The decentralized finance (DeFi) landscape in Cardano is witnessing a significant evolution through FluidTokens, the pioneering DeFi platform in the ecosystem. Through FluidTokens’ innovative solutions delivered to the Cardano community, users on Cardano can lend, borrow, boost, or rent their assets in a seamless way. In this article, we walk you through Aquarium, a transformative protocol by FluidTokens. The Aquarium Protocol is an innovative approach to feeless transactions and smart contract automation by FluidTokens that will significantly impact on the future of Cardano, including developers building applications as well as end users. But before exploring Aquarium, here’s a primer into FluidTokens and how the platform works.

Overview of FluidTokens

FluidTokens is a platform built on the Cardano blockchain that facilitates the lending and borrowing of assets through the use of non-fungible tokens (NFTs) as collateral. It allows users to leverage their NFTs to secure loans in ADA or other Cardano native tokens. This innovative approach not only provides liquidity to NFT holders but also opens up new possibilities for NFT utilities beyond the traditional collectible aspect.

FluidTokens, widely known as Cardano’s first NFT-DeFi bridge, contributes to a more fluid and dynamic ecosystem on Cardano by enabling the following:

Borrowing and Lending

FluidTokens allows users to use their Cardano Non-Fungible Tokens (NFTs), digital art pieces, and other Cardano native tokens as collateral to get loans in ADA and other Cardano native tokens. NFT owners (borrowers) can list their NFTs on the FluidTokens platform, specifying the amount of ADA they want to borrow, the loan duration, and the interest rate they’re willing to pay. Lenders will then review these loan requests and fund them based on their judgment.

When it comes to repayment, borrowers pay back the loan in one payment to retrieve their NFT. If they miss the deadline, lenders can claim the NFT, but late repayment is allowed without extra charges if the lender hasn’t claimed it yet. For platform fees, lenders pay only the transaction fee for starting the loan, while borrowers pay a platform fee based on the loan amount.

Renting of Assets

With the rise of digital assets like videos, movies, books, and music as Cardano NFTs, FluidTokens enables users to rent these items to those who need them temporarily. As a lender, you provide the digital assets on the platform for a specified period, charging a fee. Borrowers will then pay some ADA or other required assets for borrowing. The assets are then returned to the borrower when the rental period ends.

Boosted Stake

Boosted stake involves renting out the staking permissions of your ADA. Unlike traditional lending, the actual ADA isn’t lent to the borrower. Instead, borrowers can earn rewards by delegating the ADA to their stake pool or participating in Initial Stake Pool Offerings. Lenders benefit by earning more interest on their lent-out assets compared to standard staking returns.

Solving the Challenge of Transaction Fees and Smart Contract Automation

Traditionally, users engaging with dApps are required to pay transaction fees in native currencies such as ADA. This presents a barrier to entry, especially for new users that are not so familiar with blockchain technology. Additionally, there has been a consistent need for smart contracts to execute decentralized actions autonomously. FluidTokens is introducing the Aquarium Protocol to solve these two challenges.

At its core, the Aquarium Protocol aims to revolutionize Cardano transactions by introducing fee-less transactions, enabling the payment of transaction fees with custom tokens, and ensuring the safe automation of smart contracts. The protocol consists of several components:

- FeeTanks: These are ADA-filled containers that users can create, setting customizable conditions under which others can spend the ADA.

- Aquarium Lambdas: Serving as the technological backbone, Lambdas allow the spending of ADA from FeeTanks under specified conditions, such as user affiliation with specific dApps or receipt of custom tokens.

- Aquarium Rules: These define triggers for the automatic execution of smart contract actions, enhancing the protocol’s automation capabilities.

- FluidTokens Validators: A decentralized network of validators ensures the secure execution of transactions and smart contract actions within the Aquarium ecosystem.

The Aquarium Protocol simplifies complex blockchain interactions, offering an intuitive platform for various applications and providing a seamless user experience for both developers and users alike. For a deeper dive into Fluidtokens, you can check out this impressive thread on X (formerly Twitter):

Here’s a closer look into how the core components of the FluidTokens Aquarium Protocol, Aquarium Lambdas and Aquarium Rules work:

Aquarium Lambdas: Feeless Transactions

- Create a FeeTank: Any decentralized application (dApp) or project , referred to as “the Creator”) aiming to offer feeless transactions establishes a FeeTank.

- Access control: Only the Creator and the FluidTokens Validators Network hold access to the FeeTank to ensure security and prevent misuse.

- Define custom conditions: The Creator defines specific conditions for using the FeeTank during transactions. Example conditions include whitelisted addresses, chain-specific requirements, transaction content, and more.

- Integrate with Lucid Code: The Creator integrates a few lines of Lucid code into their platform. to enables users perform gasless transactions.

- Validate transaction properties: The FluidTokens Validators Network verifies conditions and ensures proper FeeTank usage.

- Sign transactions: Users sign transactions without incurring any ADA fees. The FeeTank acts as a reservoir for gasless transactions, allowing users to transact without paying ADA fees.

Aquarium Rules: Smart Contract Automation

- Fill Your FeeTank: Users start by filling their FeeTank with ADA or other native tokens. This primes the system for automated actions.

- Create an Aquarium Lambda: Users define an Aquarium Lambda that specifies trigger conditions. Triggers can be time-based (e.g., every x seconds), event-driven (e.g., chain events), or linked to external data sources. Example trigger conditions include execute a transaction every five minutes, respond to an external API call, or react to a specific on-chain event.

- Validate transactions – The FluidTokens Validators Network ensures usage of the correct FeeTank usage and adherence to specified conditions.

- Transaction execution: When the trigger conditions are met, the FluidTokens Validators Network execute the transaction without manual intervention, a flow that demonstrates true decentralized automation.

