This post was adapted from a thread originally posted by @Flantoshi on Twitter

The world was taken by storm over the last two years, and ignoring the pandemic sized elephant in the room, there was one topic that news outlets and influencers were obsessed with — NFTs and memecoins — where entire fortunes were made and lost in the blink of an eye.

But what did it all mean? What (if any) is the value of this new field?

By now you’ve probably read dozens of stories of people who gambled on random speculatory assets over the past two years and made life-changing amounts of money. But just for thoroughness sake, let’s briefly look at the life cycle of one of the more famous memecoins out there — Shiba Inu.

Had you invested a single dollar in August 2020 into the Shiba Inu altcoin, at the height of its investing madness, you would’ve had 6,172,839,506.17 Shib tokens worth $493,827 — a face-melting 493,827,000% return!

Put simply, it might well be one of the most extraordinary returns on invested capital in history; especially when in the longest recorded asset bullrun ever, traditional financial firms struggle to net an 8% return a year.

An old-school value investor, when confronted with these numbers, might briefly need to push their eyeballs back into their sockets after the shock has worn off, but then they would probably dismiss the whole field as a speculatory Ponzi scheme.

Admittedly, I’m more in that camp than I’m not. However, I can’t help but feel that there are different dynamics at work, which allow for the creation of a whole different game than we’ve previously seen.

To that end, this article will explore the underlying philosophy and value proposition that these new assets have.

The Basics

Before we get all carried along with fancy blockchain-lingo, let’s walk a few steps back and bring it to basics. What is a meme?

Sounds like a silly question to ask in the year 2022, where every person reading this will be bombarded with hundreds of memes on any given day. But if we are to understand this budding space, we need to go back to first principles.

The first usage of the word “meme” was by famed biologist Richard Dawkins in his 1976 book The Selfish Gene. This was done in reference to the fact that ideas undergo similar evolutionary pressures as genes.

After all, new ideas are complex mergers of previously existing concepts. Then, as they move from one person to the next, it never gets passed on quite the same and it mutates (if I say the word “apple” you and I might understand each other, but we don’t think of the same platonic apple, for instance).

So memes are units of culture, they’re small packets of information that contain a basic idea that evolves through each generation that it exists in.

Through misunderstandings, random chance and innovation, ideas mutate and in time become entirely different beings; much like an organism might undergo mutations and over the generations become a different creature altogether.

And, just like any other living being, it can die as well by being forgotten and never passed on. Most memes are very fragile entities, and their blockchain offshoots are no exception.

Death is the ultimate inevitability and it comes fairly quickly for most blockchain projects. This is especially true when we consider the assets that are fundamentally designed to function as memes.

The Growing Meme Economy

The vast, vast majority of crypto projects out there are memecoins — crypto assets that often have no utility, or are just blatant rebrandings of already existing projects. The infamous memecoin Dogecoin, for instance, shares many of its key architecture with Litecoin (which itself is derivative of Bitcoin). And this quirk is one of the reasons it managed to survive in the first place, as Litecoin miners were able to “merge mine” which allowed them to mine Litecoin and Dogecoin simultaneously.

It bears saying though that beyond technical quirks that might help in survival, memecoins live and die based on people’s perceptions. The key strength of a memecoin is its community, as the price soars when it is the talk of the town and crashes otherwise.

The life cycles of memecoins can sometimes even be measured in hours where there is an inevitable hype cycle where everyone thinks they’re getting rich, then the creator and majority stakeholder “rugpulls” and exits their position, leaving the vast majority of people all the poorer.

A similar story happens with Non-Fungible Tokens (NFTs), where while having vast future applications, they are now primarily JPEGs, featuring a variety of characters which are then used as profile pictures. Well, technically speaking, they are not even that. They’re tokens on the blockchain with embedded fixed links which point to a photo off-chain.

In other words, NFTs are reliant on the goodwill of whoever is hosting the third party infrastructure. If they want, they can just decide to not host the image anymore and then the only thing that people have is a token with a broken URL link.

The sector is also filled with “wash trading,” where a creator buys their own NFTs. This is done for a few reasons:

- Money Laundering, so that people with unexplained funds have a legit source of income to present to the tax authorities.

- Bidding up the price of their assets, so that it looks like people are interested in buying at elevated prices, while also raising the minimum buy price of a collection, as in the “floor.”

