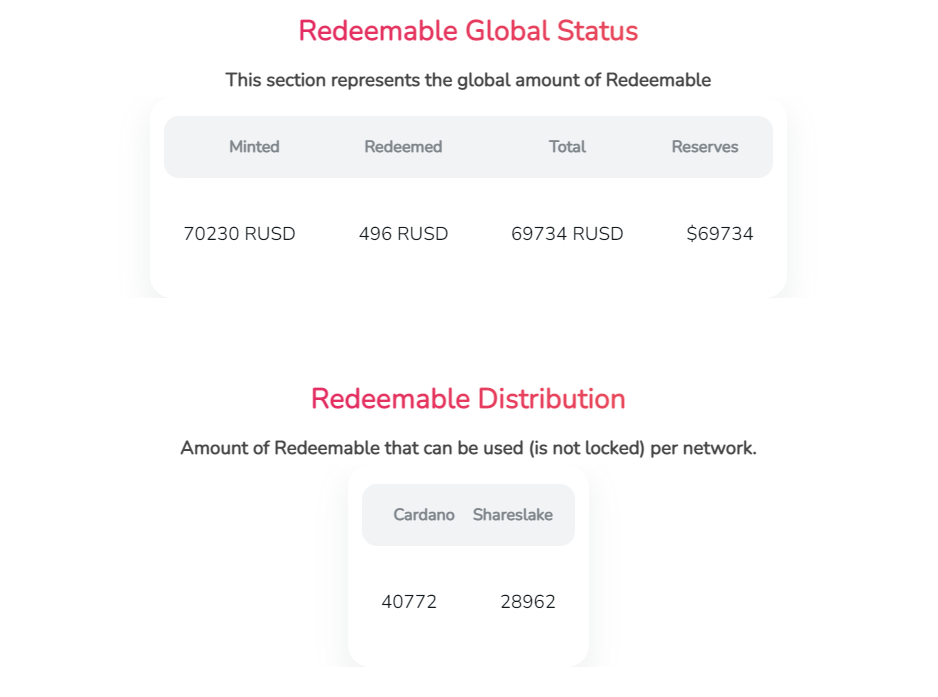

RUSD, the stablecoin powering the Shareslake network, can also be minted on both networks, increasing flexibility and interoperability. Minting can be done by sending a certain number of USD to the Reserves, and an equivalent number of Redeemable will be credited to your address. The opposite can be done by burning RUSD tokens to receive an equivalent USD bank transfer.

Currently, Minting and Redeeming are done through the Shareslake dashboard, which can be accessed after passing KYC(jurisdiction dependant).

This is one of the most significant downsides of a fiat-backed stablecoin. Due to its connectivity with the Financial Infrastructure systems, there is a certain amount of centralisation that cannot be mitigated compared to algorithmic stablecoins. Here’s what Miguel from the Shareslake team had to say about this:

“I strongly think that a fiat-backed stablecoin, obviously I’m talking about if well done and everything is covered and it’s not the next ftx, is safer for people.

Just because if you wanna have dollars and something goes wrong with anything because in the crypto space there is there are a lot of things that can go wrong depending on how stuff is built. If anything goes wrong, you can basically roll back certain transactions to before that error.

Let’s say with an algorithmic stable coin. If something goes wrong, people lose everything. But on the other hand, a fiat-backed stablecoin needs to be centralised. While algorithmic stable points can be fully distributed. So, you know, I don’t have any strong thoughts about using one or the other. I just try to have my own assets on what I think is safer for me.

This is a personal opinion, but if I have to elect between using an algorithmic stable point or a fiat-backed stable coin, I will say that if I’m going to maintain assets for a long time, I will probably use the fiat-backed one. But if I’m going to perform some operations you know, in a couple of days or a week or whatever, maybe using the algorithmic stable coin is the way to go because you can obtain it without basic KYC processes and all that”

The future of Financial Markets on the Blockchain

Shareslake plans to accommodate what they see as the inevitable future shift for companies and financial institutions to bring real-world assets such as shares, securities and much more to the blockchain.

“All the markets will move to blockchain technology. I don’t know if in two years or 10 years, but at some point, they will move. And it’s just because it is easier for everyone. It is easier for, for people to hold it. It removes the intermediaries.

For example, if you are going to tokenise a company, blockchain makes it now trivial. To tokenise the company shares, for example, in Switzerland, it’s already allowed to incorporate the company shares as network tokens.”

It is likely that the use of blockchain technology will continue to grow in the financial industry.

