Utility, value and price are three concepts that are usually used incorrectly in the cryptoverse when talking about different projects, protocols or blockchains. Since the cryptocurrency industry is the marriage between economics and technology, that half of the population is not well versed in these economic concepts is not surprising. In the same way, the other half misuses or confuses IT concepts like decentralized and distributed as well.

But first, why is it important to know and understand these concepts? Well these are important concepts when talking about investments and valuations, they are also used freely in the crypto media. So if the reader understands them, they will be able to navigate the space much better and not be so easily manipulated by whichever narrative is trending at the moment.

Utility

In economics, “utility is the total satisfaction or benefit derived from consuming a good or service. Economic theories based on rational choice usually assume that consumers will strive to maximize their utility.”[1] This concept is the bedrock for explaining the forces of supply and demand, because without utility there’s no demand, and without demand there’s no supply of goods and services. Not understanding the utility of cryptocurrencies is the reason why it took more than a decade for traditional finance to finally come around and accept that cryptocurrencies have value.

Utility is a very subjective matter, what one consumer may find useful or desirable, may generate a strong negative reaction to another. The easiest example is food, not everyone likes the same food and taste is a highly subjective matter in which the culture and the region have strong incidence upon.

Revolutionary technologies, like blockchain, the internet or the radio, usually take a long time to be recognized by the majority of the population as having utility because societies get accustomed to their own ways and changing how societies do things takes time. That’s where the entrepreneur, the visionary and the early adopter come into play, acting as the trailblazers for adopting new technologies and showing the rest of society the way forward.

Unfortunately, utility is also a buzzword used by lazy marketers to try to justify any ridiculous claim about their own project. As stated previously, utility is a very subjective thing, claiming that something has utility to every market participant is just not possible. That’s why marketers focus on finding the right consumer for their product. It’s not about throwing a big net trying to catch every fish in the sea, but having the right bait for the right fish.

A billionaire living in New York City with access to the best investment banks and hedge funds in the world is not going to find utility in crypto because it doesn’t fulfill any of their needs, thus calling it a scam. Meanwhile, a working class individual in a third world country with capital controls and no access to a bank account will find in cryptocurrencies the financial tool they have been hoping for, thus having utility.

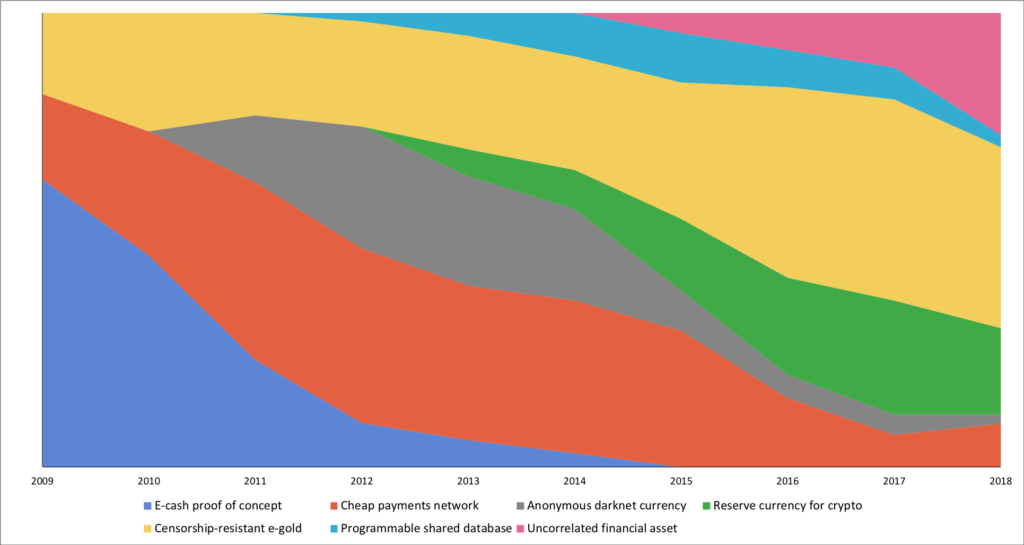

This graph shows the evolution of the economic utility of bitcoin from 2009 to 2018. In the early days, when only geeks and nerds knew about it, the utility of bitcoin was perceived as e-cash proof of concept, censorship resistant e-gold and as a cheap payments network. In 2010 we can see the emergence of its utility as anonymous darknet currency (mainly due to Silk Road). In 2011, the utility of a programmable shared database appeared and in 2012 the utility of being a reserve currency for crypto. That’s when the first forks of bitcoin, like litecoin and dogecoin, were created. And by 2014 the utility of an uncorrelated financial asset started to take relevance since it was a new financial asset without any overlap to the traditional financial system. Unfortunately, I haven’t found an updated version of this graph, but one can imagine it has changed a lot since 2018. More so recently with the release of the bitcoin spot ETFs in the United States.