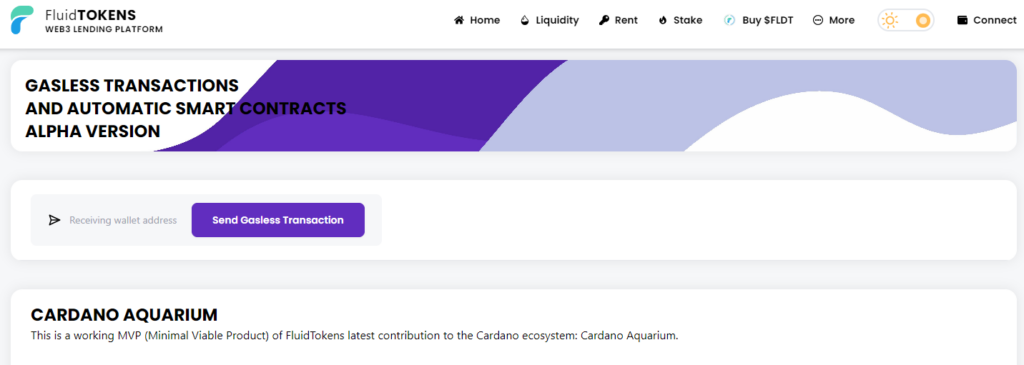

The Aquarium project is a work in progress, with an MVP for gasless transactions already running on the Cardano preview network, as shown below.

The MVP demonstrates the basic mechanism of Aquarium Lambdas allowing feeless transactions. In the MVP, users can send upto 7tADA to any other user without having to pay any transaction fee, all sponsored by a FluidTokens FeeTank.

Product Roadmap and Budget

The FluidTokens team has outlined an ambitious roadmap that promises to expand the capabilities of the Aquarium Protocol over the next months.

| Milestone | Description | Deliverables |

|---|---|---|

| 1 | Format definition for aquarium lambdas and rules; UI and SDK design for easy integration; infrastructure setup. | – Official format for writing conditions and triggers with Lambdas and Rules. – UI design ready for frontend development. – Infrastructure high-level design diagram and deployment. |

| 2 | On-demand creation, refill, and withdrawal of FeeTanks. | Backend, frontend, and on-chain components to properly create and manage FeeTanks. |

| 3 | On-demand creation, editing, and canceling of lambdas and rules. | Backend and frontend components to properly create and manage FeeTanks. |

| 4 | Formalization and implementation of the validators coordination algorithm. | Documentation and working environment for multiple Validators submitting user transactions. |

| 5 | Deployment on Cardano testnet or pre-production networks Stress-testing and auditing. | Community testing and feedback. Auditing and public docs initiation. |

| 6 | Deployment on Cardano mainnet; gradual expansion to all nodes. | – Fully working product on Cardano mainnet. – Public docs available. – Marketing for adoption by major Cardano protocols. |

To make the Aquarium Project a reality, the team requested a total funding of 285,000 ADA in the recent Fund 11 and received overwhelming support from the community. Here’s a breakdown of how the team plans to spend the funds while working on the Aquarium project:

| Task | Cost (USD) |

|---|---|

| Infrastructure design and deployment | $8,000 |

| Frontend development | $14,000 |

| Backend development | $28,000 |

| Smart contract development | $8,000 |

| SDK creation | $1,000 |

| Smart contract auditing | $35,000 |

| Marketing | $5,000 |

| Documentation production | $500 |

| Formal, stress, and quality testing | $500 |

By allowing feeless transactions, custom fee transactions, and automatic Smart Contracts, the solution encourages new disruptive use cases of the Cardano platform. This leads to a more vibrant and active ecosystem, attracting more users, developers, and enterprises. The overall value provided by the project justifies the investment. It creates new opportunities for projects and dApps, encourages platform usage, promotes standardization, and prioritizes security and user experience, all of which contribute to the long-term success of the Cardano ecosystem.

Comparing this to IOG’s solution that’s at the ledger level, Aquarium would run on a decentralized network of validators to allow not only Babel fees but also Sponsored and Automatic Transactions. The future looks promising as the applications for Aquarium are endless. Think about hiding blockchain infrastructure from user experience thanks to sponsored transactions, the ability to transact using custom currencies, and automatic payments on the network. How disruptive will this turn out?

The FluidTokens Team

The entire FluidTokens team consists of a diverse group of experts, each contributing their unique skills to bring this innovative solution to life. Matteo Coppola: a cloud architect who doubles up as a backend/smart contract developer serves as FluidTokens CEO. Raul Antonio, FluidTokens CTO focuses on smart contract development and offchain integrations. The development team consists of Ullas M, Alberto Rizzi, Anastasia Polozova, and Henry Peters. Lorenzo Martani rounds up the team as their marketing expert. Together, this team is driving FluidTokens towards success.

The FluidTokens is also behind two other projects that were approved and funded in Catalyst’s Fund 11. These are:

- Real World Assets Tokenization Launchpad, built though FluidTokens strategic partnership with NMKR & IAMX.

- BaFin Audited Cardano Smart Contract for compliant real world asset tokenization

Final Thoughts

As FluidTokens continues to develop and implement its solutions, it stands as a testament to the power of blockchain technology to drive change and create a more inclusive and efficient digital economy. The Aquarium Protocol represents a transformative step forward for the Cardano blockchain. By eliminating transaction fees, offering flexible payment options, and automating smart contracts, it streamlines blockchain interactions and creates a more accessible and efficient DeFi ecosystem. As we look ahead, their product roadmap promises exciting developments that will continue to shape the future of decentralized finance 🌊🚀

For more detailed information on the Aquarium Protocol and the full product roadmap, you can refer to the FluidTokens website and official documentation.