If one’s not careful, one can also buy NFTs that weren’t minted by the actual copyright holder, so there’s that level of complexity to consider as well. It’s like trying to dig for treasure in a minefield.

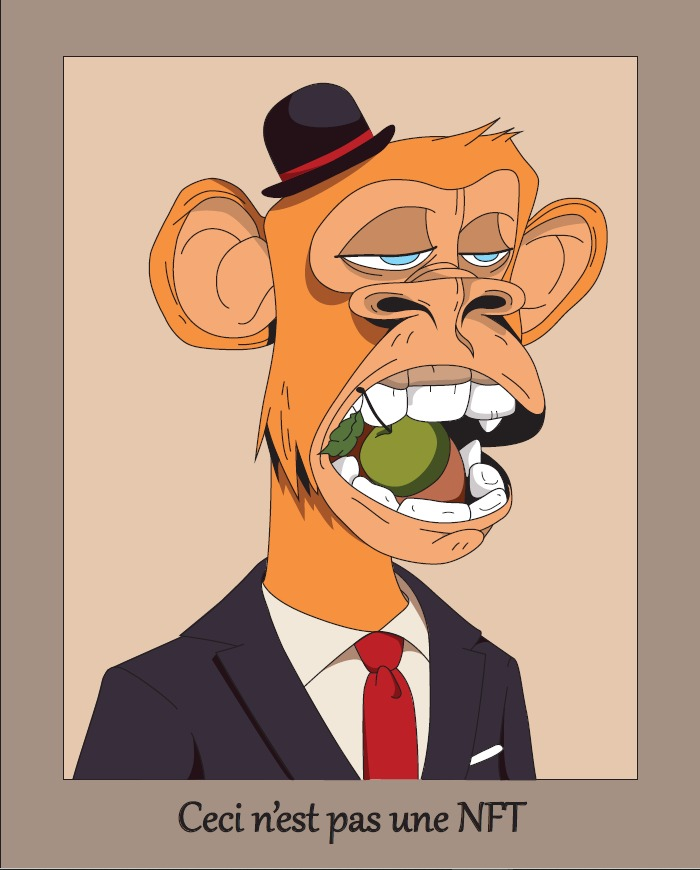

Despite this, there are now thousands of avid collectors, and some of these images have gone for vast fortunes (even though they often look like they were drawn by a chimp with severe developmental issues).

So is that all there is about NFTs and memecoins? They’re just a blatant scam that people are using as a get-rich-quick-scheme?

Not exactly!

Yes, yes, most NFTs and memecoins are outright scams, but I’d even go as far as saying that about most crypto projects, period.

(Either that or they are so ineptly run that they might as well be scams.)

It’s easy to get caught up in the everyday boom/bust cycles and lose sight of the general trend of what is happening. Memecoins & NFTs are accidentally doing something that has only happened a handful of times in world history.

Tokenization of Ideas

As I’ve elaborated in more detail in other articles, money as a concept came into existence because barter is difficult. You might want something I have, but you might not have something I want, so you have to find some way of convincing me to give you my possessions.

In order to dispense with this difficulty, people just started assigning some items with the abstract notion of “value.” Whatever it was that our society happen to like at the time, that was what got assigned as valuable — arrowheads, cocoa beans, cowry shells, really big rocks, bottles of booze, cigarettes, gold coins, etc have all been used as money at one time or another.

Put simply, through analogue means, we manage to tokenize the abstract concept of “value.”

But the interesting thing about crypto is that we’re managing to tokenize a lot of other ideas, like virality, community, etc. I’d like to put forward that anything groups of people care about can and will be tokenized and indeed traded in the near future.

This, in turn, means that we will start seeing bizarre things like religions that tokenize elements of their faith. It might seem weird at first glance, but it’s a natural extension of taking abstract concepts and creating digital objects to represent them.

We’ll address such farfetched notions another day though. For now, let’s go back to memecoins and NFTs along with their volatility.

If we aren’t dismissing the whole field as a scam, what exactly is being reflected with the rapid price changes from one moment to the next?

In short, it’s people’s faith in the community. Much like the value of a Dollar is essentially a referendum where people are asked, “what is the value of the American Empire and what is the likelihood that it can meet its obligations without losing its influence?” the same happens with memecoins and NFTs.