Many financial institutions are already exploring the use of blockchain technology for various applications, such as processing payments and settling transactions.

In the future, new stock exchanges and financial markets could be built entirely on top of blockchain technology, offering a more secure and efficient way of trading securities. However, the exact way they will move onto the blockchain will depend on several factors, including regulatory developments and the evolution of the technology itself.

Shareslake bridges the needs between Financial institutions and Decentralised blockchains by giving stability in the form of a stablecoin ecosystem and security with its KYC requirements.

As an incentive structure Shareslake also retains a percentage of the Tx’s fees on the network, which will be used as a reward mechanism to drive institutional adoption and bring companies to incorporate their shares as network tokens.

Trust and Decentralisation

Achieving trust as a blockchain is essential for adoption, and there are two main metrics in a fiat-Backed stablecoin chain.

Decentralisation — An essential feature of blockchain technology because it helps to ensure trust among the participants in the network. In a decentralised blockchain network, no single authority controls the network; instead, all participants can validate and verify transactions on the network. This allows for increased transparency and security, as no single entity has the ability to manipulate the network or alter the transaction history and helps to ensure that the network is resistant to tampering and other types of attacks.

The network currently, due to its infancy, is still very centralised, running primarily on Shareslake network nodes. However, there is a big push for the community to begin decentralising the network. Over 10% of the block minted are now being done by community nodes and will continue to increase over time.

An exciting feature of a stablecoin network is that through staking RUSD, users can receive rewards without any volatility risk, such as staking ADA or being open to vulnerabilities in current DeFi lending protocols.

Essentially users participating in decentralisation are gaining the rewards from transactions compared to the financial systems where banks would be solely benefiting from these Tx’s who then pass on very little to their customers, usually in sub 1% APR.

Proof of Reserves — A critical concept in the world of stablecoins. Proof of reserves refers to the practice of publicly disclosing the amount of fiat currency that is being held in reserve to back the stablecoin. This is important because it helps to provide transparency and reassurance to users of the stablecoin that sufficient funds are backing the value of the stablecoin. Without proof of reserves, there would be no way for users to verify that the stablecoin is truly backed by the fiat currency it is pegged to, which could lead to doubts about its stability and value.

Shareslake is in the process of setting up regular audits for their fiat reserves which they plan to execute bi-monthly. With these audits and corresponding RUSD tokens, a level of trust can be maintained to ensure the stability of the project and tokens.

The project still has a long way to go regarding decentralisation, trust, and utility. But overall, Shareslake is a promising project looking to bridge the gap between DeFi and RealFI and onboard Financial institutions to the Cardano Ecosystem. It is an excellent example of how a Sidechain can be created to leverage the Cardano codebase and bring tremendous utility to the mainnet in terms of stability and creating a liquidity on-ramp for the ecosystem.

Additional comments from Shareslake

You are currently not allowing tokens to be redeemed if you have not minted any. This is leading to a depeg on Dex’s, how is this going to be solved as pegging can really only be achieved fully by Arbitrage?

“This limitation was set to avoid draining the initial liquidity. It did not work, because as you said, broke the peg because people cannot arbitrage. We are currently working on improving the funds flow for a better and faster UX and will remove the limitation on the new dashboard version.

If the release of the new version takes longer than we expect, then we will remove the limitation in the current one. Our idea is to have it before the end of the year.”

How have you found building on Cardano?

“Well, we have more or less built everything that we needed. For example, for the sidechain, we have to build a bridge, which is in its earliest stage yet. It works only for the sablecoin we have pending to support any assets. So the idea is that we’ll be creating a new version of the bridge that will allow any native asset from Cardano to Shareslake and from Shareslake to Cardano. That’s the idea. But currently, we are in the first version. It only allows the stablecoin, but it’s not a big problem because people can still mint assets in the sidechain. So just like if they are meeting assets in Cardano. And also deploy any apps because you can deploy code out of the box.

You,can deploy your applications without changing anything in the, sidechain directly. So, for example, a dex can be deployed now, right now to the sidechain. I’ve seen that the Cardano space has been growing a lot during the last year because when we started, there were not too many resources to start.

Actually, it was like a year ago. I remember that I got crazy looking for how to create transactions from code . Then I found the serialisation lib where the documentation was not too good, to be honest. But during the last year, I have seen that there are many new tools with improved documentation for creating contracts in JavaScript. I feel like, currently, you can build stuff in Cardano much more easily than one year ago.”

Interview with Shareslake: https://www.youtube.com/watch?v=BimpeeSYKdw