Value

Economic value is derived from utility, because a good or service will only provide a benefit to a consumer that finds utility in it. Unlike utility, value is measured in monetary terms which should not be confused with the market value of said good or service. The difference between economic value for an economic agent and the market value is the foundation on which value investing is built upon. That is, finding assets whose market value are depreciated against their economic value and waiting for them to appreciate.

But economic value is not only influenced by the utility assigned by the consumer, other market variables like supply, demand, scarcity and desirability also play a role. A product may have a high utility and value to a lot of people but if the supply of this good is very high and it’s not scarce then its economic value may not be as high. The opposite is true as well, the same exact product presented to economic actors in a place where it’s scarce and in high demand, the economic value of said product will be much higher.

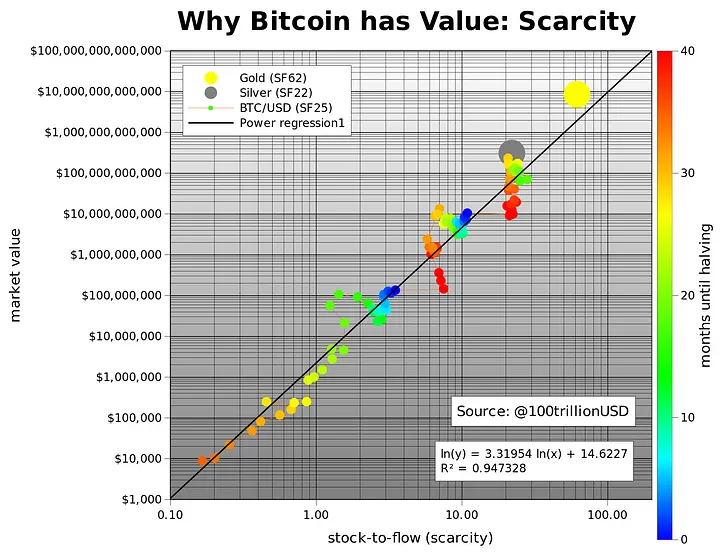

There have been different approaches to calculate and find the economic value of crypto assets since their inception. In the beginning when it was just Bitcoin, most financial analysts called it a scam based on the approach of traditional finance of calculating the economic value of a stock based on their cash flow. However, as we all know now, neither bitcoin nor any other crypto has a cash flow because it’s not a company. So other alternatives had to be implemented. More notably PlanB came up with the idea of applying the valuation methodology of commodities such as gold and silver. In his famous article titled Modeling Bitcoin Value with Scarcity the stock-to-flow model is applied to derive the value of bitcoin based on the current stock of BTC in circulation and the time or flow it takes to produce it.

In March 2019, when this article was published, gold had a SF value of 62. Meaning it would have taken 62 years to mine all the gold in reserve (stock) at the rate (flow) at which gold was mined in March 2019. At that time, bitcoin had a SF value of 25, a little bit over Silver at 22. However, today on April 2024 after the fourth halving bitcoin has a SF value of 76.3 meaning it is now harder than gold.