When a memecoin or NFT is sold, its sales price is really a referendum where people are asked “how much is the community behind the tokens worth and is their influence rising or falling?”

If we look at it under that lens, of course, this is bound to be an insanely volatile asset class. Ideas are like a gas, where they’re never in one fixed spot and they’re always in flux. Even within a single person, an idea, a desire to do something, can change from moment to moment.

For instance, imagine if there were some sort of equation that calculated how likely I am to order a delicious slice of chocolate cake. When it’s out of sight, and out of mind, my demand for it is fairly nonexistent — I can resist the urge.

But put a slice of Sachertorte in front of me, and my willpower all but disappears. My “demand” and willingness to pay for the chocolate cake fluctuates moment to moment based on considerations of proximity, availability, what I’ve had for lunch, my weight, whether other people are around to judge my eating habits, etc.

My perception of my life circumstances and likely future is what determines my willingness to eat further fattening and delicious cake. The price is of a secondary concern, only to be considered when I’m already primed to get some more cake.

Now, take this exact same dynamic, but multiply this by all the community participants that indirectly affect the price of a meme asset. This is why the price graph for this asset class looks so particularly schizophrenic — it’s a million people with radically different views on life trying to will their ever-changing perceptions into reality.

Some believe that the community is worthless, while others believe their random assets will become the world’s reserve currency. The price graph is merely a discourse between them, and obviously, there’s bound to be violent disagreements.

Volatility is not a bug, it’s a feature of meme assets.

A sense of belonging

Value-driven investors often look at meme assets under the wrong lens — they look at them and ask “where is the revenue, the business model, etc?”

Those are usually fair questions, but they’re not necessarily relevant for meme assets. Yes, there are often projects with a roadmap and vague promises (I’ve seen everything promised from DEXes, movies, comic books, TV Shows, opening casinos, party invitations, etc.) but by and large, those are usually incidental.

In praxis, when you look at how the people in this asset class behave, what you discover is fairly interesting. You’ll often see Twitter threads where people say they’ll follow everyone that owns and displays a certain NFT, for instance.

It kinda works as a football jersey, a digital item of clothing to signify that you’re a part of the group, which just so happens to appreciate in value if the community becomes more desirable. Thus there’s a built-in incentive to make your investments an intrinsic part of your identity and to dedicate a large portion of your time talking about them.

The dynamics of sports fandom are so similar in fact, that there are already “Fan Tokens,” which are Memecoin/NFT hybrids that represent a given sports team. Many of them started out as unofficial cash grabs, but as the official team representatives started realizing that this was a new means of monetizing their brands, there started being official tokens.

These official tokens are typically done via hired third parties, like the Chilliz blockchain infrastructure provider, which takes care of the complexity on the backend and provides a smooth experience for the fandoms.

Ownership of these tokens might occasionally grant their owners fringe benefits like merch discounts, access to exclusive tickets, and sometimes even the ability to influence some of the team’s decisions, like their uniform design.

Be that as it may, there comes a point where people tie so much of their soul into these assets, that it becomes difficult to untangle themselves from them and sell them. This is where the famed “diamond hands” come in and people refuse to sell, no matter the price.

But if we are to fully understand meme assets, perhaps we need to fight fire with fire and use memes to make sense of the situation.

There was a shitpost I read a while back, I won’t be able to find it if my life depended on it, but it went something like this:

“Grown men are afraid of selling their million-dollar monkey pics because they’re afraid of losing the friendship of others like them.”

This seems absurd, no? But what if we change the asset class?

What if instead of a meme profile picture of a monkey, it’s an exclusive country club membership? That somehow makes sense, we might not be willing to spend hundreds of thousands of dollars on such a membership ourselves, but it does still sound like something sane people might actually do.

After all, having a sense of community, of participating in something bigger than oneself, is a basic human drive, which is sorely lacking in our atomized modern lives.

Communal Culture

Back before lawyers had built tollbooths around cultural artefacts of great significance, culture was communal. One night, you might sit by a campfire, and hear a fantastic story. Then, the next week, you would go to another group where you’d retell the same story, but you might omit or change details.

The story would morph with each retelling. Instead of having a single author, stories, or any such cultural touchstones, ended up having thousands of different creators.