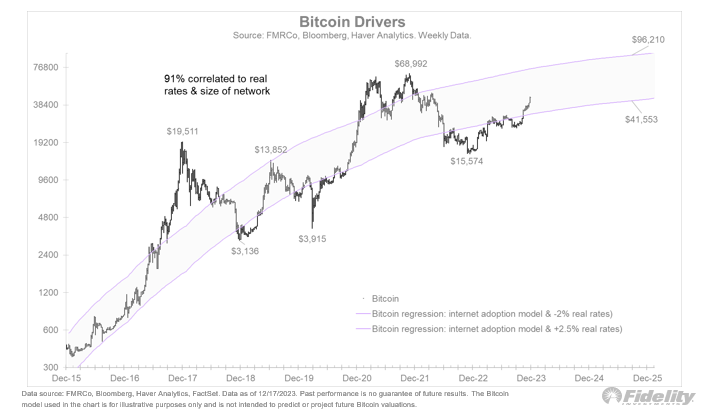

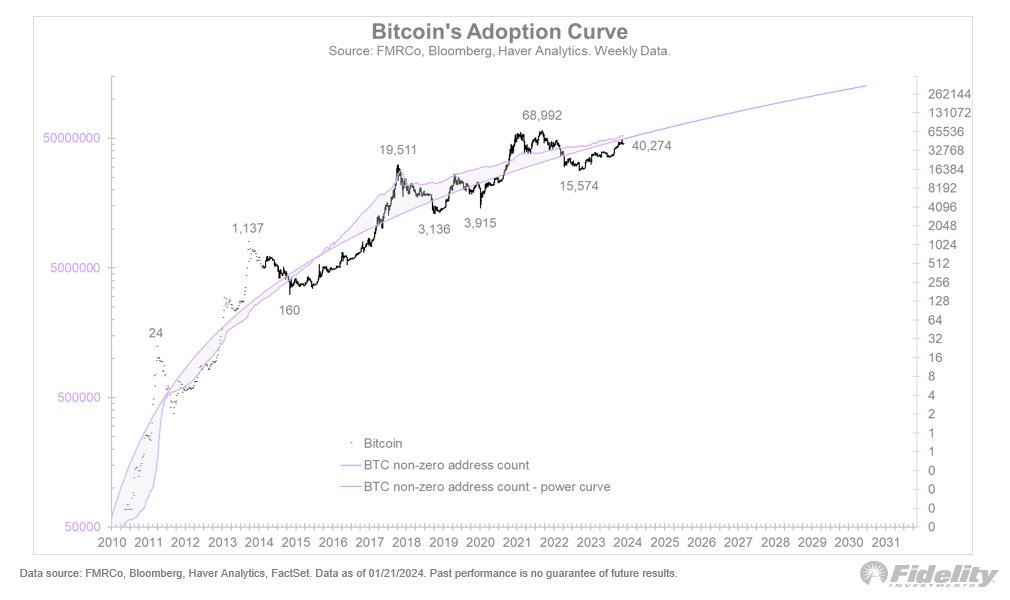

A different approach has been trying to value the adoption of bitcoin by comparing it to the adoption of other general purpose technologies like the internet or the adoption of mobile phones. Jurrien Timmer, director of global macro from Fidelity, has been publishing these valuation models on X/Twitter for a while now.

In this post from December 21st, 2023 Jurrien presents a model using internet adoption and real interest rates to project bands (+2.5% & -2%) which indicate bubble territory or overvaluation when market price is above it, fair value when it’s inside it and undervaluation when it’s below it.

In this most recent post from January 23rd, 2024 Jurrien presents a model based on non-zero address count. Using the number of wallets with non-zero value is a way to approximate the number of users using bitcoin, in this case. Of course one person can have more than one wallet with non-zero amount of satoshis, the same way an internet user can have more than one device connected to the internet. The main idea behind this approach is that the technology becomes more valuable as more people find utility in it. Bitcoin appreciates in value not only because it is scarce but because it becomes more desirable as time progresses.

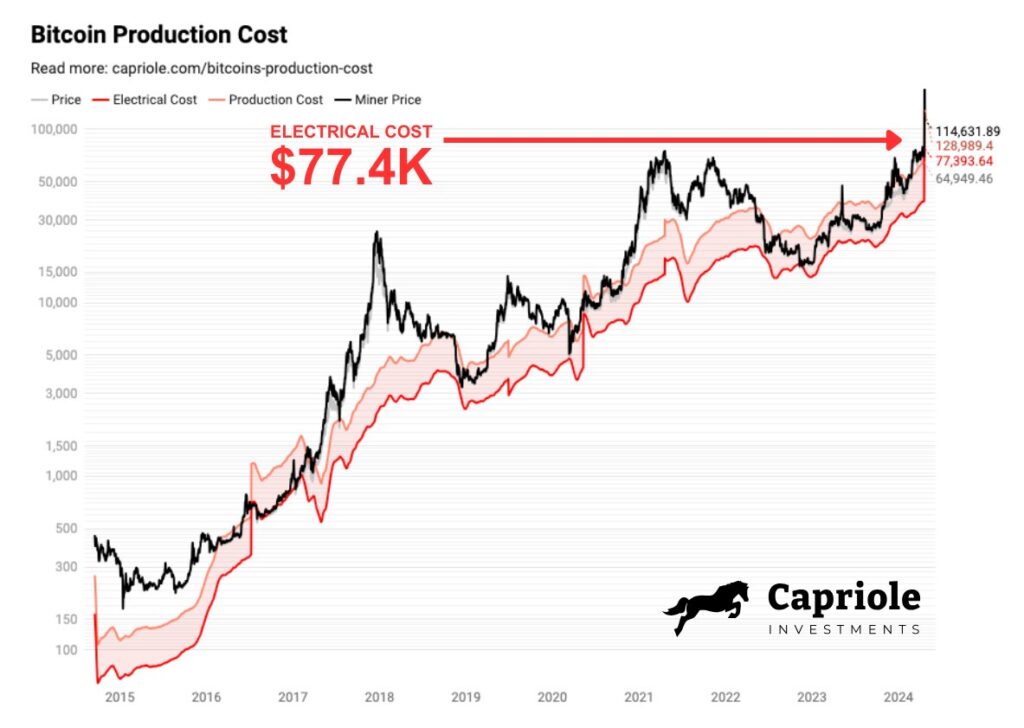

This final model I will present to you, relies on the notion that something has intrinsic value if there are people willing to spend their time, energy and resources to produce it. In this case bitcoin has value because it requires computational power and electricity to be created.

Charles Edwards, founder of Capriole Investments, occasionally publishes the following chart showing the bitcoin production and electrical cost. This calculation is open to interpretation, in the manner that electricity costs vary greatly depending on the continent, country and region where the mining operation is located. Since bitcoin mining became a multi-million dollar endeavor, companies have been making bespoke deals to get cheaper electricity thus gaining an edge on the competition. The production cost includes the cost of the ASIC miners and other variable costs involved in the operation. Here we can also find variables such as the model of the miners, the cost at which they were acquired and shipping costs.

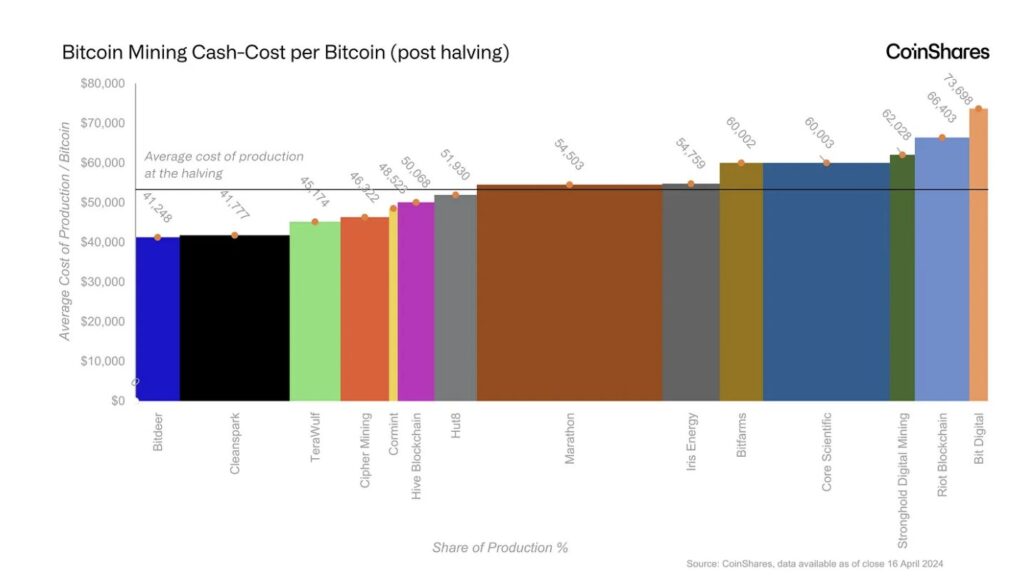

Coinshares published a similar analysis of the production cost of bitcoin after the fourth halving. In their report they made the distinction by mining company, providing a more in depth picture of the industry’s costs. According to them the average production cost of 1 BTC after the halving is $53,000 USD. As we can see from the image below, some companies find themselves below this average, while others above it. It’s also important to remember that this metric is changing everyday as it is dependent on many external factors.

Price

Price or more specifically market price is the last piece of this puzzle. As we have learned so far, consumers find utility in goods and services. This utility is subjective and has a different economic or intrinsic value to each individual. So now it’s time to head to the market to acquire this asset that we desire, but how much should we pay for it? As we have seen, value is not only influenced by utility and scarcity but also by the market forces of supply and demand.