A few years ago, when I was a financial journalist in London, I used to frequent the British Museum where the Brits have all the artefacts they l̶o̶o̶t̶e̶d̶ …erhmhh… got gifted by grateful people. In either case, one thing that struck me was that the Greek Pantheon of Zeus, Hera, Athena and the gang were originally all different cults.

As in one area might have had one God, and then as the people in that territory interacted with other societies, they incorporated the other culture’s myths into their own. So the Greek Pantheon ended up being something comparable to the Avengers, where heroes and Gods of completely separate traditions ended up sharing one common story.

This wasn’t the exception, it was the norm throughout most of history. Culture and tradition used to be the common heritage of humanity. It just so happens that as money entered into the picture of the production process, it started to become pertinent to ask who owns what cultural artefacts.

Fast forward a few hundred years later, and we have Disney suing parents for putting Spiderman on their child’s grave, and this sort of thing is fairly normal. Though it must be said that it also has to do with how copyright is set up.

Disney ideally doesn’t want the PR nightmare of suing grieving families, but if it doesn’t defend its intellectual property with viciousness, in some jurisdictions it is seen as a partial revocation of their rights. So they either make full use of the lawyer goon squad, or they could lose important assets for their balance sheet.

Because of this, companies see the passion and creative output of their fandoms as a liability. Especially as some of the fan creations end up being superior to the official ones; as happened with Star Trek Axanar, which was [is?] an unofficial fan film with a more gripping story and execution than the official Star Trek holders have managed to produce in decades. Naturally, it got sued to oblivion.

NFTs and Memecoins are the exact opposite. While the end copyright is often into question about who actually owns it (does owning a token give you any IP rights?), what isn’t up for debate is that this asset class needs community involvement to thrive.

As such, people create their own content revolving around the communities that they join. Through this mechanism, their participation in a communal culture actually financially benefits them. So in a very roundabout way, we’ve managed to rediscover communal cultural ownership, while still somehow managing to find a way to make it fit within a capitalistic framework.

Admittedly at the moment, the vast majority of this field is get-rich-quick scheme garbage, and I feel comfortable in saying that most of it is unlikely to retain any value. If I were to take a guess, I’d say that any of the successful projects will have a median lifespan of however long influencer careers typically last, as their struggles of building and maintaining a community are similar to those of meme assets.

As such, I would peg the median lifespan of a meme asset that does well to be somewhere between a few months to half a decade, by which point people grow bored and move on to something more exciting and new.

If I were to try to look into the crystal ball, I would say profile picture NFTs will always exist, but they’ll lessen in importance and they won’t be nearly as expensive as they are now. The market will fragment into millions of communities with different interests and thereby share the wealth more.

Meme assets are tokenized units of culture, and as such we will see them bootstrap any cultural element that we can think of. I’ve already seen people funding movies through them, which would have never been able to be conventionally funded as their potential audiences are too niche.

So overall, I think culture is going in a communal direction, and indies will thrive over the coming decades. There won’t be some monolithic project but thousands of smaller ones, catering to little communities that people are passionate about.

Conclusion

We’ve been looking at NFTs and memecoins wrong — they’re not traditional assets, which retain value because of their utility, revenue and presumed profitability.

Instead, memecoins and NFTs are tokenized units of culture, deriving value from people participating in their communities; through them, owners feel like they belong to something grander than they have ever belonged to before.

It bears saying though that this is not solely present in these assets. Basically, the whole crypto sector admittedly errs on the more cultish end of the spectrum, with weird rituals, beliefs and traditions to go along with them. However, meme assets are the purest distillation of this phenomenon.

I’m hopeful that this new movement will give birth to a compelling open-source culture that is the common heritage of all mankind. Perhaps it’s a farfetched dream, but it is definitely possible now that culture’s going decentralized!

If you’re in the crypto or in the traditional finance industry looking for someone to ghostwrite content for you, please do not hesitate to message me. I’m a full-time ghostwriter.

Join the community over at @flantoshi on Twitter.

And if you would like to support this project and help me pay rent, I’ll pass on the tip hat and you can send ADA to:

addr1qxfgs44d763uuw4hy6qatx383v9mmrrm6qazay6eren9sp5r2usruecwv33lp2t2nqp4ss6hrc9ac8yd2klxnsfnxz2qw3su4s

Thank you for your support!