During the 2021 NFT mania phase, people claimed that NFTs were valuable because they were scarce thus were willing to pay an elevated market price to own this asset. High demand fueled by FOMO (fear of missing out) produced desirability plus an artificial scarcity led to an amazing bubble. Once the bubble burst, due to external macro events, people who paid a lot of money to own a jpg realized that there’s no utility in it. Desirability banished overnight, scarcity was not real (right click, save image), demand plummeted so price only had one way to go, down.

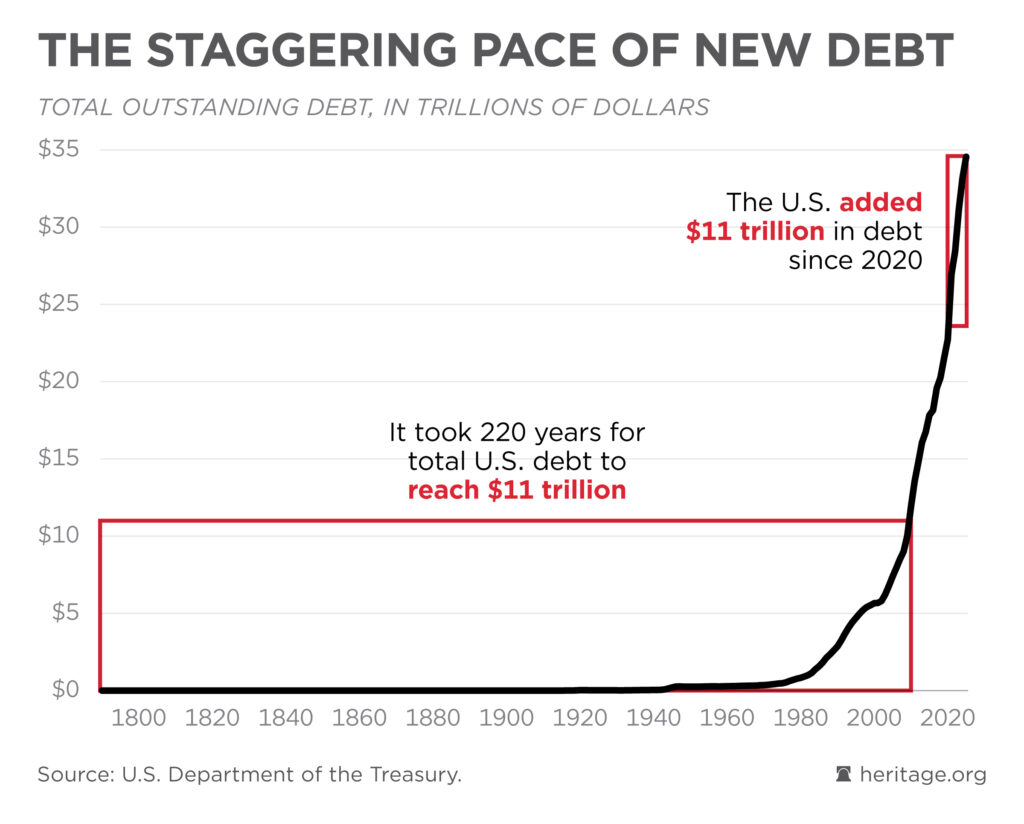

In the case of cryptocurrencies, empirical evidence seems to suggest that their market price is highly sensitive to global liquidity. This is the sum of all the liquidity or money printed by central banks. Since most cryptocurrencies have fixed supplies, it is not surprising that when there is more cash going around the world they would appreciate in monetary value. This is the origin of the bitcoin meme “∞/21M” which represents the infinite amount of fiat currencies that can be printed by central banks divided the maximum circulating supply of 21 million bitcoins.

The massive injection of new liquidity in response to the covid pandemic by the main central banks of the world, is what fueled the crazy rally we saw in cryptocurrencies in 2021. As central banks become more reckless in their issuance of new money and expanding their balance sheets, it will continue to fuel the rise in global inflation which will also contribute to the appreciation of hard assets, like cryptocurrencies and commodities, specially precious metals.

As the late stage capitalism, fiat currency, fractional reserve banking system we find ourselves in continues to unravel into its downfall, market prices will become more volatile as market participants try to navigate this tumultuous economic landscape. Cryptocurrencies in particular, an asset class famous for its volatility, will become even more volatile (an excuse politicians will probably use to try to regulate it even further) which will result in inexperienced market participants loosing their money trying to time the market. However, those experienced and knowledgeable market participants that understand utility, value and price will come out on top.